Tokens of decentralized finance (DeFi) protocol Olympus (OHM) dropped as much as 32% in the past 24 hours as crypto traders moved away from experimental Defi projects amid an overall negative sentiment in the crypto market.

OHM fell from Monday’s peak of $264 to $161 during the early Asian hours on Tuesday, reaching lows previously seen in May 2021. The move was part of a larger downtrend since October 2021 highs of $1,360, when the protocol reached a market capitalization of $4 billion. As of Tuesday, OHM prices are down 87% from all-time highs.

Olympus, like other DeFi projects, relies on smart contracts instead of intermediaries to provide financial services to users. Its goal is to create a stablecoin backed by crypto instead of fiat currencies like the U.S. dollar, which users can in turn stake for currently offered annualized returns of 7,800%.

Users are incentivized to deposit or sell their OHM collaterals in return for discounted OHM sold by bonds issued by Olympus. This is said to create “protocol-owned liquidity,” as the user-issued liquidity provider (LP) tokens are tied back to the bonds issued by Olympus, creating a continuous loop of supply and demand.

Fuse liquidations contribute to OHM fall

Analysts said a popular pool to leverage returns on OHM tokens saw overnight liquidations which contributed to the price drop.

“People who employed the leveraged OHM strat (9,9) by borrowing from Fuse got liquidated,” explained Ashwath Balakrishnan, VP of research at Delphi Digital, in a Telegram message to CoinDesk.

Fuse is an interest rates product by Rari Capital, a DeFi protocol that provides yield-earning services to users. Fuse lets users create their customized pool consisting of various interest-earning tokens, allowing other users to stake their own tokens on such pools and earn yields.

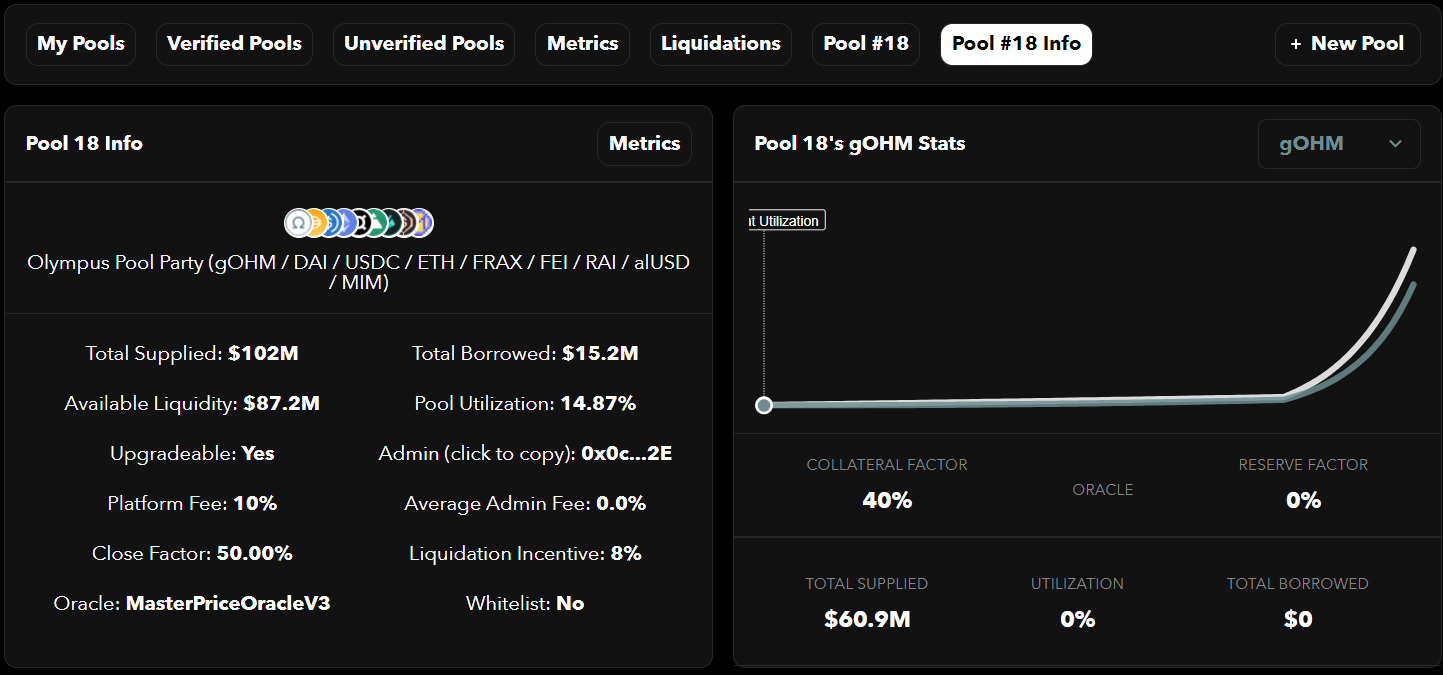

The rather risky Pool #18 on Fuse is focused on Olympus, locking up over $101 million across OHM and right other cryptocurrencies. The pool takes OHM staking a step ahead for users: unlike staking OHM on Olympus, staking OHM on Fuse allows users to borrow cryptocurrencies against their OHM holdings while continuing to earn interest on the staked OHM. This allows users to access liquidity without having to sell their OHM rewards and missing out on potential gains.

However, such borrowing features come with their drawbacks. Holdings are automatically liquidated when prices of underlying tokens fall below a certain level, as the Fuse protocol needs to maintain the collateral’s monetary position.

Sell-offs in the open market lead to falling prices, which in turn lead to further sell-offs by token holders who may want to take profits on their positions. This creates a cascading event that contributes to drastic price drops, one that OHM saw in the past 24 hours.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.