New blockchain Aptos unveils controversial tokenomics, APT incentive plans

Recently-launched blockchain Aptos published a summary of its token distribution and incentive plans this morning amid reports of a slower-than-expected start and community criticism surrounding the amount of its native APT tokens held by private investors.

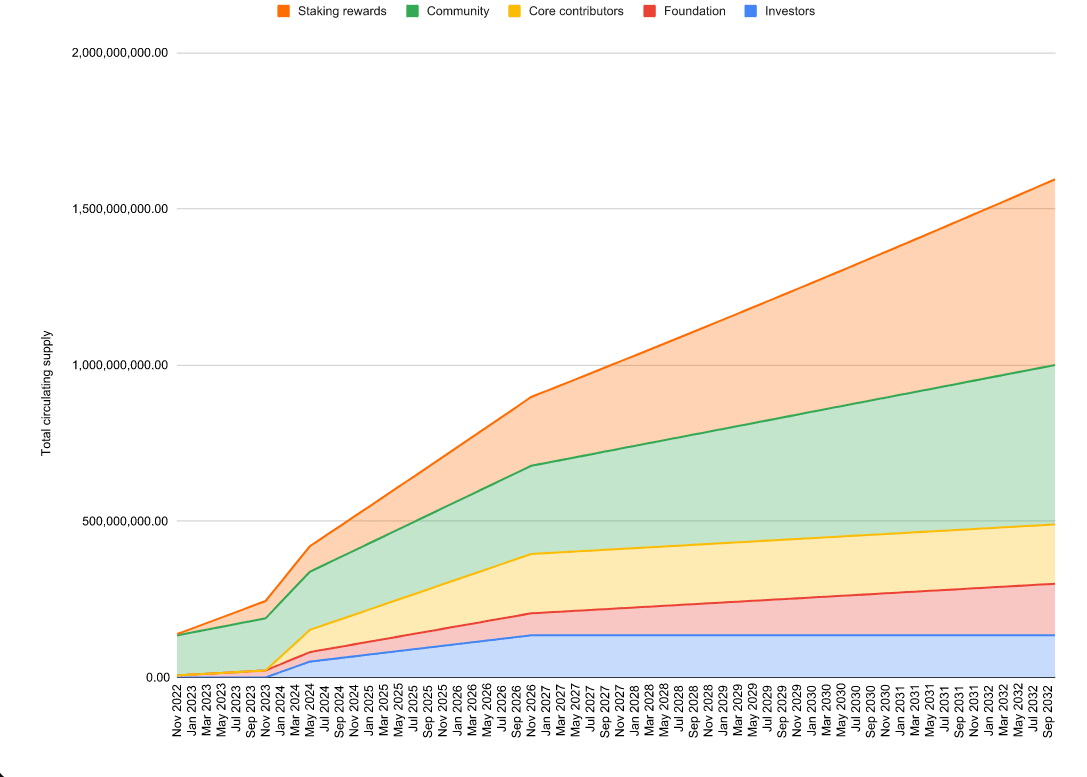

The initial total supply of Aptos tokens (APT) at Monday’s mainnet launch was 1 billion tokens, with some 510 million distributed to community members, 190 million to core developers and the remaining to the Aptos Foundation and private investors.

The Aptos Foundation holds 410 million tokens overall, which will be released over the next ten years. Of that, 125 million APT is available initially to support ecosystem projects, grants, and unspecified community growth initiatives, and a smaller 5,000,000 APT available initially to support the Aptos Foundation initiatives for the Foundation category.

Another 100 million tokens are held by Aptos Labs, a centralized entity that develops and maintains the blockchain.

Aptos said tokens held by private investors and current core contributors are subject to a 4-year lock-up schedule from the mainnet launch.

Aptos token supply is to be released over the next ten years. (Aptos)

There are rewards for holders who stake their tokens to contribute to the network’s upkeep. “Currently, the maximum reward rate starts at 7% annually and is evaluated at every epoch,” the post read.

“The maximum reward rate declines by 1.5% annually until a lower bound of 3.25% annually,” it added, pointing out that all transaction fees are currently burned but this may change based on future governance decisions made by the Aptos community.

Community sentiment toward the token plan remained largely tepid, with most criticizing the large allocation for developers.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.