OKX boasts 100% clean reserves to Binance’s 88.95%, yet its native token OKB fails to recover

- OKX has 100% ‘clean reserves’ according to a new metric developed by CryptoQuant.

- The “Clean Reserves” metric measures the percentage of reserves not held in the exchange's potentially vulnerable native token.

- Binance, one of the world’s largest cryptocurrency exchanges, has 88.95% clean reserves.

- OKX’s native token has failed to recover from its recent decline, despite the clean bill of health.

The reliance of FTX and Alameda too heavily on their own native token FTT ultimately catalyzed their demise, after it fell from $22 to $2. Now investors, battle-weary, from exchange crypto scandals are keen to know the extent to which custodians of their funds are vulnerable from holding reserves in volatile native coins.

Crypto data aggregator CryptoQuant has come up with a solution, a new metric called “Clean Reserves”, which measures the percentage of an exchange’s reserves that are not held in its own native token. The closer to 100%, meaning “none”, the better.

OKX is one crypto exchange that scores 100%, meaning none of its reserves are held in its native token OKB. Instead, most of its reserves are held in Bitcoin, Ethereum and USDT, of which it is “overcollateralized in” according to its proof-of-reserves report. This compares positively to the largest exchange in the world Binance, which only scores 88.95% on CrypotQuant’s Clean Reserves metric.

Also read: Bitcoin recovery fuels NFT growth, digital collectibles garner big interest as BTC crosses $21,550

OKX exchange is overcollateralized, beats competitor Binance in clean reserves

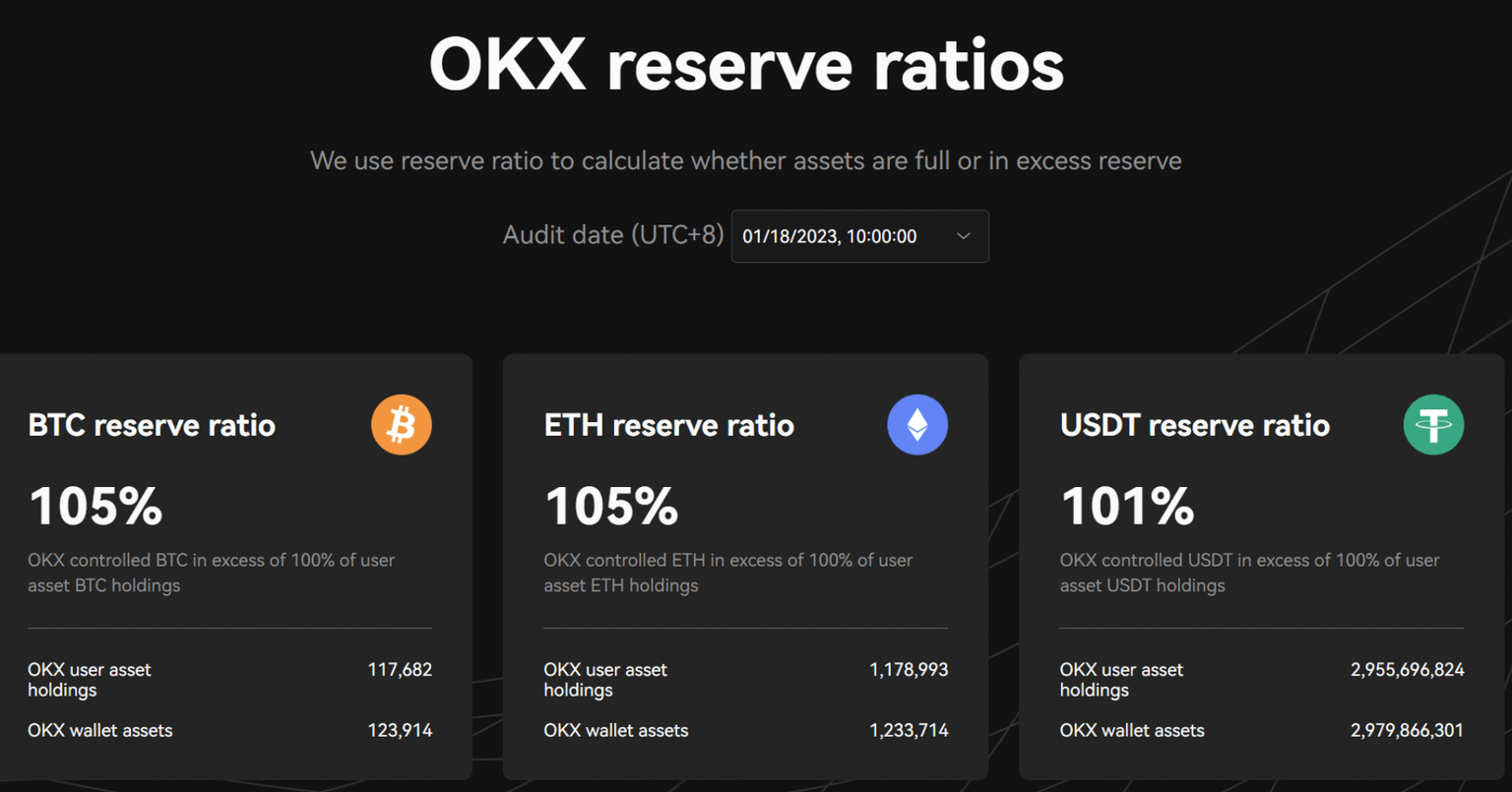

OKX exchange is considered overcollateralized in the excess reserves against user holdings in Bitcoin, Ethereum and stablecoin USDT. The BTC, ETH and USDT reserve ratio is actually at 105%, 105% and 101% respectively.

The exchange published their exact asset mix in response to CryptoQuant’s new metric that measures “cleanliness” of reserves.

OKX reserve ratios

Rival exchanges Bitfinex and Huobi, meanwhile, score 70% and 60% respectively for Clean Reserves.

OKX tops the list at 100%. The exchange therefore features a total separation between coin and exchange. Despite launching its native token OKB, the Seychelles-headquartered exchange, has adequate reserves in Bitcoin, Ethereum and the stablecoin Tether, unlike its competitors that hold part of user funds or reserves in their own native tokens.

Native tokens of exchanges have faced severe criticism since the collapse of FTX exchange after its token FTT dropped from $22 to $2 in less than five days causing the platform to suffer a liquidity crisis.

Despite the bill of clean health for its parent exchange, OKB is struggling to recover from the recent decline in its price. OKB price nosedived 5.5% in the 24-hour period between January 18 and 19 and the native token of OKX is struggling to recover from the drop.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.