NFT Ordinals usher meme coin mania on Bitcoin

- Bitcoin blockchain’s BRC-20 tokens have witnessed massive price rallies despite low trading volume.

- Meme coins on the Bitcoin blockchain have hit a market capitalization of $320 million.

- BRC-20 transactions have pushed miners’ fees 11% higher, reminding users of elevated transaction fees from 2020.

Ordinals are a type of NFT (non-fungible token) on the Bitcoin blockchain, founded by Casey Rodarmor. BRC-20 is an experimental token standard on the Bitcoin blockchain modelled after Ethereum’s ERC-20 that allows users to attach data to individual satoshis (Ordinals) on the BTC blockchain.

The recent spike in BRC-20 adoption and popularity is driving a meme coin rally on the Bitcoin blockchain.

Also read: AAVE V3 deployment on Ethereum layer 2 METIS network unanimously approved

Meme coins thrive on the Bitcoin blockchain

Crypto assets built on the BRC-20 token standard are rallying. The category’s market capitalization climbed to $320 million, despite low trading volume.

Meme coins on the Bitcoin blockchain

Gate.io, a leading cryptocurrency exchange, recently announced the listing of BRC-20 token ORDI, fueling a rally in the meme coin. Minting meme BRC-20 tokens has emerged as a trend and crypto experts at Airdrop Official have shared a step-by-step process for the same.

BRC-20 is the next trend.

— Airdrop Official (@its_airdrop) May 7, 2023

It has already reached a $300Mn+ market cap within just 2 months of launch.

Still way too much smaller than ERC20's marketcap, making it an early opportunity for #Airdrops.

Here is how to mint, buy BRC-20, and more pic.twitter.com/QtDLVI8fEm

Assessing the impact on the Bitcoin blockchain

The arrival of BRC-20 tokens and their popularity has resulted in an increase in block generation time on the BTC blockchain. A Chinese journalist, Colin Wu, reported that the Bitcoin network did not produce a block at block height 788,759 for nearly an hour today. A similar occurrence was noted on June 11, 2021, when the block generation time at a height of 687,143 reached 119 minutes. In April 2021 it was as high as 122 minutes.

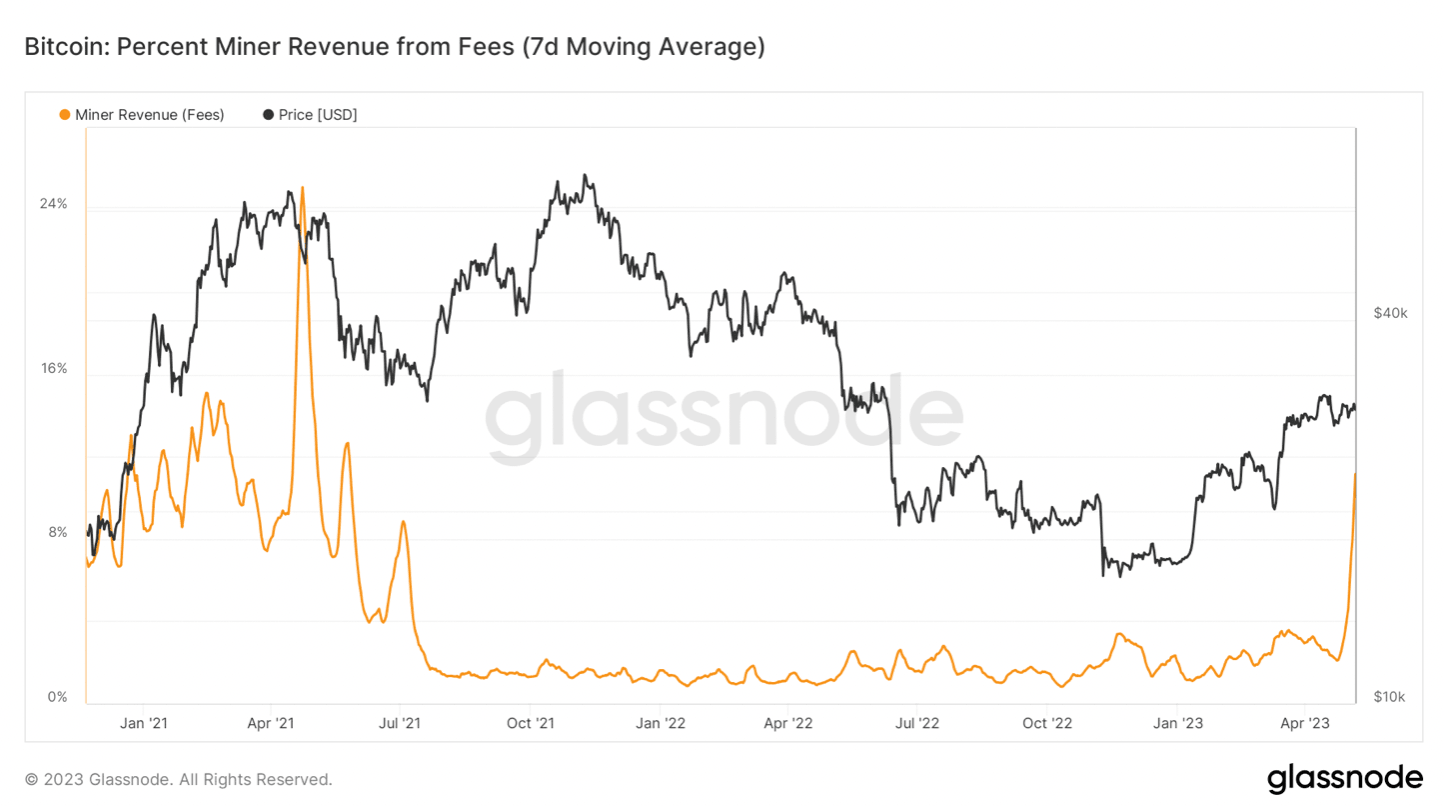

Higher block generation time slows down the Bitcoin blockchain and this is a negative impact of BRC-20 projects on BTC. Interestingly, Ordinals or Bitcoin-based NFTs have significantly influenced miner fees, pushing them 11% higher to levels observed in 2020.

Bitcoin miner revenue from fees

A spike in fees on the Bitcoin network translates to higher revenue for miners in the BTC network. Ordinals have therefore increased miner revenue, but they have not catalyzed a Bitcoin price rally yet.

At the time of writing, Bitcoin is exchanging hands below the $28,000 level following the recent pullback.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.