- Optimism, Yield Guild Games, and SingularityNET ecosystem will have massive token unlocks this coming week.

- OP, YGG, and AGIX token holders should brace for volatility

- Token unlocks are often bearish catalysts, as traders tend to get caught in exit liquidity.

Next week has major token unlocks lined up, with millions of dollars worth of tokens due to flood markets. Investors should expect volatility around the calendar dates of the specific token unlocks and maintain cognizance that this event is often a bearish catalyst.

Token unlocks to watch next week

Yield Guild Games

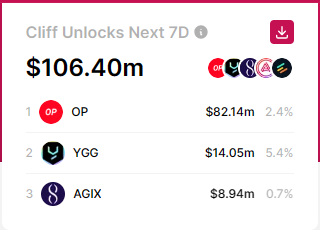

Three cliff token unlock events will be of interest this coming week. First on the list will be on the Yield Guild Games ecosystem, which will be unlocking 16.69 million YGG tokens on March 27, worth $13.55 million at current rates.

Comprising 5.39% of the network’s circulating supply, the tokens will be allocated to the community, founders, the treasure and investors, with the latter expected to cash in for quick profits.

SingularityNET

On March 28, the AI crypto network SingularityNET will unlock 8.84 million AGIX tokens worth $9.18 million at current rates.

The tokens make up for 0.69% of the network’s circulating supply, and will be allocated toward AGIX-ADA utility. Token holders should brace for volatility.

Optimism

The biggest token unlocks event next week will happen on Ethereum Layer 2 (L2) network, Optimism on March 29. On this day, the network will unleash 24.16 million OP tokens worth $82.62 million at current rates.

The tokens will be allocated to core contributors and investors and will make up for 2.40% of the network’s circulating supply.

Over $106 million worth of unlocks next week

The unlocks will be worth $106.40 million at current rates, all part of a cliff event. In cliff token unlocks events, the tokens have been set to unlock on a schedule that is more periodic than daily, and not the traditional weekly, monthly or yearly periodicals.

Cliff token unlocks next week

It is different from linear unlocks, where the tokens are paid out on a linear schedule, say monthly or yearly, thus delivering some level of price stability.

Unlock events could offer sidelined investors an opportunity to enter positions in assets, taking advantage of the short-term volatility. Proactive traders know how to make a profit by trading around these events. The other lot is often rekt as part of exit liquidity.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.