- Flamingo (FLM) is a full-stack decentralized finance protocol built on the NEO blockchain.

- Flaming.Finance will launch on September 25, allowing users to stake NEO and other coins to receive FLM tokens.

The Flaming project announced its launch back in August when NEO saw another 15% surge. Binance will be launching the FLM staking pool on September 27 and list the token one day later. There are only two supported pools, BNB and BUSD; however, the Flamingo website itself will allow NEO staking.

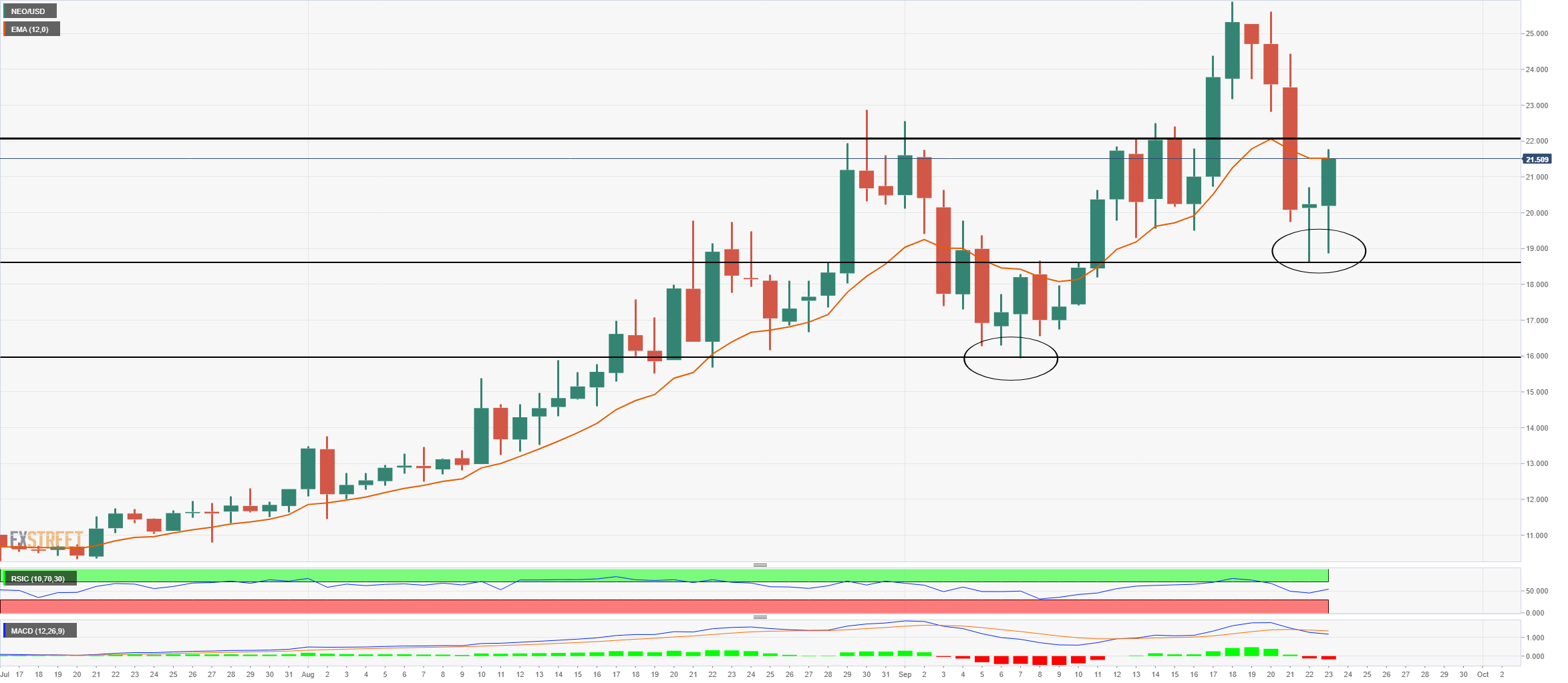

NEO/USD daily chart

NEO is one of the few cryptocurrencies to hold its daily uptrend and has been outperforming the rest of the coins since September. The price is currently fighting to climb above the 12-EMAat $21.52 after a 15% surge in the past 24 hours.

The next most important level of resistance is right at around $22. The MACD did turn bearish but could flip bullish again in the short-term considering the recent shift in momentum. The nearest support level was established at $18.60, followed by $15.93.

NEO/USD 4-hour chart

The 4-hour chart has clearly flipped in favor of the bulls after climbing above the 12-EMA. The MACD just turned bullish, and the RSIC has finally bounced after being overextended for more than one day.

However, in the short-term, the price of NEO could go back down and re-test the 12-EMA at $20.63 before the next leg up towards $22.

Traders need to look at the $22 resistance level as the key for NEO to re-test the 2020-high and $20.63 as the most critical support level in the short-term.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637364656843152068.png)