- Neo, Ontology and Switcheo partner to launch an interoperability protocol alliance - Poly Network.

- Devs can now build dapps to run on multiple blockchains without compromise.

- Poly Network’s core function will include swapping digital currencies for other tokenized assets.

Neo (NEO), Ontology (ONT) and Switcheo have recently joined forces to unveil the “heterogeneous interoperability” protocol alliance - Poly Network. Additionally, the NEAR project has rolled out the Rainbow Bridge, connecting NEAR and Ethereum.

Ontology co-founder, Andy Ji, said:

Cross-chain interoperability is becoming increasingly important as we focus on moving away from a siloed way of working.

Maksym Zavershynskyi, NEAR engineering manager, explained that their new protocol will help devs as they don’t have to choose between blockchains or solutions that are not compatible. Ji noted that Ontology was already connected to Ethereum via cross-chain functionality.

Now, through Poly Network, an enterprise leveraging the Ontology blockchain will be able to seamlessly interact with an enterprise leveraging Ethereum, Cosmos, or Neo, helping these platforms overcome challenges to scalability, mainstream adoption, and collaboration.

Ji added that swapping digital currencies for other tokenized assets is one of the Poly Network's primary functions, which will soon add support for the Bitcoin blockchain. NEAR co-founder, Alex Skidanov, said that devs could avoid paying excess fees on Ethereum by transferring “performance or gas-fee critical parts to NEAR while keeping their Ethereum-native user base.” Currently, the bridge is running in a test environment.

Several other projects are also trying to solve the interoperability issue. Earlier in 2020, the Tether (USDT) stablecoin was moved onto the OMG network to ease the gas burden on Ethereum.

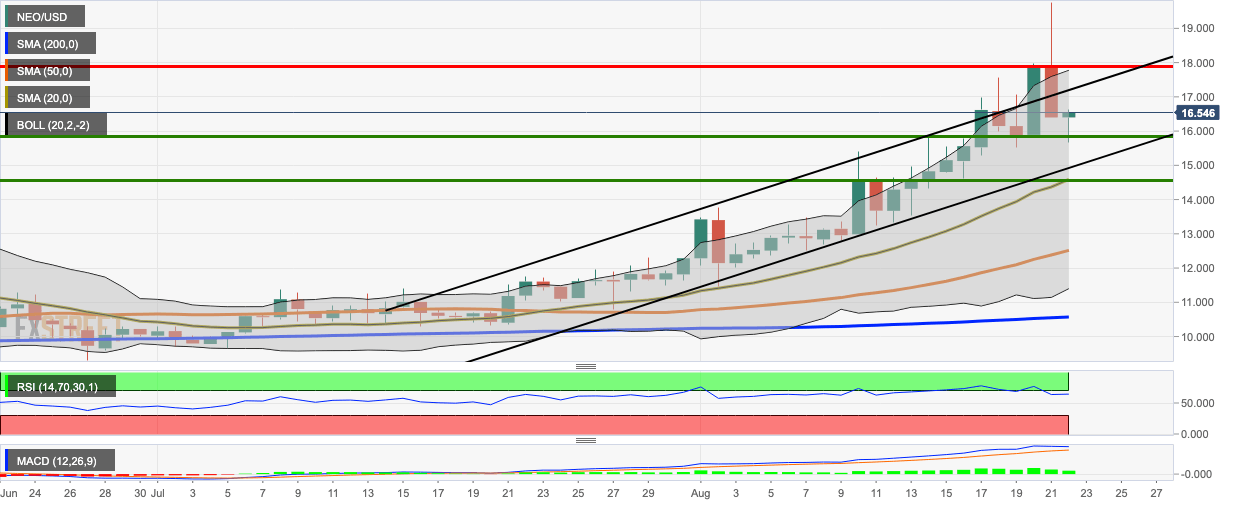

NEO/USD daily chart

NEO/USD bulls re-entered the market following a bearish Friday as the price went up from $16.39 to $16.49. This Friday, the price faced bearish correction since NEO/USD was trending above the 20-day Bollinger Band, indicating that it was overvalued. The MACD shows sustained bullish momentum, while the RSI is trending next to the overbought zone around 66.10.

NEO/USD has one strong resistance level at $17.90. On the downside, we have healthy support levels at $15.87, $14.573 (SMA 20) and $12.55.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.