Ondo Price Forecast: Reaches new all-time high after purchase from Trump-backed DeFi project

- Ondo price reaches a new all-time of $2.14 on Monday after rallying more than 20% in the previous week.

- The fresh all-time high came after on-chain data showed Donald Trump-backed World Liberty Financial purchased 134,200 Ondo tokens worth $250K.

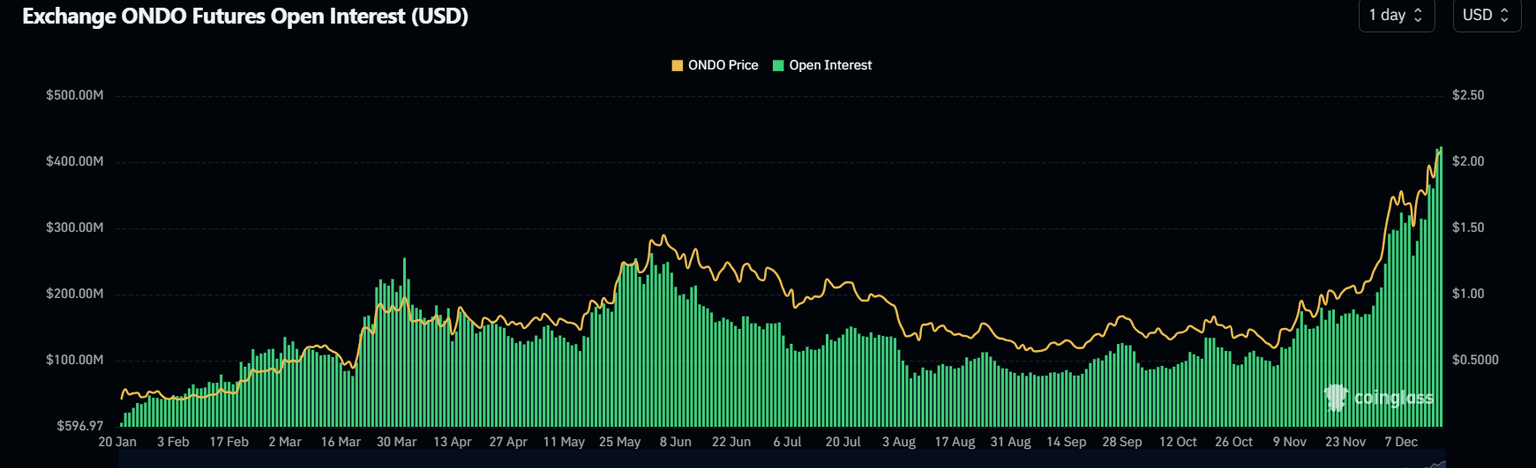

- ONDO open interest reaches a record level, suggesting a continuation of the rally toward $2.51.

Ondo (ONDO) price reaches a new all-time high of $2.14 on Monday after rallying more than 20% the previous week. On-chain data further support the Real World Asset (RWA) token’s bullish outlook, as it showed US President-elect Donald Trump-backed World Liberty Financial purchased 134,200 Ondo tokens and open interest reached record levels, suggesting a continuation of the ongoing rally.

Ondo price hits a new all-time high of $2.14

Ondo’s weekly chart shows that it reached a new all-time high (ATH) of $2.14 on Monday after finding support at around the weekly level of $1.37 the previous week. Since early November, ONDO has been rallying for six straight weeks, resulting in over 200% gains.

If the upward trend continues, ONDO price will extend the rally to test a new ATH of $2.51. This level aligns with the 141.4% Fibonacci extension line drawn from the October low of $0.588 to the December 2 high of $1.95.

The Relative Strength Index (RSI) on the daily chart reads 78, signaling overbought conditions and suggesting an increasing risk of a correction. An RSI’s move out of overbought territory below 70 could signify a pullback.

ONDO/USDT weekly chart

This ongoing rally is further supported by the recent ONDO token purchases by a Donald Trump-backed DeFi platform. According to Data Nerd, Trump-backed World Liberty Financial (WFLI) added the RWA token to his portfolio on Monday. The multisig wallet has swapped $250K USDC stablecoin for 134,200 Ondo tokens.

4 hours ago, @worldlibertyfi just added $ONDO into his portfolio by swapping $250k $USDC for 134.2k $ONDO.

— The Data Nerd (@OnchainDataNerd) December 16, 2024

Address:https://t.co/VyZg81KmJe https://t.co/8NVkhb9o70 pic.twitter.com/rDesB6NILT

Coinglass’s data shows that the futures’ Open Interest (OI) in ONDO at exchanges rose from $258.57 million on December 10 to $426.36 million on Monday, reaching the highest level since its launch. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the Ondo price.

ONDO Open Interest chart. Source: Coinglass

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.