- The Federal Reserve of New York and a group of private banking firms launched a 12-week digital dollar pilot project.

- The project is titled “the regulated liability network,” and it will conduct a test on usage of digital dollar tokens by banks.

- The stablecoin market has stabilized once again, Fitch Ratings announced return of confidence to larger coins like Tether (USDT).

The Federal Reserve of New York kicked off its digital dollar pilot alongside major lenders Citi, Bank of America, BNY Mellon, HSBC and payment specialists Mastercard and Swift. The goal of this project, titled “The Regulated Liability Network” (RLN) is to experiment with wholesale digital asset transactions and settlements.

The usage of digital dollar tokens by banks could speed up settlements and bring blockchain innovation to the real economy.

While the crypto market is on shaky ground after FTX exchange’s collapse, leading credit ratings provider, Fitch Ratings said that the stablecoin market has stabilized.

Also read: US Treasury Secretary Janet Yellen believes FTX collapse exposed weaknesses in crypto

New York Fed and leading global banks begin digital dollar pilot

Leading global banks and payment giants kicked off a 12-week digital dollar pilot together with the Federal Reserve of New York. The project titled “The Regulated Liability Network” will serve as a ground for participants to experiment with wholesale digital asset transactions and settlements.

Major lenders Citi, Bank of America, BNY Mellon, HSBC and payment specialists Mastercard and Swift will use simulated data to test tokenized deposits and transactions by banks. The Federal Reserve of New York issued a statement,

This theoretical [financial market infrastructure] provides a multi-asset, always-on, programmable infrastructure containing digital representations of central bank, commercial bank, and regulated non-bank issuer liabilities, denominated in U.S. dollars.

The Regulated Liability Network represents an alternative to unregulated crypto like Bitcoin

The Regulated Liability Network consisting of leading global banks, payment giants and the New York Fed is working on the establishment of new digital forms of money. RLN represents a potential alternative to unregulated cryptocurrencies like Bitcoin, Ethereum and altcoins.

RLN can be considered an alternative to Central Bank Digital Currencies (CBDCs) and commercial and electronic money issued by regulated non-bank payment firms. The premise is that digital dollar, CBDCs and tokens issued by payment firms could exist on the same distributed ledger.

The digital dollar pilot is aimed at using interoperable blockchains for near-instant cross-border payments and clearing. On November 10, the New York Fed announced a joint experiment with the Monetary Authority of Singapore to test how wholesale CBDCs could streamline cross-border payments involving multiple currencies.

The news of the digital dollar pilot followed the collapse of FTX exchange and bloodbath in unregulated cryptocurrencies like Bitcoin, Ethereum and altcoins.

Michelle Neal, head of New York Fed’s markets group said that the use of the central bank digital dollar could speed up settlement time in currency markets and is promising.

While the US Fed’s New York arm begins testing the digital dollar, stablecoins have stabilized and recovered from the FTX-induced crypto crash.

Fitch Ratings announces belief in stablecoins has been reinstated

During the FTX-collapse, the crypto market witnessed a spike in volatility and a bloodbath. Stablecoins USD Tether (USDT) and Tron ecosystem’s USDD suffered a temporary depeg. The stablecoins re-established their peg and recovered from the loss of investor confidence.

Fitch Ratings, a leading credit ratings provider, noted that stablecoins have stabilized again. Investor confidence is returning to larger stablecoins as Tether and Circle, the issuers of USDT and USDC have made concerted efforts to increase confidence and improve price stability.

Fitch Ratings said in a report that USDT and USDC have increased the proportion of liquid assets backing the stablecoins, although excess risk remains. Tether reduced USDT's commercial paper holdings, now at zero according to the firm. In its portfolio, Tether still holds more volatile and potentially less liquid assets, such as precious metals, the report said.

The report reads:

USDT's consolidated assets exceed its liabilities by 0.3%, which may not cover volatile swings in values of some underlying assets if USDT has to liquidate assets.

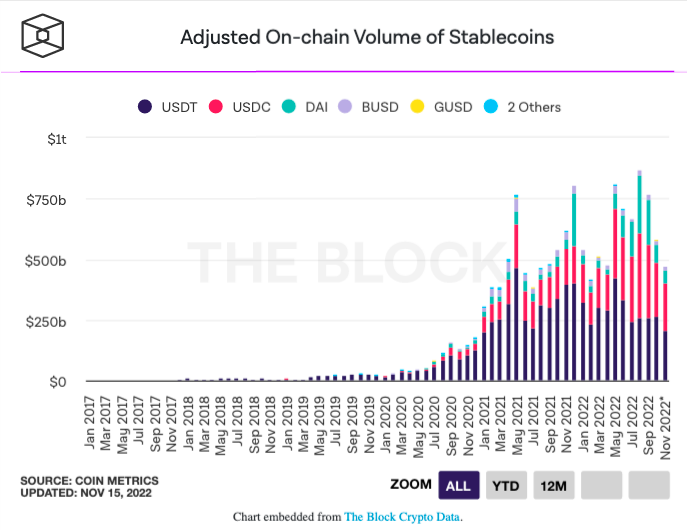

Circle issued USDC holds a high level of cash through US deposits (20%) and short-duration US Treasuries (80%). The following chart compares the adjusted on-chain volume of stablecoins.

Adjusted on-chain volume of stablecoins

Stablecoins have been showing signs of increased stability, USDT briefly traded below its peg to the US dollar last Thursday. The rating agency said that the number of new stablecoins has increased to 132, a 76% increase from Q1 2022, despite the FTX-collapse.

Fitch Ratings believes that the entry of new stablecoins could result in additional issues and failures of smaller projects. The digital dollar pilot therefore, comes at the right time for entities to reduce settlement times and increase transaction speed using regulated digital assets.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.