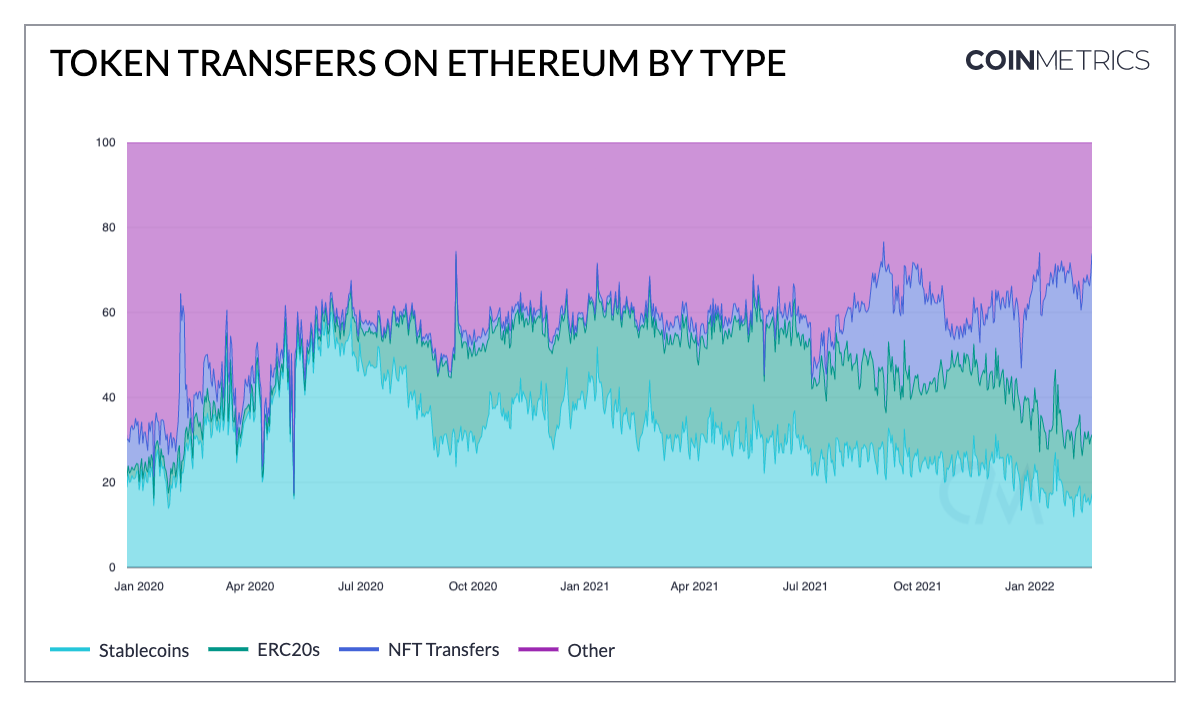

NFTs have increased their lead over stablecoins and ERC-20 tokens in transfers on the Ethereum network since last July, while WBTC minted on chain has leveled off this month.

Transfers of nonfungible tokens (NFT) on Ethereum have surpassed transfers of stablecoins and altcoins while the supply of wrapped Bitcoin (WBTC) has remained relatively stagnant since late last year.

Those are two of the key findings in the latest State of the Network update from Coin Metrics. It details how ERC-721 transfers overtook stablecoins and altcoins on Ethereum starting last July and have continued to increase the margin between them ever since. ERC-721 is the token standard for NFTs on the Ethereum network.

NFT transfers topped 50,000 per day on average starting late July and have not dipped below that line since. Daily NFT transfers are now averaging an all-time high over 300,000, a 600% increase since July.

Conversely, ERC-20 tokens including altcoins and stablecoin transfers have steadily decreased since late July. Transfers of altcoins have fallen 39% from 42,000 per day to about 30,000. Stablecoin transfers are down from about 24,000 in July to 18,000 today, a 25% decrease.

The numbers make the message fairly clear: NFTs are more popular than they have ever been. Demand on marketplaces to transact NFTs has never been higher according to data from DappRadar.

OpenSea is currently the all-time leader in NFT trading volume with $21.85 billion in value traded, but the LooksRare marketplace threatens OpenSea dominance. Over the past 30 days, LooksRare has seen $11.6 billion in volume compared to OpenSea’s $4.13 billion.

Such popularity is aided by the expansion of pro sports and the music industry into NFTs and the growth of virtual real estate. NFL superstar Tom Brady raised $170 million on Jan. 19 to help scale his Autograph NFT marketplace. On Feb. 3, recording artist John Legend launched an NFT platform for musicians to tokenize their work.

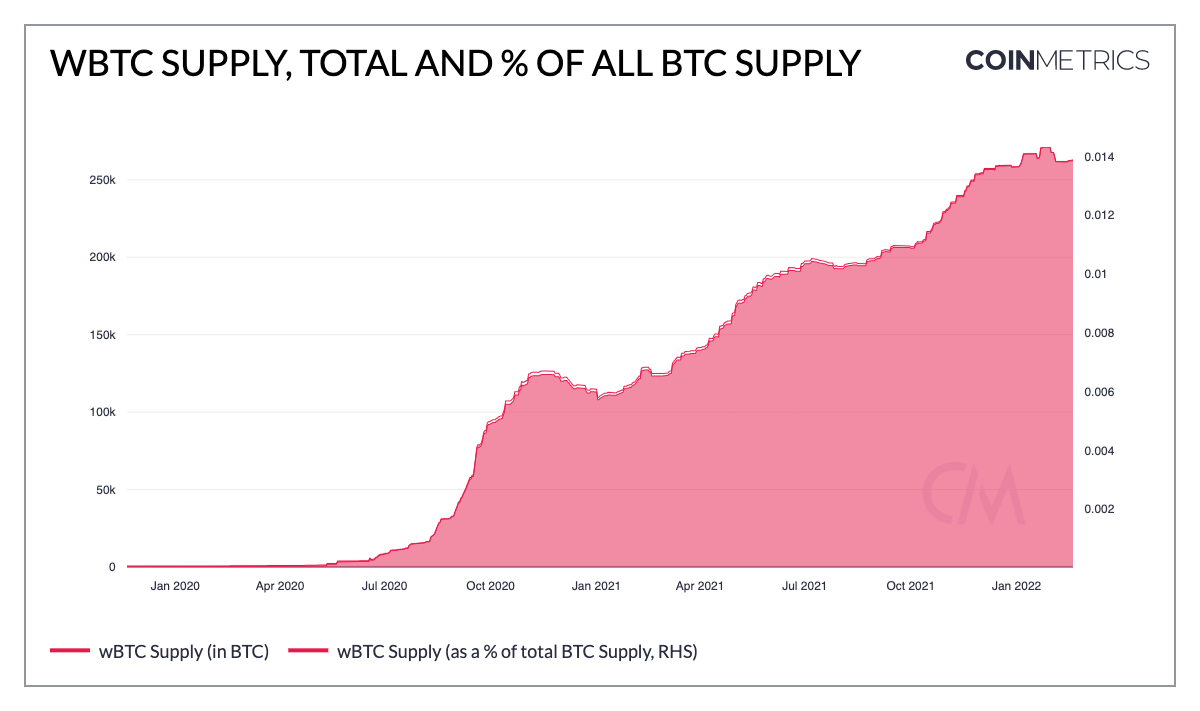

WBTC supply plateaus

WBTC is an ERC-20 token that has al enjoyed an increase in total transactions since July. After hitting a low of 110,000 daily transfers on Jul. 9, transfers peaked on Nov. 3 with 557,700. There are currently about 232,000 daily transfers according to CoinMetrics.

WBTC acts like a stablecoin that is pegged 1:1 to the value of Bitcoin, and can be redeemed at any time for a real BTC.

Although the total supply of WBTC on Ethereum is near its ATH of 271,000, equating to about 1.4% of the total BTC supply, CoinMetrics shows the rate of tokens being minted has flattened out since the beginning of February.

However, the total number of Ethereum addresses holding WBTC is currently at an ATH of 43,290 wallets according to CoinMetrics.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.