Optimism grows as China aims to end COVID lockdown, with Ethereum price targeting nearly $5,000

- Ethereum price pops higher as news flow in ASIA PAC session points to reopening of China.

- ETH price is set to rally 26% as stock markets book solid gains, which might be the start of a bull run.

- Expect an overall 150% rally towards $4,951.83 as more tail risks diminish.

Ethereum (ETH) price saw its tail risk ballooning to a massive extent on Monday, but many elements got quickly defused near the US close. With tail risks diminishing, the dollar backing off, and equities rising, investors look ready to head back to cryptocurrencies and invest in the asset class. With that inflow, almost all cryptocurrencies are up against multiple percentages, and the horizon looks promising as possibly a rally is underway longer term towards $4,951.

ETH price seems perfect scenario unfolding

Ethereum price saw negative risk factors diminishing significantly overnight. The most significant event was Turkey’s VETO of Sweden and Finland joining NATO, as this will have the effect of delaying their membership for at least a year, so the tail risk of a Russian retaliation is out of the way. A second fuse that got neutralised was Hungary vetoing any joint EU oil embargoes against Russia, after a new EU sanctions package was proposed. This will make it impossible for the EU to come up with a new set of sanctions before the summer.

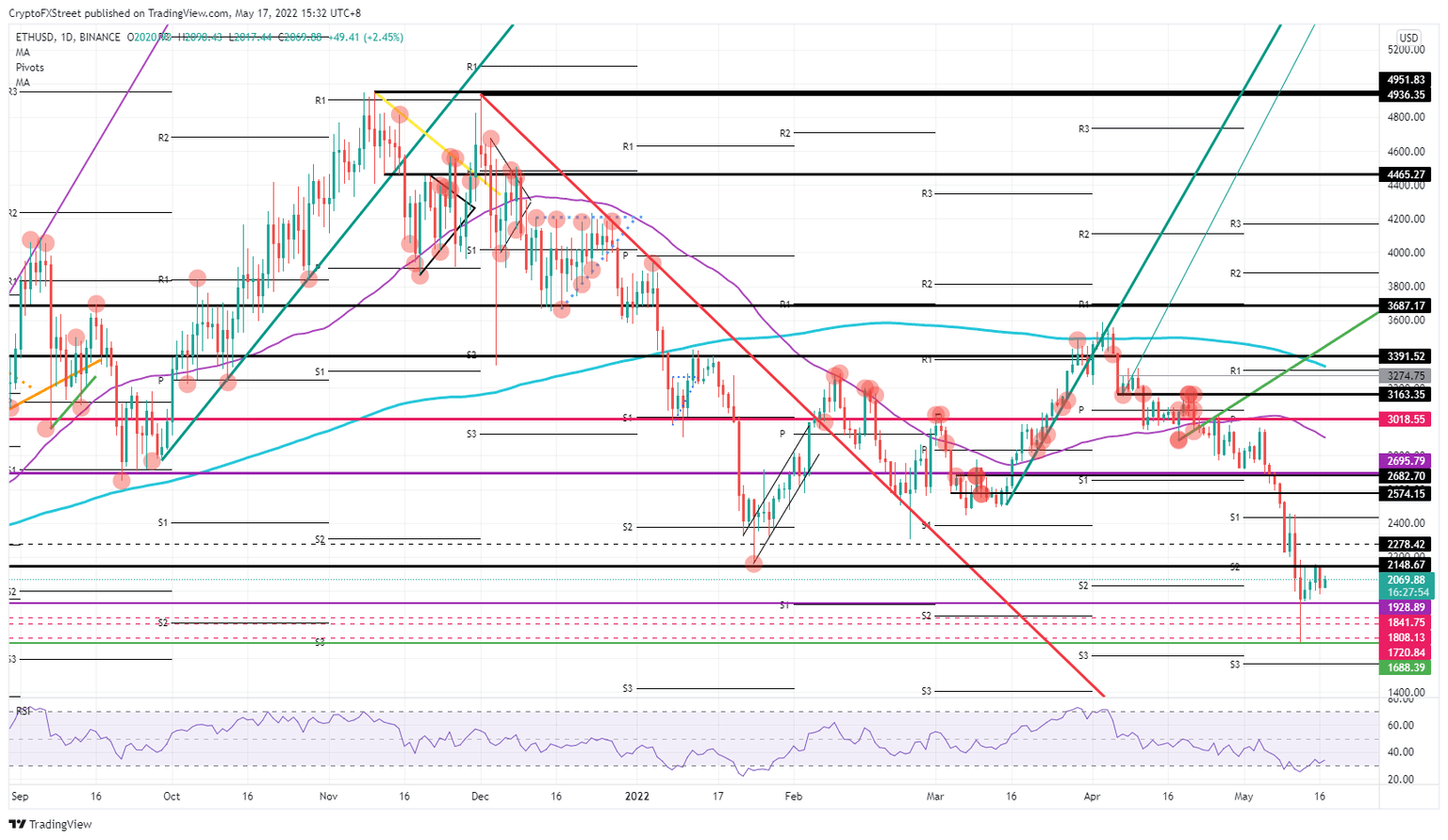

ETH price has thus two key tail risks that are already delayed for multiple months, opening room for risk assets to rally as the Greenback backs off. Expect to see a rally of 25% during this week towards $2,682.70, but overall even a rally towards $4,951.83 looks possible as a time window of several months has opened with only upside potential. Expect to see a massive shortage of ETH supply as the demand side explodes.

ETH/USD daily chart

Downside risks come from retaliation by Russia against Finland and Sweden as now they are exposed by their commitment to joining NATO, while they can not count on help from NATO yet because of Turkey’s block. A military escalation in the North could add a massive risk to the markets and see the dollar strengthen to parity against the euro, triggering another selloff in cryptocurrencies, with ETH set to drop to $1,688.39. An additional risk that could push ETH price to $1,400 would be when the FED raises rates even more hawkishly and quickly, and thus scaring investors away from risk assets.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.