Neutron Price Forecast: NTRN bulls eye 20% rally amid optimistic market sentiment

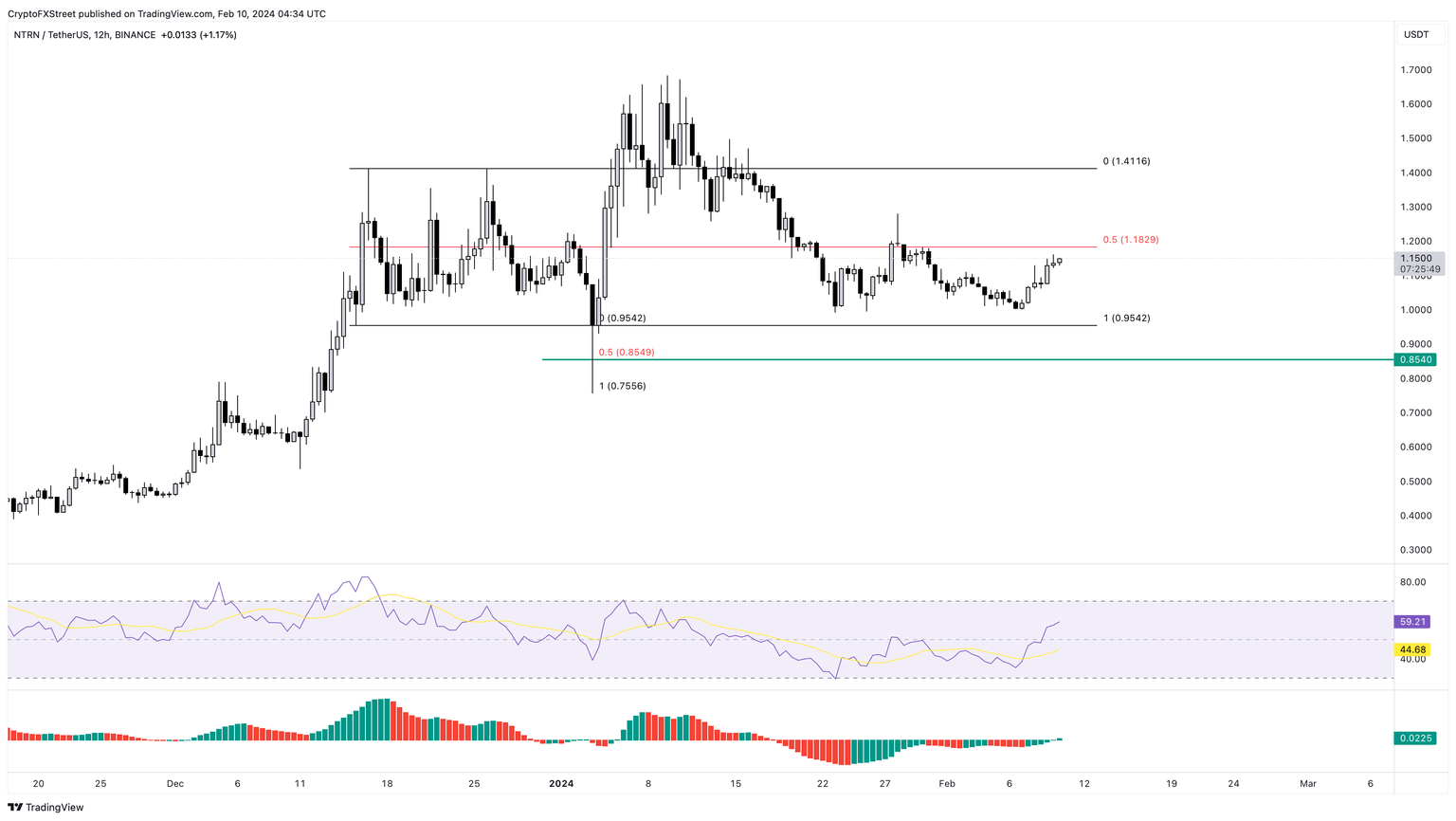

- Neutron price is trading inside a range, extending from $0.954 to $1.416.

- A breach of the range’s midpoint at $1.182 could trigger a 22% rally to $1.416.

- Invalidation of the bullish thesis will occur on a twelve-hour candlestick close below $0.54.

Neutron (NTRN) price has been consolidating inside a range for nearly two months. The recent NTRN move hint at a continuation of the ongoing upswing.

Also read: APT, CYBER, SAND, APE tokens to experience unlock waves next week

Neutron price ready to move higher

Neutron price action created the $0.954 to $1.418 range in mid-December 2023. Since then, the range low was swept first and was followed by a range high sweep. Following this move on January 5, NTRN slowly bled 41% from its local top at $1.683 to $0.991.

After a base formed here, Neutron price kickstarted its next leg, which has resulted in nearly 15% move in the last three days. As NTRN approaches $1.182, the aforementioned range’s midpoint, investors need to be cautious of a potential breakout.

Typically, consolidations tend to produce a volatile move from the midpoint of the formed range. There is an added benefit for NTRN due to the positions of the Relative Strength Index (RSI) and Awesome Oscillator (AO).

The RSI and AO have flipped above their respective mean levels at 50 and 0, signaling a surge in bullish momentum for NTRN.

Therefore, investors can expect Neutron price to kickstart an explosive move over the weekend, which could potentially tag the range high at $1.416 after a 22% upswing.

NTRN/USDT 12-hour chart

While the outlook for Neutron price remains bullish, NTRN could get rejected at $1.182, which could lead to a minor pullback. If this development occurs and the conditions are still right, it would be a good buy-the-dip opportunity.

However, if NTRN continues to bleed and produces a twelve-hour candlestick close that flips the $0.954 support level into a resistance level, it would invalidate the bullish thesis. In such a case, Neutron price could drop 14% and tag $0.854.

Also read: Solana Price Prediction: Is SOL ready for a breakout?

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.