Not a rally to $1, but this is what XRP has to look forward to after September 19

- The SEC vs. Ripple story took a new turn after it was revealed that the parties would file open redacted versions of briefs on September 19.

- XRP’s market value has been declining week on week and is currently at a three-month low.

- Stuck in a downtrend for 17 months now, XRP is looking to breach it once again and flip the crucial resistance level into support.

The future of many cryptocurrencies hangs in limbo since the broader market signals have been fluctuating consistently, and XRP is not alien to it either. But beyond just the ongoing trend, XRP is also affected by its internal issues as well which are about to get much more complex.

SEC and Ripple reach the “endgame.”

As described by lawyer and XRP supporter Jeremy Hogan, the Securities and Exchange Commission (SEC) vs. Ripple case has reached its “endgame.” This is in effect to the trial scheduled for September 19, during which both SEC and Ripple will have to bring forward everything that they hold.

Post this, it is expected that before the end of 2022, a negotiation will be stationed during which will Ripple’s lawyers and regulators will discuss.

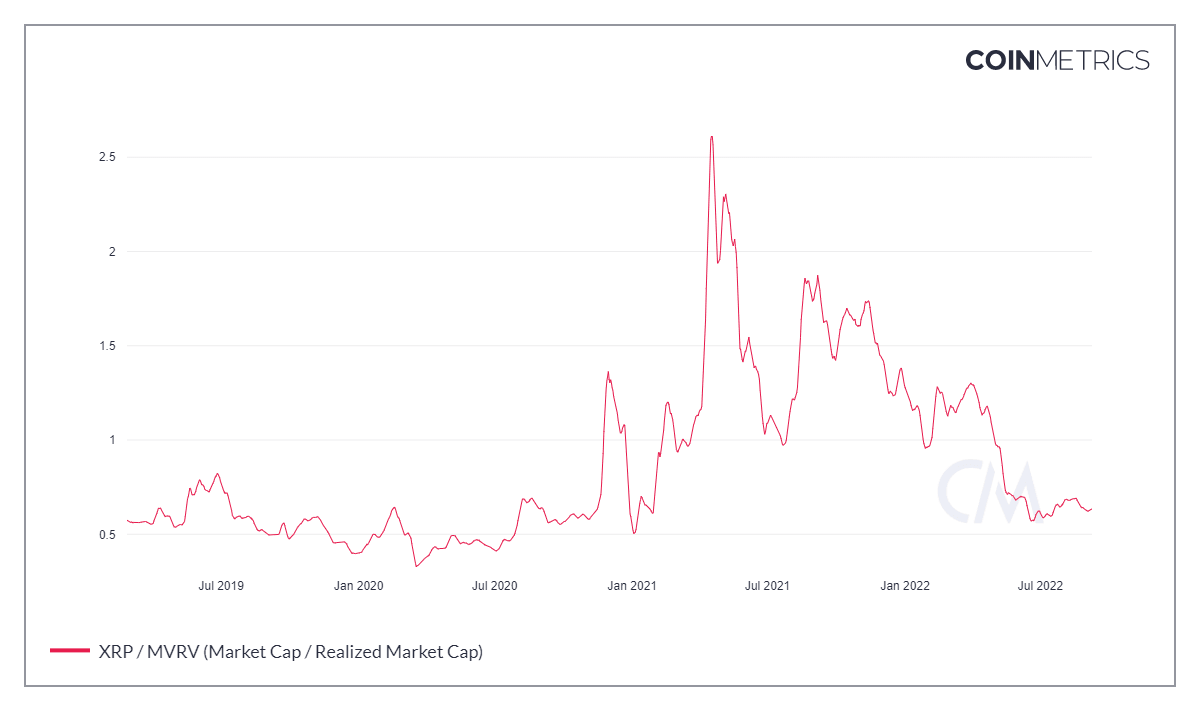

Based on how things go on September 9, XRP will be subjected to positive or negative reinforcements. The market value of the asset has been on a straight decline since July last year and only caught wind this year to reach its 20-month lows.

XRP market value

For the last three weeks now, the overall value has not changed by much, oscillating in the same range they were in July.

XRP’s next challenge

Beyond the issues of the court, XRP is also set to go through another critical challenge which it has tested and failed at multiple times in the past. The downtrend that began back in May 2021 continues to stand strong as a resistance line.

After testing and failing on different levels, XRP will soon once again test it for breaching through the $0.386 resistance level.

Rising above both of these will put XRP in a safe zone, far away from the troubles that will arise from the lawsuit. Besides, flipping these two resistances into support will also provide XRP the strength it needs to eventually head towards $1.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.