Ontology Price Prediction: ONT could retrace 16% before setting up new swing high

- Ontology price is trading inside a rising wedge pattern.

- Failure to breach the upper trend line might lead to a 16% correction.

- Multiple on-chain metrics point to a resurgence of interested investors.

The Ontology price is in a pickle as technicals point to a correction, while on-chain metrics suggest a more positive outlook.

Ontology price awaits clear trend to establish itself

The Ontology price has set up three higher highs and two higher lows since February 14. A rising wedge pattern forms if one were to draw trend lines that connect these swing points.

This technical formation has a bearish bias that triggers if ONT slices through the lower boundary at $1.59.

However, if the bulls rescue ONT at $1.59, the pessimistic outlook could be postponed. A new uptrend could evolve if the buyers can manage a decisive close above the 127.2% Fibonacci extension level coinciding with the Momentum Reversal Indicator’s breakout line at $2.15.

This move would invalidate the bearish outlook and kick-start a 17% upswing to $2.53. If the buying pressure persists, a 25% surge could place ONT at $3.17, which coincides with the 161.8% Fibonacci extension level.

ONT/USDT 1-day chart

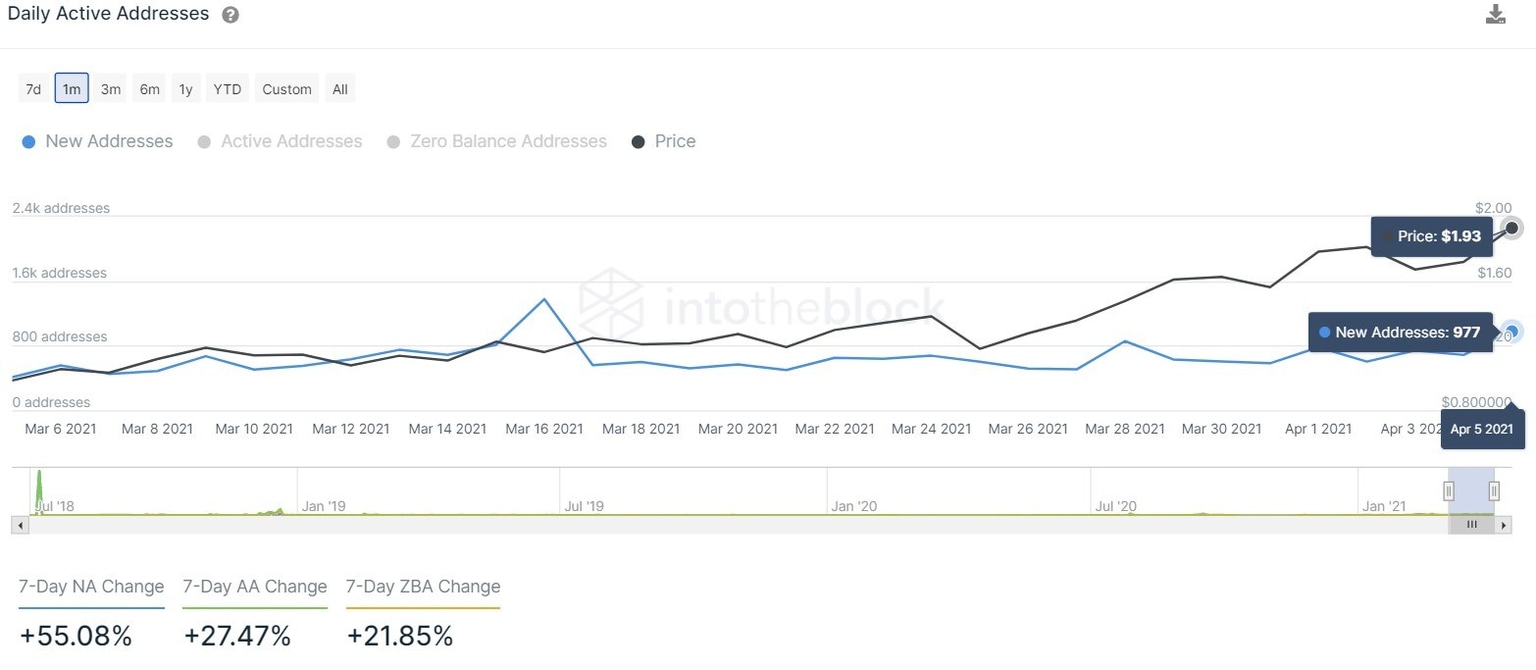

Adding credibility to the bullish outlook is the 138% increase in new addresses joining the Ontology blockchain. About 977 new addresses have joined the ONT network today, indicating their interest in the cryptocurrency at the current price levels.

Ontology new addresses chart

Moreover, the number of transactions worth $100,000 or more has skyrocketed from 3 on March 5 to 79 as of this writing. This stark surge in whales could be interpreted as a proxy to their investment interest, thus painting a bullish picture for the Ontology price.

Ontology large transactions chart

The optimistic scenario depends on bulls rescuing ONT after a 16% retracement to $1.59. A decisive close below the aforementioned level will signal a breakout from the rising wedge pattern.

In such a scenario, the technical formation forecasts a 42% crash, determined by measuring the pivot high and low distance and adding it to the breakout point. This move places the Ontology price at $0.915.

However, this descent will face multiple demand barriers at $1.37, $1.25 and $1.04 that could dampen the bears’ momentum.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.