Optimism price could rally 25% amid this big move by VC in DeFi and TradFi spaces

- Optimism price is coiling up for a breakout amid a recent bullish move by venture capital a16z.

- OP could rally 25% to $2.807, escaping a formidable supplier congestion zone.

- A daily candlestick close below the $1.994 support level could invalidate the bullish thesis.

Optimism price (OP) engaged a gains-shedding gear in mid-April as bears took over the market following waning bullish momentum. However, bulls appear to have regained control in the New York trading session, commencing what seems to be the beginning of a trend reversal. This comes amid ongoing network hype after venture capital firm (VC) Andreessen Horowitz (a16z) disclosed plans to work on an Optimism-based rollup application christened Magi.

Based on an announcement posted by crypto engineer Noah Citron, Magi will be a roll-up client for Optimism’s OP stack. It is still latent and months away from being ready for release into the market. OP stack is the standardized, open-source development stack powering Optimism, presented as a system written in the Rust programming language. It is a faster alternative to the only existing rollup client maintained by OP Labs and written in the Go programming language, op-node. According to a16z, the number of systems is directly proportional to the degree of robust decentralization for Optimism.

Optimism price eyes 25% gains

Optimism price is up over 3% in the last 24 hours, with CoinMarketCap data showing a 41% increase in trading volume over the same timeframe. This indicates growing demand for OP as it is healthy and viable.

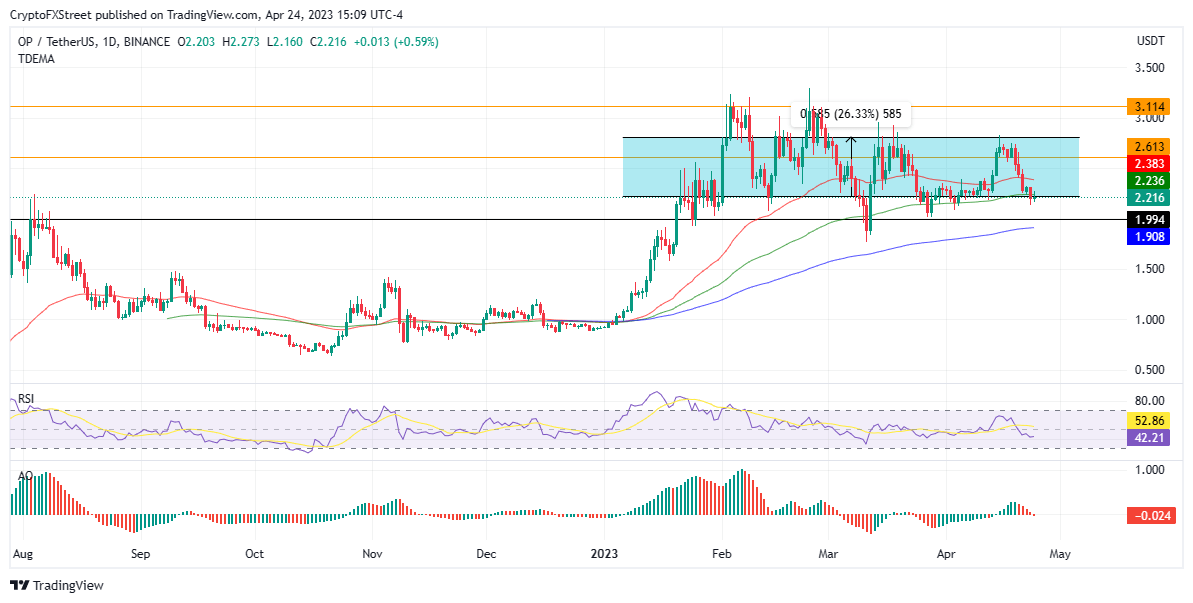

If bullish momentum increases, the Optimism price could rise above the 100- and 50-day Exponential Moving Averages (EMA) at $2.236 and $2.383, respectively. These were crucial supplier congestion zones; therefore, bulls could leverage them in reentering the OP market.

Beyond the levels, the Optimism price could exceed the psychological $2.787 and escape the multi-month consolidation zone. In highly ambitious cases, OP could tag $3.114, constituting a 40% uptick from current levels.

OP/USDT 1-day chart

On the other hand, if sellers dominate, Optimism price could repel the 100-day EMA toward the immediate support at $1.994. A daily candlestick close below this level could invalidate the bullish outlook.

Also Read: After Arbitrum’s 50% rally, is Optimism (OP) next Layer 2 altcoin to explode?

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.