NEO Price Analysis: NEO needs to break above $17.7 to avoid massive sell-off

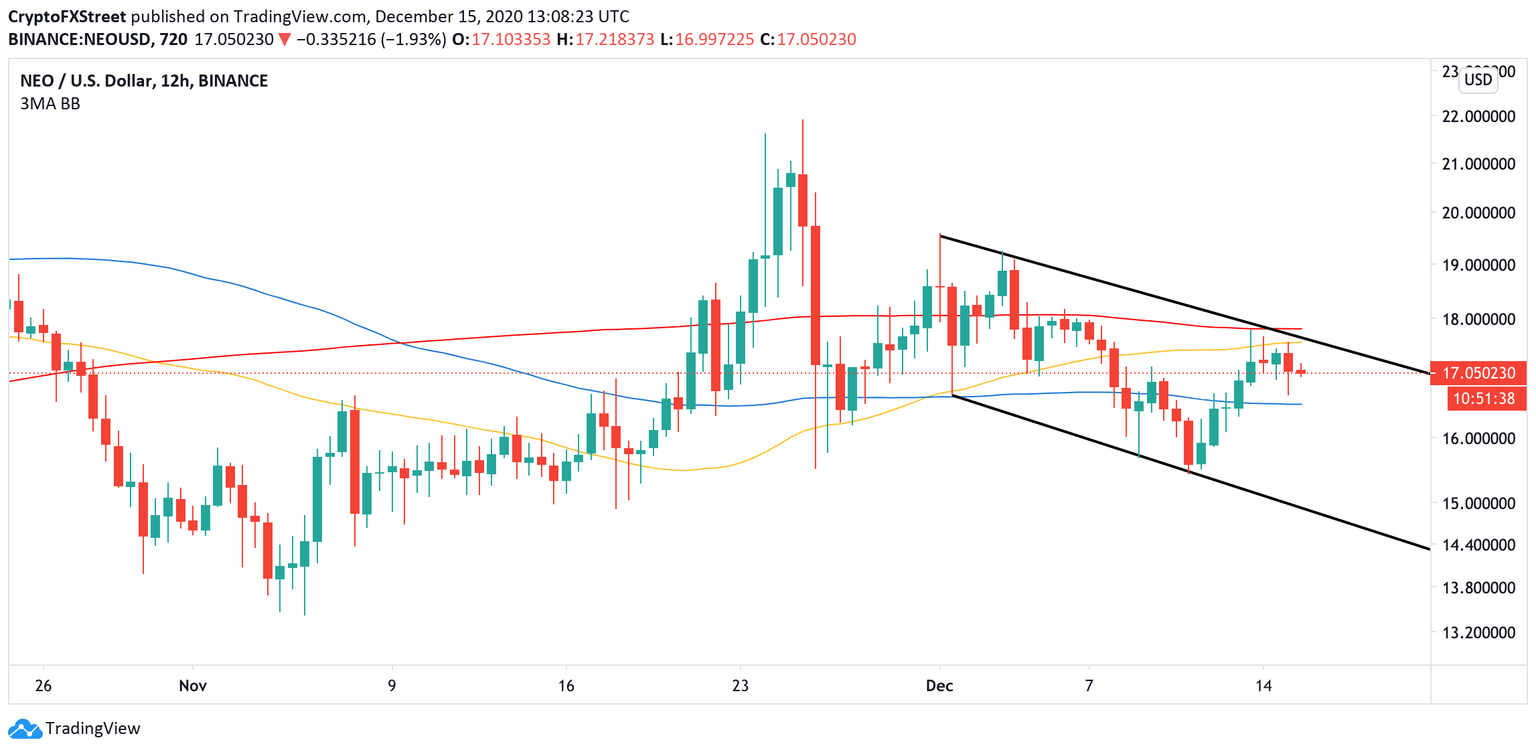

- NEO is moving within the downside channel.

- The rejection from $17.7 may lead to a sell-off towards $15.

NEO bottomed at $15.4 on December 11 and has returned to $17.20 by the time of writing. The coin attempted a move to $17.8 on Monday, December 14, but the upside momentum faded away on approach to the local resistance level.

The token of the smart contract platform, often referred to as Chinese Ethereum, has been falling behind most altcoin majors this year. Despite the recovery on the cryptocurrency market, NEO is still around 90% lower from the record high of $207 reached in January 2018.

Currently, NEO takes the 23d place in the global cryptocurrency market rating with a market value of $1.2 billion and an average daily trading volume of $363 million. The token stayed unchanged since Monday and gained nearly 2% on a week-to-week basis.

Technical indicators bode ill for NEO bulls

On the intraday chart, NEO's recovery is limited by the 1-hour EMA50 at $17.20. This local barrier needs to be taken away for the price to extend the rally towards the local high of $17.7, followed by $18. The mentioned resistance separates the bulls from the ultimate short-term goal of $20.

On the downside, a sustainable move below $16.7 will take the price outside the recent consolidation range and worsen the technical picture. This barrier is reinforced by a combination of the 1-hour EMA100 and EMA200, as well as the 4-hour EMA50 located on approach. If they fail to absorb the downside pressure, NEO will be poised for a decline towards $16, followed by the recent bottom of $15.5.

NEO, 12-hour chart

The longer-term timeframe confirms the resistance of $17.7 with a cluster of technical barriers, including the 12-hour EMA50 and EMA100 and the sloping trend line too. Rejection from this area may eventually result in a deeper downside correction to $15.

Author

Tanya Abrosimova

Independent Analyst