- Net flows into spot Bitcoin ETFs have been increasingly negative, recording $158 million in outflows on Wednesday.

- Grayscale’s outflows, on the other hand, do not seem to be slowing down as the fund has lost over 106,091 BTC.

- Bitcoin price is still stuck hovering around $40,000, testing the 100-day EMA on the daily chart.

Spot Bitcoin ETFs were expected to have an explosive start following their approval, which they did, but even though it has just been two weeks, the interest of the investors seems to be waning. Grayscale, which began bleeding right from the first day of trade, has seen some of the highest outflows.

Bitcoin ETF outflows hit a milestone

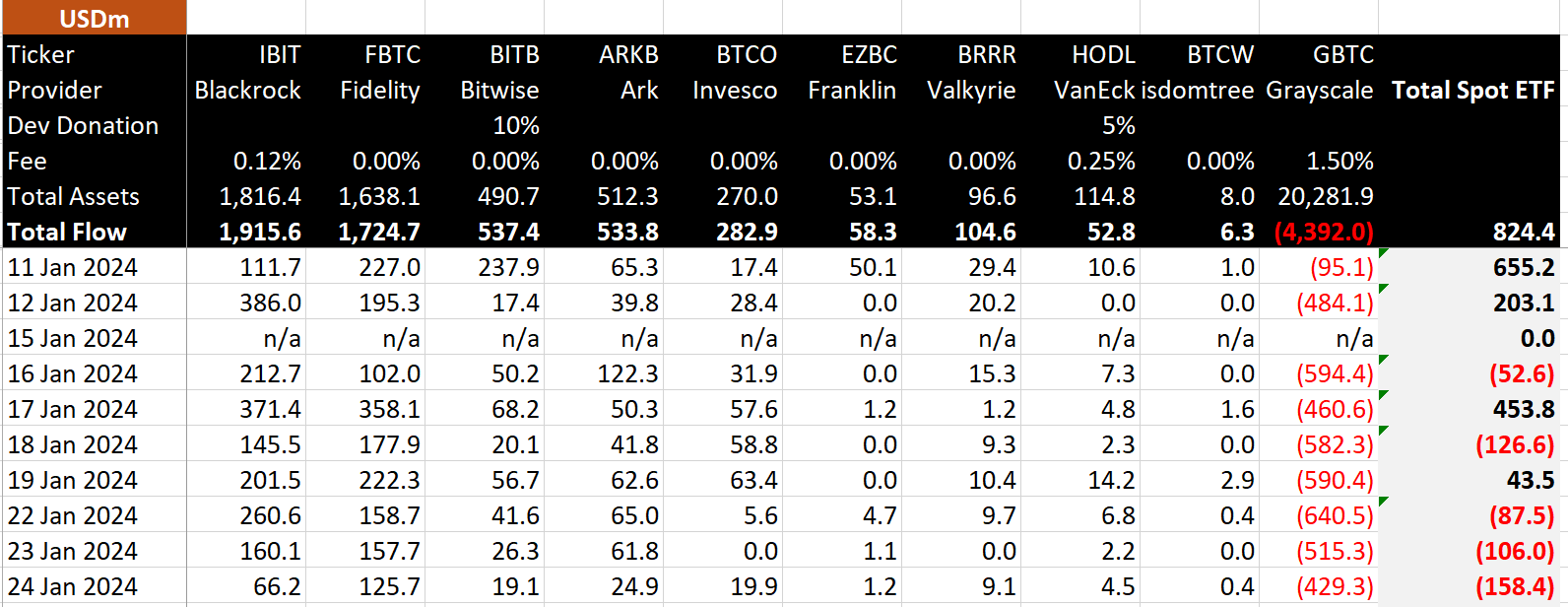

Spot Bitcoin ETFs have completed nine days of trading, and as of the moment, the outflows seem to be dominating. The net outflows recorded on the ninth day were about $158 million, which, combined with the outflows from the past nine days, brings the total to $528 million. This is solely due to Grayscale, which has seen consistently high outflows since Bitcoin spot ETFs were approved.

Thus, in less than ten days, over half a billion worth of BTC has already drained out of the spot ETF market. During the same period the market has noted inflows worth $1.2 billion in the same duration. This gives an overall balance of $824 million in net inflows.

Spot Bitcoin ETF outflows

The biggest loser, Grayscale, has been bleeding since the first day of trading, collectively noting 106,091 Bitcoin being sold in the same nine days. Apart from this $4.2 billion worth of outflow, the inflows of other digital assets have also begun declining. Wisdomtree spot BTC ETF noted the lowest inflow of just $10.6 million on Wednesday.

Total BTC outflow

It is evident that the hype is slightly fading since many people who were expecting a price rally soon after ETF approval have been left disappointed since Bitcoin price has not seen any growth in the last few days, hovering around $40,000.

Bitcoin price at risk

The cryptocurrency is observing support at $39,353, coinciding with the 100-day Exponential Moving Average (EMA). Some recovery on the daily chart has been observed in the last 24 hours. If this continues and the $41,814 resistance is breached, BTC will be able to flip the 50-day EMA into support.

BTC/USD 1-day chart

However, if the outflows continue to remain as large as they are at present, and Bitcoin price falls through the crucial support of $39,535, it could note a decline to $35,504, likely invalidating the bullish thesis.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto trading volume declines further, signaling waning trader enthusiasm and market momentum

The total crypto market capitalization lost $1.01 trillion since January, while Santiment data shows that crypto-wide trading volume has dropped since February’s peak. For a healthier and more sustainable recovery, bulls look for rising prices accompanied by increasing volumes; until trading activity picks up, cautious market sentiment is likely to prevail.

BNB price tops $570 as Binance receives $2 billion investment from Dubai

BNB price rose as high as $574 on Thursday as markets reacted to news that Binance received major investments from an Abu Dhabi based firm. Derivative markets analysis shows how BNB traders are repositioning amid the latest swings in market sentiment.

PEPE price outperforming DOGE and SHIB as US CPI boosts Crypto markets

PEPE price crossed the $0.00007 for the first time this week as markets reacted to positive macro market signals. Early insights show crypto traders are displaying high risk appetite at the onset of the current market rally. Could this sustain PEPE price uptrend along with the rest of the memecoin market.

XRP records slight gains as Ripple's battle with SEC nears end

Ripple's XRP recorded a 2% gain on Wednesday following rumors of the company nearing an agreement with the Securities & Exchange Commission (SEC) to end their four-year legal battle.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.