- OMG Network bulls are building momentum upon the crucial support at the 50 SMA.

- A breakout to $5 could materialize if OMG/USD pierces through the resistance at $3.2.

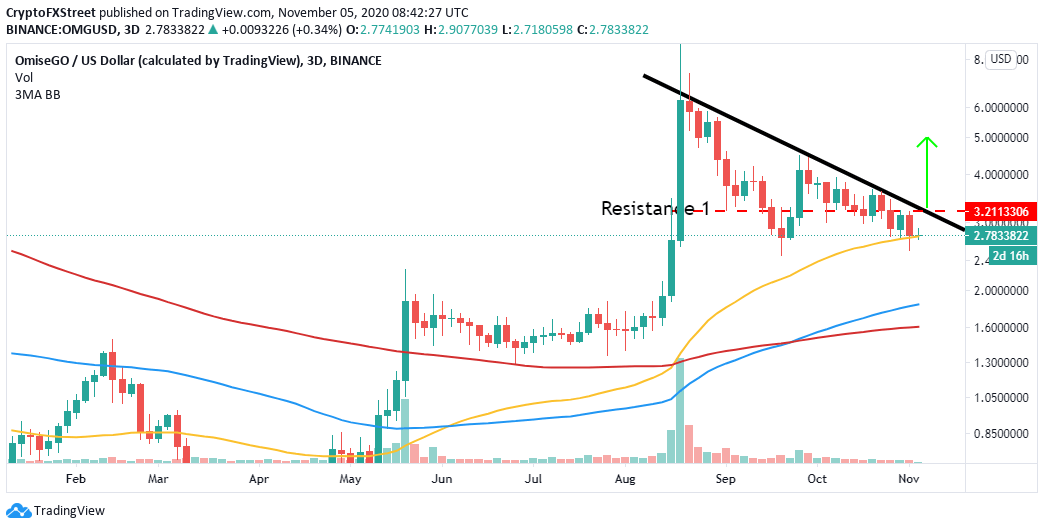

OMG Network made a remarkable recovery from the lows in March to the yearly highs of $9.9, achieved in August. Despite the month-over-month gains, bears swung into action, hence the losses under the descending trendline.

The declines became unstoppable until OMG/USD recently embraced support at the 50 Simple Moving Average (SMA) on the 3-day chart. At the moment, OMG is looking forward to massive price action amid growing buying pressure.

OMG prepares for a massive liftoff

The value transfer token is changing hands at $2.8 at the time of writing. OMG is ranked 35th in the market and boasts of $391 billion in market capitalization. The token has attracted a 24-hour trading volume of $423 million.

OMG Network’s immediate downside is supported by the 50 SMA, as mentioned earlier. If this buyer congestion zone continues to hold, prices may rebound to $3.2. Breaking above this critical seller congestion zone could catapult the token above the descending trendline. OMG’s bullish outlook will then be validated with prices setting up for a 50% rally to levels around $5.

OMG/USD 3-day chart

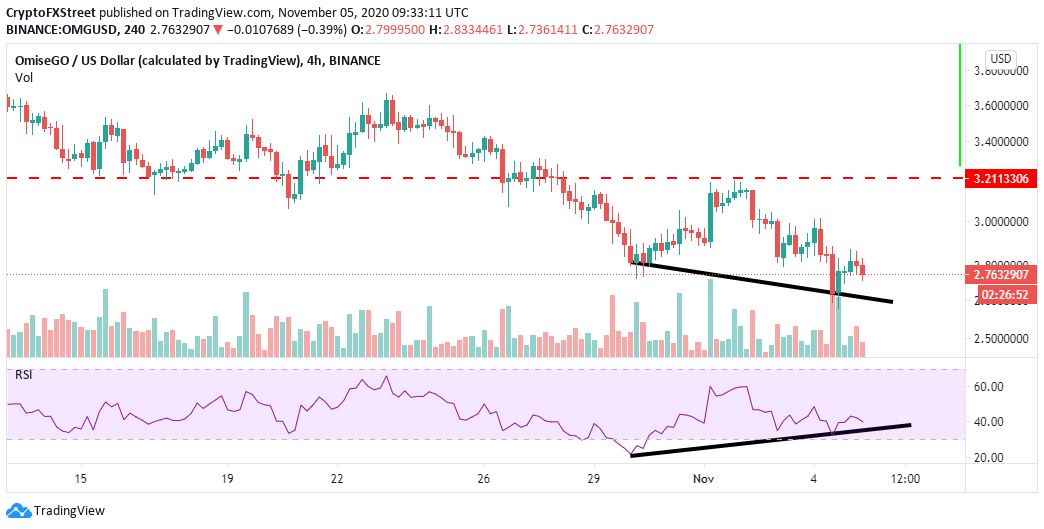

The Relative Strength Index (RSI) adds credibility to the bullish outlook – take a look at the divergence formed since October 20 between OMG price and the RSI.

It is worth stating that the bullish divergences mainly occur when an asset price makes a lower low pattern, while the RSI makes a high low pattern. In this case, the technical pattern does not provide an exact entry point for buy orders; instead, it highlights that the medium-long downtrend may be approaching exhaustion.

OMG/USD 4-hour chart

On the downside, the bearish outlook will be invalidated if the 50 SMA support on the 3-day chart is broken. The declines that might ensue will likely pull OMG Network to the tentative support at the 200 SMA in the same timeframe.

OMG Network IOMAP chart

The IOMAP model by IntoTheBlock discredits the technical optimism after revealing strong resistances ahead of OMG. If bulls manage to overcome the seller congestion at $2.8 and $2.9, it is uncertain that they will slice through the next crucial resistance.

A massive seller congestion range lies between $2.96 and $3. Here, nearly 1,400 addresses had previously bought around 5.4 million OMG. On the flip side, the lack of a formidable suggests that OMG might breakdown to $2.5.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Litecoin Price Forecast: 40,000 LTC traders exit as crypto crash triggers $500M in liquidations

Litecoin price slid 10% to hit a 7-day low of $102 on Wednesday. On-chain metrics show a large number of LTC holders exiting their positions as hawkish US jobs data sparked downward volatility.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

DOGE and SHIB traders book profits at the top

Dogecoin and Shiba Inu prices broke below their key support levels on Wednesday after declining more than 9% the previous day. On-chain data provider Santiments Network Realized Profit/Loss indicator shows massive spikes in these dog-theme memecoins, indicating traders realize profits.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Over $560 million in liquidation

Bitcoin (BTC) hovers around $97,000 on Wednesday after declining more than 5% the previous day. Ethereum (ETH) and Ripple (XRP) follow in BTC’s footsteps and decline 8.3% and 6.15% respectively.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637401656970545949.png)