Ondo moves $95 million worth of OUSG assets to BUIDL as tokenized fund attracts $245 million since debut

- The RWA narrative is shaping up as Ondo becomes among the first crypto protocols with large holdings of BUIDL.

- OUSG tokens offer instant investment and redemption.

- BUIDL has attracted $245 million since launching on March 20.

Ondo Finance (ONDO) announced on Wednesday that it's shifting about $95 million worth of its OUSG's underlying assets to the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). With more crypto players shifting their assets to BUIDL, the real-world assets token category is heating up and may likely post gains in the coming days.

Read more: BlackRock to launch tokenized fund on Ethereum as battle for ETF intensifies

BUIDL is attracting attention to RWA

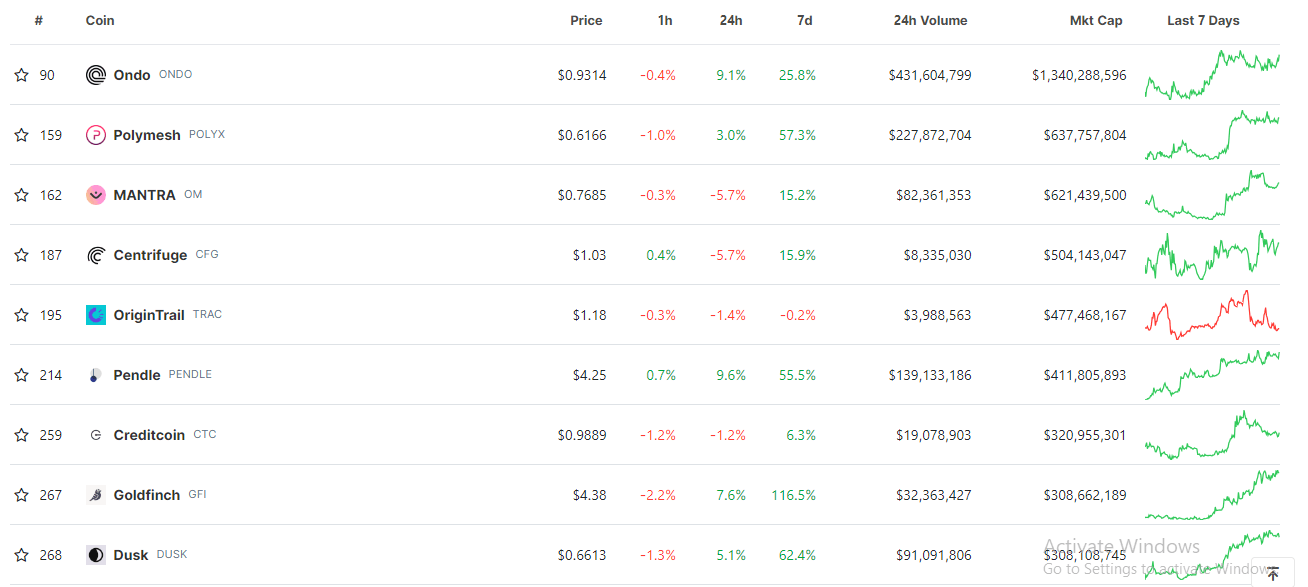

ONDO and many other crypto tokens in the real-world assets category have gained mainstream attention in the crypto space since last week. Their 7-day price performance shows that many of these tokens have posted gains of between 30% to 100%, according to data from CoinGecko.

Top RWA tokens

The recent spark of the RWA narrative follows BlackRock's move into web3's world of tokenization through the launch of BUIDL on March 20. BUIDL was launched on Ethereum in partnership with Securitize LLC to provide investors access to trading ownership on a blockchain, allowing for transparent and global instantaneous settlement.

Also read: AI, RWA: Two token classes to watch next after meme coin and staking market drive rally

BUIDL invests 100% of its underlying assets in cash, US Treasuries, and repurchase agreements, according to the announcement on its launch day. Securitize CEO had earlier commented that the fund is aimed at crypto companies seeking to manage their treasuries on-chain or looking to create derivatives of Treasury bills.

ONDO moves OUSG tokens to BUIDL

As a result, Ondo Finance has capitalized on the fund's structure to move $95 million worth of its OUSG Treasury-backed token to BUIDL. Before BUIDL, Ondo primarily held the underlying assets of OUSG in BlackRock's iShares Short Treasury Bond exchange-traded fund (ETF). Considering the longer settlement time of T+2 securities, it constrained how quickly users could redeem their OUSG tokens.

However, "OUSG will soon offer instant investment and redemption, 24/7/365," especially with the shift into BUIDL, said Ondo in a blog post.

Also read: Real-world assets narrative saturates crypto market despite $16 million exploit on Curio

Within the first few days of BUIDL's launch, Ondo moved $15 million of OUSG assets to the tokenized fund. On Wednesday, Ondo minted another $79.3 million worth of BUIDL tokens on Ethereum, according to data from Etherscan. This has taken BUIDL's total supply to $245 million in just one week, with Ondo Finance holding 38%.

This also follows BlackRock CEO Larry Fink's comment that tokenization is "the next generation of markets."

Ondo trades at $0.9314 at the time of writing, rising about 9.1% on the day.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi