- NFT sales reached a seven-month high following the crypto market’s recovery.

- LooksRare joining hands with MoonPay will allow the traders to purchase NFTs and native token LOOKS on the platform directly.

- Opensea, over the last week, has lost its position as the biggest NFT marketplace to NFT marketplace and aggregator Blur.

Non-fungible tokens (NFTs) exploded to their peak last year. Since then, they have only declined in trade volume and sales to the point that the month of December 2022 recorded less than $4 billion worth of sales. Even so, NFT marketplaces are attempting to expand their reach, an instance of which can be seen in the case of LooksRare as well.

LooksRare joins hands with MoonPay

In a blog post on Thursday, the cryptocurrency payment service provider MoonPay announced its partnership with NFT marketplace LooksRare.

The Ethereum-based NFT marketplace will allow users to directly buy and sell cryptocurrencies such as LOOKS, ETH (Ethereum) and wETH (wrapped Ethereum) on the platform.

Going forward, the platform will also integrate NFTs enabling a user to buy NFTs through the platform using a credit card, thus eliminating the compulsion to buy them using cryptocurrencies.

Despite launching just a year ago, in January 2022, LooksRare has grown significantly, even becoming the fourth-largest NFT marketplace over the last week. Conducting sales worth $6.97 million, LooksRare was responsible for nearly 3.5% of all NFT sales.

However, surprisingly Ethereum’s biggest NFT marketplace, Opensea, did not note the highest volume. The decentralized application was overtaken by the recently launched NFT marketplace and aggregator Blur.

Opensea loses the top spot

Launched in October last year, Blur has been pushing its presence in the community as the marketplace for professional traders. Consequently, it has observed a surge in volume, with the last week’s sales surging past Opensea’s.

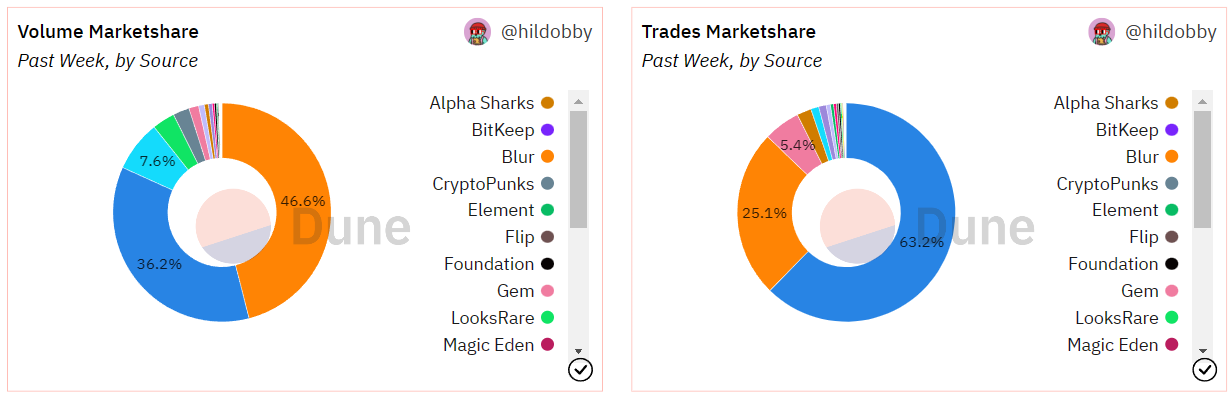

Dominating 46.6% of the market, Blur led the NFT market, with Opensea following with a 36.2% domination leaving X2Y2 with 7.6% sales, followed by LookRare in the fourth place.

NFT sales and trades market share

However, when it comes to the number of trades conducted within a week, Opensea remains at the top of the board. Conducting more than 63% of all the trades in the crypto market, Opensea left Blur with just a 25.1% market share.

This shows that despite observing higher capital movement, Blur is still behind Opensea in terms of user numbers.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.