Markets across the board, as well as crypto markets, were boosted by US inflation coming in better than expected. Since market participants had been pricing in a deeper decline of 8.7%, July's 8.5% fall was a sign of relief for risk markets.

Before deciding whether to trigger a 50-point or 75-point rate increase at the September meeting, Federal Reserve members will gather in Jackson Hole in late August to digest inflation and jobs reports.

There is a possibility that risk assets will rally further in the event of a dovish tone adopted by the US central bank amid soothing inflation pressures.

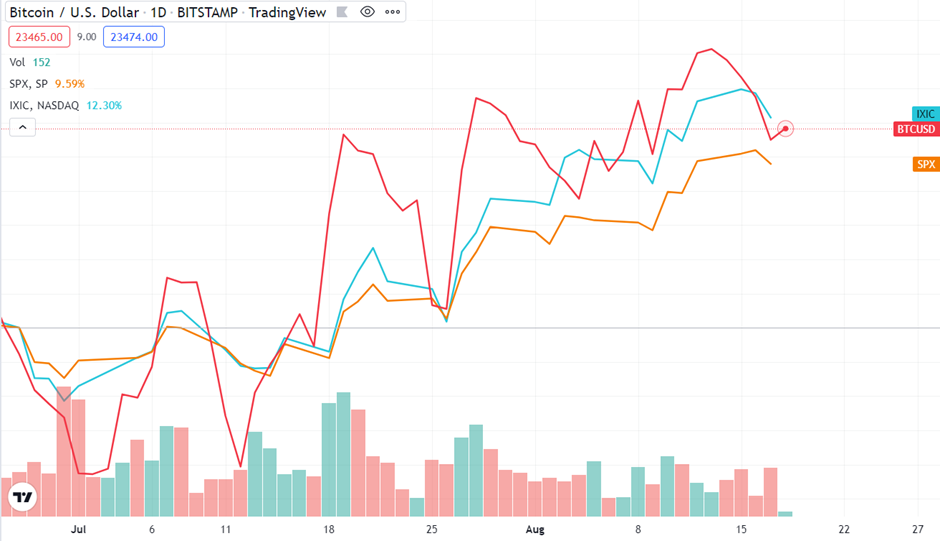

Historically, Bitcoin has tracked legacy markets, as shown below with the S&P 500 in orange and the NASDAQ in blue. Since reaching its latest bottom, it appears the BTC market is headed upwards.

Source: TradingView

The CPI data and subsequent monetary policy decisions will continue to play a significant role in determining what happens next. It is evident that the next few months will be shaped by the geopolitical situation involving the Ukraine-Russia conflict, the European winter energy crisis, China's policy toward Taiwan, the Covid lockdowns, etc.

Long-term holders are optimistic

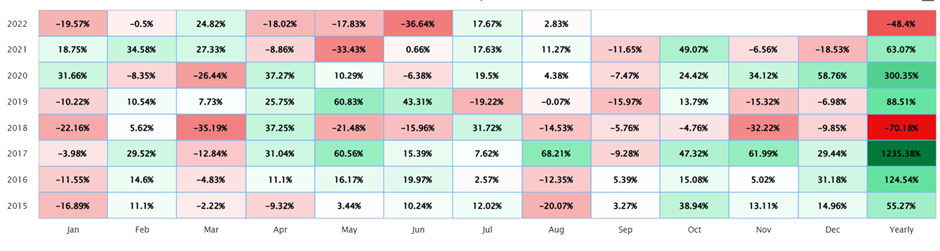

Still, over the past few years, BTC has generated at least double-digit annual percent gains for long-term holders, and it's too early to say how this year will end, as things might change in an instant.

Source: laevitas.ch

Current on-chain activity indicates that a buy-on-dip mentality is prevailing. For long-term investors, Bitcoin is still a promising investment with potential for growth.

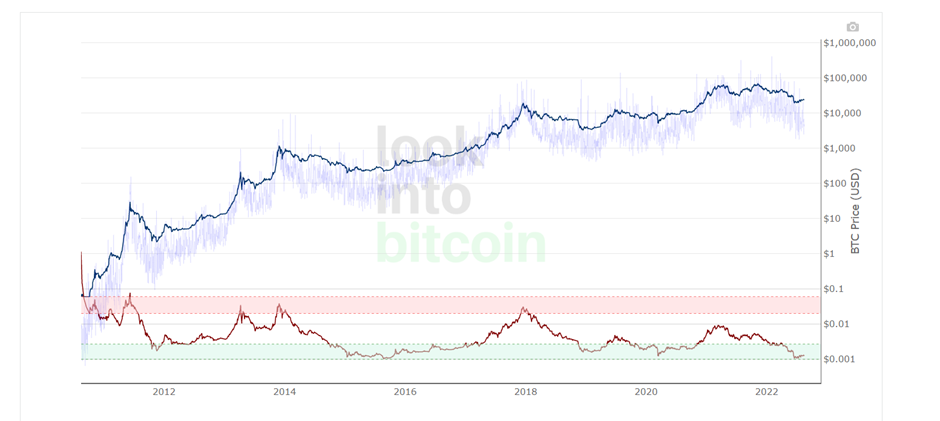

Long-term BTC holders seem confident that the flagship will increase in value in the future, as shown by the following chart. LTHs are typically better at predicting Bitcoin price movements compared to newcomers so it’s worth paying attention to them.

Based on the reserve risk chart, which has been in the green zone for a while now, Bitcoin seems to be an appealing risk/reward investment.

Source: LookintoBitcoin.com

Fear wanes; the big players are back on the scene

Overall, crypto market sentiment has improved since mid-June, when it was in a panicky state. Even though the current score of 30 is still in fear territory, it's a far cry from the score of 6 back then.

Soure: LookintoBitcoin.com

A major move has also been made by BlackRock, the global asset management giant, by partnering with Coinbase. Wall Street is slowly but steadily making its way into the crypto space. It is a well-known fact that prices rise when institutional investors enter the game. Their foray into crypto certainly impacted the last major bull run that saw Bitcoin hit its latest ATHs.

An overview of top-performing cryptos

Some notable gainers include the following tokens.

Energy Web (EWT)

EWT Token jumped after BlackRock gave a shout-out to Energy Web, a nonprofit that develops operating systems for energy grids and whose mission is to accelerate the decarbonization of the global economy.

In the past week, EWT rose 36.6%, bringing its monthly gain to 47.6%.

Source: Messari.io

Ankr Network (ANKR)

After receiving an investment from Binance Labs, Ankr Protocol, a leading provider of blockchain infrastructure services, saw its ANKR token go parabolic. Within the past week, its price moved up 30.5%, and on a monthly basis, it soared 58%. The project's total value now stands at $377.5 million thanks to this price increase.

Source: Messari.io

iExec (RLC)

Also among the gainers was RLC, the native cryptocurrency of iExec, a decentralized computing platform where anyone can generate revenue via the rental of computing power, datasets, and applications. The price of RLC rose 39% over the past two weeks.

Source: Messari.io

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Lukas Enzersdorfer-Konrad, Bitpanda deputy CEO: “Crypto needs Gary Gensler gone”

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a broker based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation.

Bitcoin still consolidates despite positive spot ETFs demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

Why is ONDO’s price outlook bullish?

DefiLlama data shows that Ondo TVL reached a new ATH of $613.75 million. Ondo’s Supply Distribution metric shows whale accumulation. On-chain data shows that ONDO’s daily trading volume is rising, and the supply of exchanges is decreasing.

Maker price eyes a rally on technicals and on-chain metrics

Maker trades above $1,500 on Thursday, suggesting a potential rally as technical indicators show bullish divergence. This positive outlook is reinforced by MKR’s Exchange Flow Balance, which shows a negative spike, indicating growing investor confidence in the platform.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.