- NEO is currently trading at $17.95 after a pullback from 2020-high at $25.85.

- Several indicators are showing bullish signs in the short-term for the digital asset.

NEO is down 12% since the beginning of October and continues trading inside a downtrend. Despite the launch of Flamingo, a decentralized finance protocol built on top of NEO’s blockchain, the price of the digital asset has continued to drop.

NEO price is close to a massive move

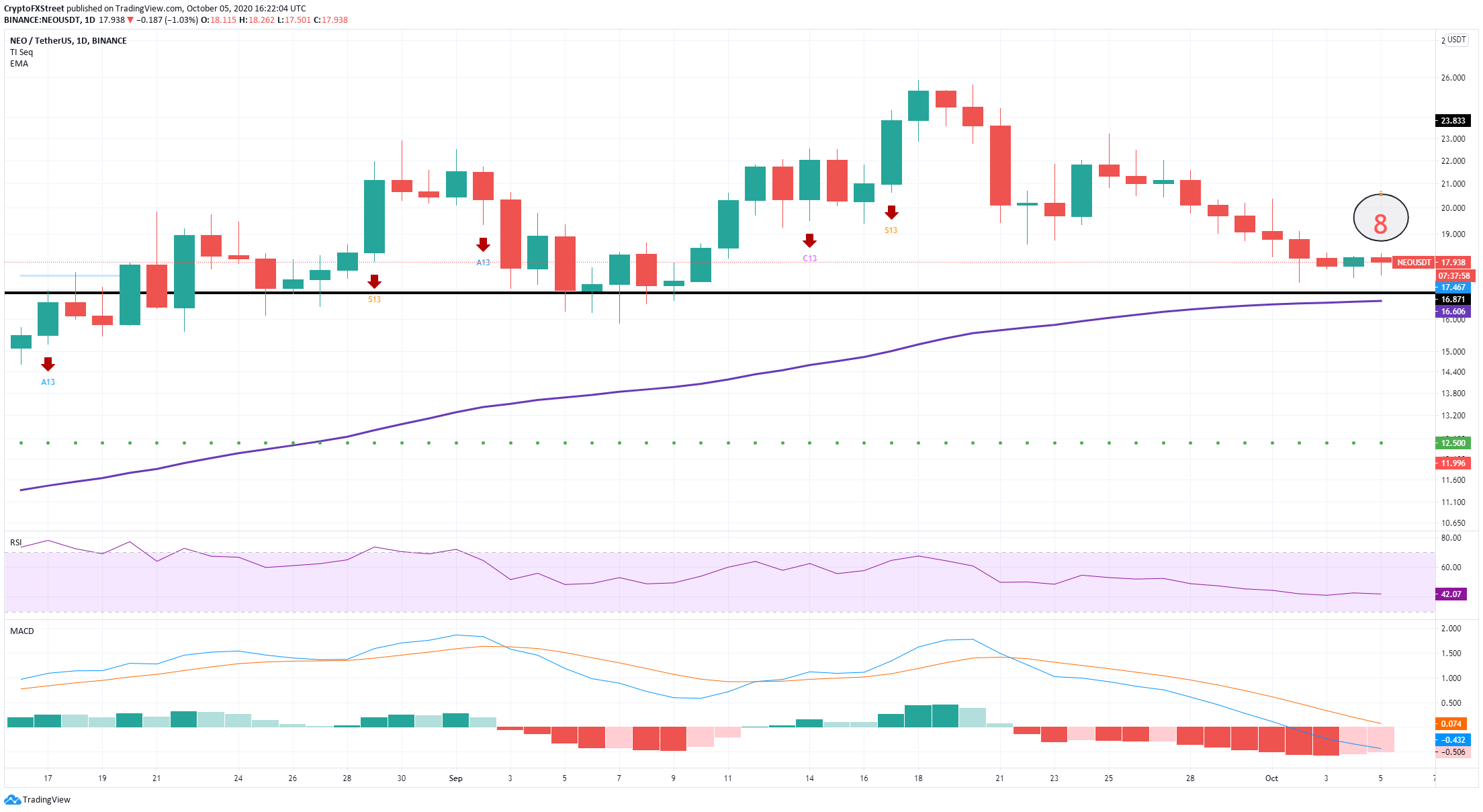

Several key indicators are showing that NEO is on the verge of a spike. If we take a look at the daily chart, we can recognize an ‘8’ presented by the TD sequential indicator, a sign that a buy signal will come up soon.

NEO/USD daily chart

The price of NEO is at $17.94, right above an important support level formed at $16.9. This level was defended on several occasions in the past on September 6 and August 25.

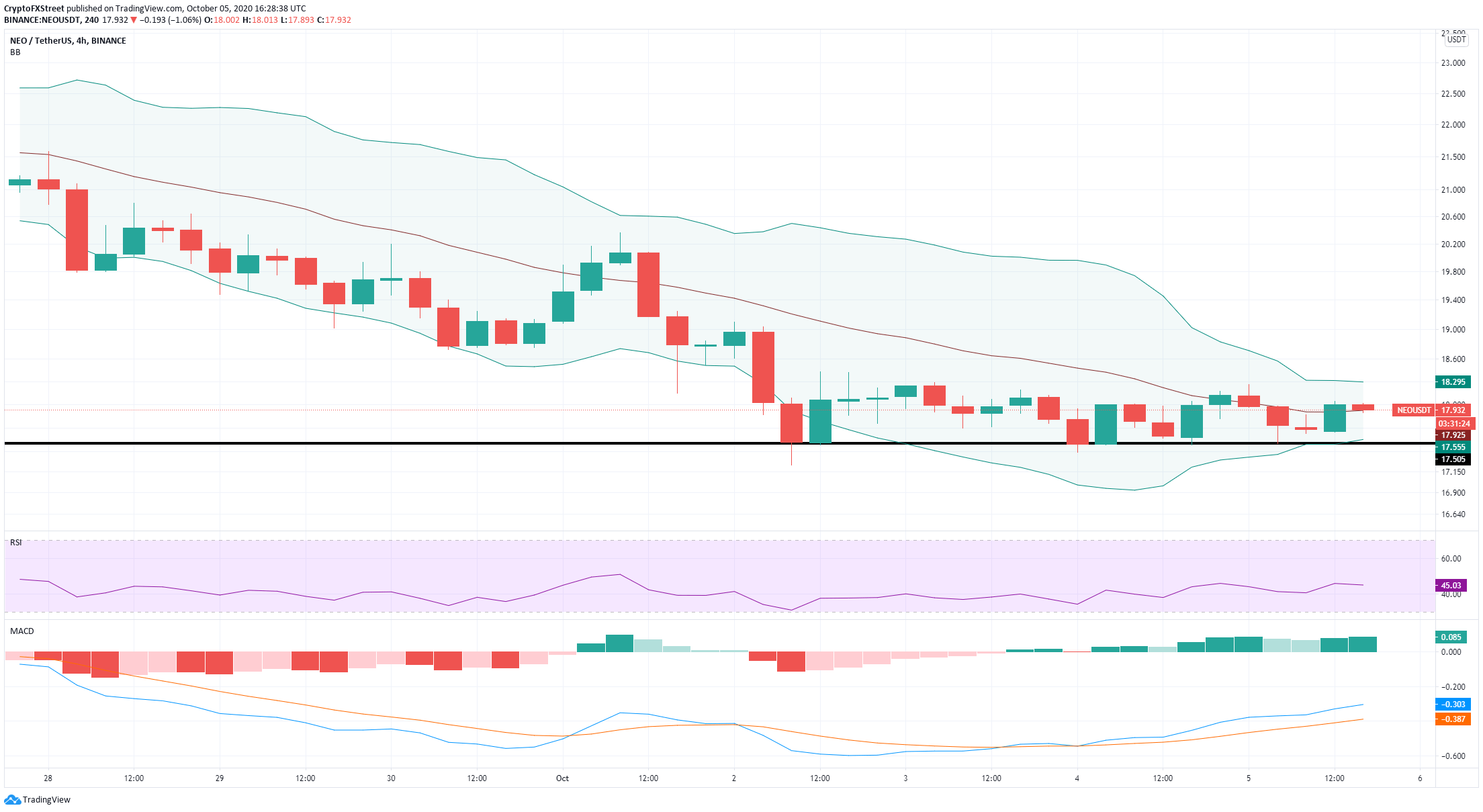

Another crucial factor showing the upcoming volatility for NEO is the Bollinger Bands indicator. The bands are squeezing on the 4-hour chart, which usually means that a significant price movement is underway. Breaking through the upper band of the indicator will most likely push NEO up to $20.

NEO/USD 4-hour chart

NEO also formed a healthy support level at $17.5 on the 4-hour chart while the MACD turned bullish on October 3, indicating that bulls are in control over the short-term.

However, a bearish breakout below $17.5 would most likely bring NEO down to the daily 100-EMA at $16.6. Furthermore, it seems that on the hourly chart, the digital asset is getting rejected from the 100-SMA.

NEO/USD 1-hour chart

The 100-SMA, currently established at $18, acted as a strong resistance level several times in the past on October 1 and September 27.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637375122708501725.png)