- OKEx derivatives exchange has recently listed SNX - the native token of Synthetix.

- SNX token deposits and spot trading against BTC and USDT have recently gone live on the exchange.

- Synthetix is one of the largest DeFi apps on Ethereum in terms of locked positions and is valued at around $456 million.

OKEx derivatives exchange has recently listed SNX - the native token of Synthetix, a derivatives liquidity protocol for issuance and trading of synthetic assets. SNX token deposits and spot trading against BTC and USDT have recently gone live on the exchange.

Synthetix lets users trade multiple real-world financial instruments, including cryptocurrencies and stocks, over the blockchain as synthetic assets using ERC-20 tokens. The tokens linked with each synthetic asset track the price of the external assets to make such transactions possible.

By adding support for SNX, OKEx said that it is fulfilling its long-standing vision of being a prime mover in the DeFi sector. Synthetix is one of the largest DeFi applications on Ethereum in terms of locked positions and its value is calculated to be around $456 million.

OKEx CEO Jay Hao said:

OKEx believes that DeFi holds some of the most potential in the cryptocurrency space. We are glad to see so many high-quality DeFi applications like Synthetix standing out in 2020 and have long been paying attention to and promoting the development of DeFi. We’re also expanding our own footprint in this area with products like our C2C Loan that generates passive income for our users and the development of OKChain that will be used to support a thriving DeFi infrastructure.

Hao added that while listing a new token, the project’s utility, user expectations, project’s compliance and other conventional aspects are considered. He said that SNX has qualified all these requirements and that OKEx is happy to support projects like it.

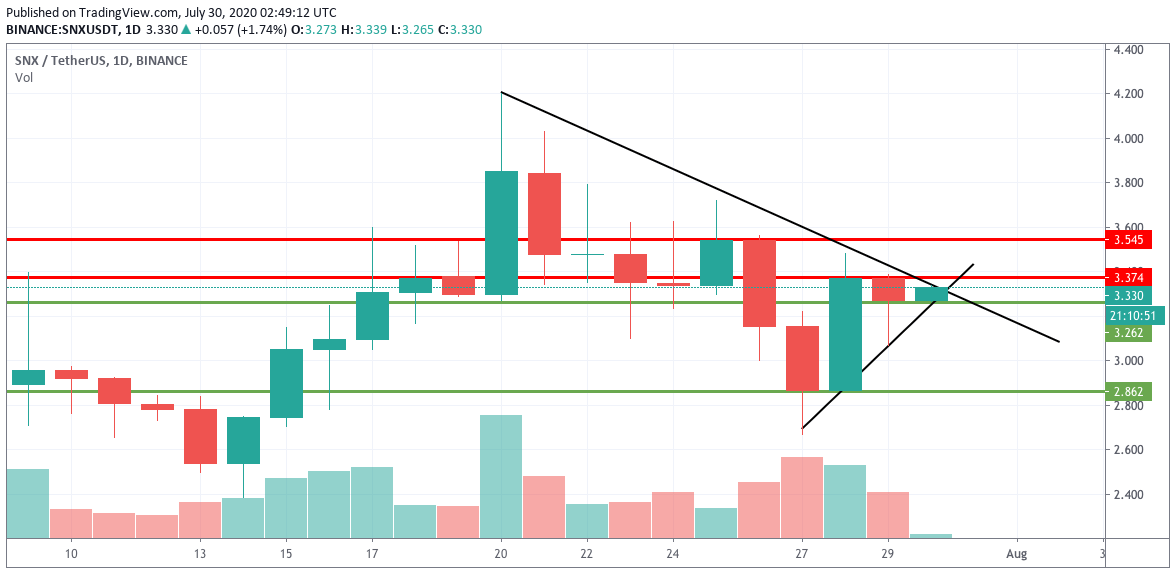

SNX/USDT daily chart

SNX/USDT bulls started the day strong, by taking the price up from 3.262 to 3.33. The price chart shows strong resistance at 3.374 and 3.545. On the downside, SNX/USDT has healthy support at 3.262 and 2.862.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.