Asset tokenisation, which involves splitting up real-world assets and converting them into their digital equivalent on the blockchain, could take off within the next three to five years. But its rate of adoption depends on two key challenges.

Asset tokenisation: revolution or evolution?

More than 10 years ago, the pseudonymous Satoshi Nakamoto designed the first prototype of bitcoin. Thanks to its highly secure cryptographic algorithm and ability to operate without a trusted intermediary, bitcoin’s bold promise was to disrupt the global financial industry and allow people to transact with one another without the need to “shake hands”. Today, as central banks combat deflationary pressures stemming from the digital economy, economists are struggling to come up with a consistent framework around digital currencies and assets, and their implications for the economy and capital markets. But there is a silver lining. Asset tokenisation – the process of slicing and dicing real world assets into their digital equivalent on the Blockchain – could take off within the next three to five years. That said, and despite advances in ground-breaking technology and the potential to unlock new pots of liquidity in previously illiquid assets, there are two key hurdles to overcome.

The key ingredients of asset tokenisation

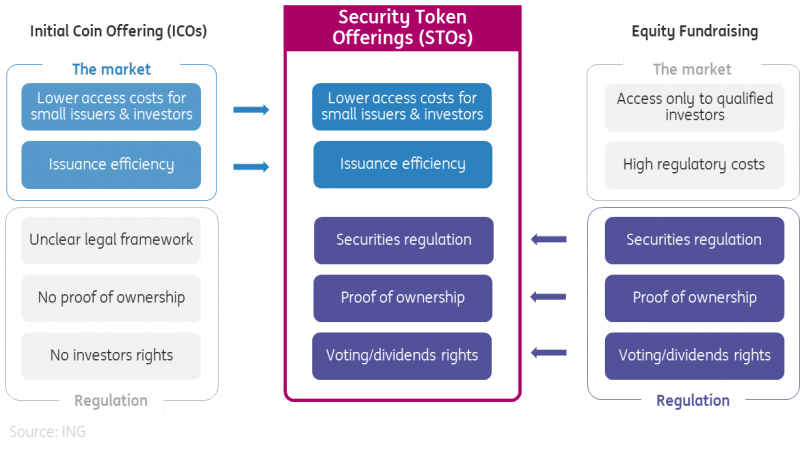

Security tokens are programmable, digital, crypto assets. Programmable because they can follow business-driven logic statements; digital because they are a digital representation of an existing real world asset; and crypto because they are fully encrypted on a distributed ledger environment. Similar to initial coin offerings, security tokens are issued through security token offerings, but with a key difference: security tokens are often sandboxed within the existing financial securities regulatory framework, and as such they come together with a set of legally binding rights for buyers and obligations for issuers, sellers and trading platforms. This special blend is what could make them more appealing to investors and regulators alike.

Security tokens are versatile

So how does the token economy work? Imagine you own a house but you just lost your job and you need to make some cash. Unless you have savings or other income, you are almost forced to sell your property and if it is your only property you probably don’t want that. But with tokenisation you can slice up the value of the asset into digital tokens and sell just a fraction of them to investors. This way, tokenisation kills two birds with one stone: it offers a “liquidity premium” for the underlying asset and it facilitates market access to new types of investors. Therefore, security tokens could unlock new opportunities and liquidity for issuers and investors alike. They are versatile, as they can be used for tangible assets (including commodities, shares, real estate, properties, art work) as well as intangible assets (such as music property rights). But before this can happen, the capital markets industry must catch up with technology, moving away from paper-based manual-intensive workflows and clearing and settlement processes that could take days to complete.

Undeniably, security tokens could elevate the capital markets industry. But their rate of adoption depends on two key challenges. The first relates to regulation. Because security tokens fall within existing regulation, their pace of adoption should accelerate. There are increasing signs that regulators are willing to catch up quickly, with Germany, Switzerland and Luxembourg leading the pack in Europe. But equally, the lack of global standards for all securities casts some doubt on their cross-border development. To be clear, the regulatory challenge of cross-border transactions is as daunting for security token offerings as it is for any other security.

Regulators are moving fast in Europe too

Are security tokens any different than investment funds?

The second challenge concerns tokenisation itself. Although fractional ownership could unlock more liquidity, it will not necessarily generate higher demand for those assets. From an economic standpoint, what security tokens make possible in the current regulatory landscape is what is already made possible by investment funds. Funds are able to invest in illiquid assets, and to make them available to (retail) investors. They can divide their asset portfolio into a number of units or shares of their choice (“units”… “tokens”…). And while it is true that tokenisation could significantly expand the pool of assets, crucially, the investment fund is an intermediary.

What security tokens make possible in the current regulatory landscape is what is already made possible by investment funds.

The current regulatory framework requires an intermediary (liability, responsibility, single point of contact). Therefore, for security tokens to fit in within the existing regulation, they have to act as an intermediary. Funding models for security token offerings may become more decentralised over time, and regulation could evolve to accommodate, but this will take time. Developing the technology is only the first step. Shaping the economic and regulatory landscape is a much bigger challenge: as the intermediary disappears, the unit-holders become direct fractional owners, directly responsible and liable. This begs a number of economic and legal questions, not least on asset valuations, verification of ownership and marketability of the tokens. The Financial Stability Board, for instance, has warned against the risks posed by the rise of tokenisation, such as the potential liquidity mismatch between the token and the underlying asset or the overestimation of the degree of liquidity of traditionally illiquid assets during periods of market stress.

Finance is the business of trust. Without trust, an investor is unlikely to engage in a transaction.

Ultimately, finance is the business of trust. Without trust, an investor is unlikely to engage in a transaction. Even in a fully decentralised world where transactions take place on a public blockchain ledger, there needs to be trust in the algorithm, or the coder who designed it. It is difficult to see how a fully decentralised model might work given these issues, which then leaves the door open to trusted intermediaries such as banks and investment funds.

Read the original analysis: New Money VI: Asset Tokenisation - a new chapter for the capital markets industry?

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

This week could be explosive for ETH: Ethereum ETFs to debut in the US on Tuesday

Ethereum (ETH) is down nearly 1% on Monday as the Securities & Exchange Commission (SEC) confirmed via its website on Tuesday that it has given the final approval for spot ETH ETFs. Considering the ETH ETF launch and the upcoming Bitcoin Conference, this week could prove crucial for Ethereum.

SEC gives final approval for Ethereum ETFs to begin trading

The Securities and Exchange Commission (SEC) approved the S-1 registration statements of spot Ethereum ETF issuers on Monday, making it the second digital asset ETF to go live in the US, according to the latest filings on its website. The approval is also visible across the websites of the various asset managers that applied for the product.

Could Donald Trump and Elon Musk provide Bitcoin's bullish spark?

Trump could use Justice Department's 200,000 BTC as headstart for potential Bitcoin reserve, says analyst. Elon Musk hints at potential Bitcoin endorsement after US dollar value destruction post and laser eyes profile picture. The bearish crowd has remained silent since Bitcoin's two-week rebound.

Crypto investment products continue positive run after $1.35 billion net inflows

CoinShares' weekly report shows that crypto investment products saw a third consecutive week of inflows. Bitcoin saw inflows of $1.27 billion, with short-bitcoin recording more outflows. Ethereum-based products outperformed Solana on year-to-date inflows.

Bitcoin: Will BTC continue its bullish momentum?

Bitcoin (BTC) price increased by 5.5% this week until Friday after breaking above a descending trendline. Currently, it is trading slightly higher by 0.23% at $64,166.