- NEO succumbed to intense selling pressure after trading September highs at $26.

- Recovery from the support at $18.50 is dealing with resistance at $20 as well as the descending trendline.

- A possible breakout to $25 depends on NEO's ability to hold above the 50-day SMA.

Over the past couple of weeks, NEO has been on a retreat from highs around $26. As the bearish wave swept through the market, bulls tried their best to hold NEO above various key support levels at $22 and $20 but failed. NEO/USD extended the bearish leg under $20 and refreshed the levels close at $18.50. A bounce from the support lost steam marginally above $22, giving way for another slump to $18.50. At the time of writing, NEO bulls nurture an uptrend, reflected by the minor recovery to levels slightly above $19.

User-friendly account names coming to NEO

Interacting with cryptocurrencies requires the creation of an account by generating a cryptographic keypair. Unfortunately, these keypairs carry with them usability challenges. For instance, users must guarantee the safety of private keys or risk losing all their holdings. The private keys are also associated with seed words that are a bit complex and could be misplaced. In other words, it can be an uphill task interacting with cryptocurrencies.

NEO's development team is currently "working on a native domain service to improve this design." The upgrade will give users the ability to "map their addresses into easy-to-use domain names." The main goal is to have user-readable addresses that represent the public keys.

NEO's bullish outlook to $25

NEO is seating comfortably above the 50-day Simple Moving Average (SMA). This is a key level on the daily chart. NEO has not traded below indicator since mid-August. It took NEO/USD almost two months to hit highs of $26. With the price holding above the 50 SMA, the crypto might resume the rally, with a target at $25.

NEO/USD daily chart

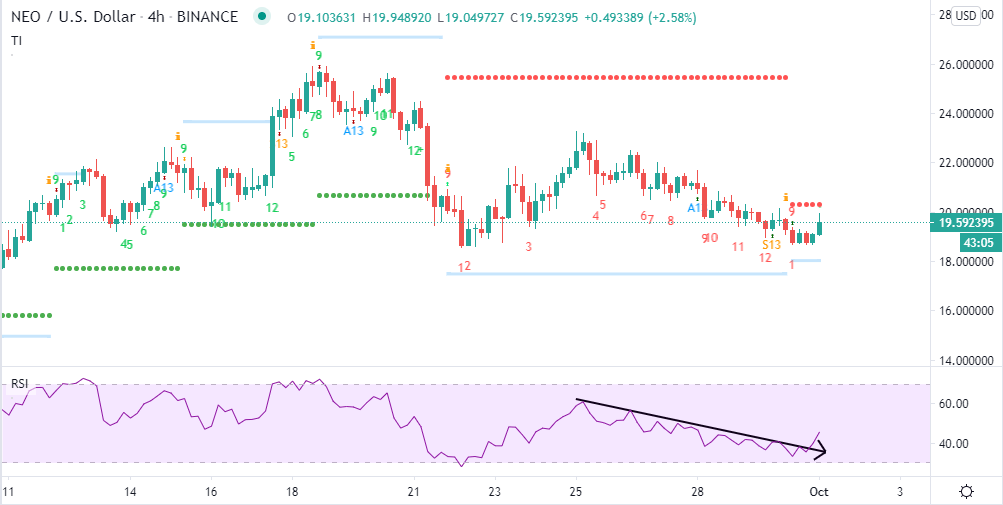

The TD Sequential indicator already presented a buy signal in the form of a red nine candlestick in the 4-hour range. Moreover, the Relative Strength Index (RSI) in the same timeframe has resumed the uptrend, highlighting the presence of buying pressure. Continued uptrend towards the overbought area would occur in tandem with the NEO/USD rise above $20 and $22, respectively.

NEO/USD 4-hour chart

According to Santiment, a leading provider of on-chain analysis, NEO's social volume shot up to 1,700 on September 20 when the token traded highs around $26. The social volume has since done down to 8 alongside the breakdown of the price to $18.50. The low volume opens the door for future spikes as well as price rally.

NEO social volume chart

Looking at the other side of the picture

NEO is dealing with the resistance at $20. A break above this seller congestion zone would boost the token above the descending trendline, raising the price towards $25. However, if the daily candlestick closes below the 50-day SMA, the next level of support would be the 100-day SMA around $15. The critical support range between $16 and $18 will also absorb the selling pressure, probably halting the potential slide to $15.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

social volume chart-637371212784072986.png)