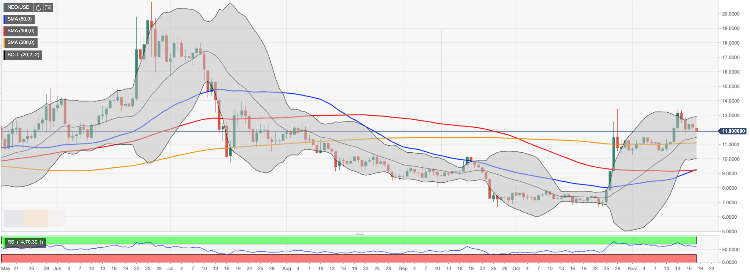

NEO price analysis: NEO loses ground, unable to settle above $13.00

- NEO/USD drops to $12.00 amid waning bullish momentum

- The coin may extend the downside to $11.00.

NEO reached the recent top at $13.44 on November 13 only to retreat to $11.75 by November 15. While the coin managed to recover to the area of $12.00 by the time of writing, it is still locked in a short-term bearish trend. The 17th largest digital asset with the current market value of $861 million, has lost nearly 2% on a day-to-day basis and stayed unchanged since the beginning of the day.

NEO/USD, the technical picture

From the longer-term perspective, NEO/USD recovery is initially capped by the upper line of the daily Bollinger Band at $12.87. Psychological $13.00 that follows thee above-said barrier may attract new short-term sellers and push the price back inside the range. However, once it is out of the way, the upside is likely to gain traction with the next focus on the recent high of $13.44 and $14.00.

On the downside, the first support awaits us at $11.50. The recent low located marginally above this level and the middle line of the daily Bollinger Band may slow down the sell-off. The next support is created by SMA200 (Simple Moving Average) daily on approach to psychological $11.00. The lower boundary of the previous consolidation range at $10.00 may serve as a backstop for the asset.

NOE/USD, 1-day chart

Author

Tanya Abrosimova

Independent Analyst