- NEO developers announced a significant network update.

- NEO/USD stays bid despite the technical correction from the recent high.

NEO announced the MainNet upgrade, scheduled on June 3. The new update is expected to improve the network stability as all consensus nodes on NEO platform will be moved to neo-cli v2.10.2 with the optimized dBFT 2.0 consensus algorithm, according to the announcement.

"In order to improve network stability, the Network Fee mechanism will also be adjusted. The main change is the addition of an Oversize Fee that will be charged relative to size on transactions larger than 1024 bytes," the developers wrote in the blog post.

The developers explained that the fee changes would not affect ordinary users that perform regular transactions as the primary aim of the changes was to prevent malicious transactions and network attacks.

"Prior to the MainNet upgrade, it is recommended that all exchanges upgrade their neo-cli to v2.10.2 in advance. NEO related tools or projects should also be upgraded according to the new Network Fee mechanism to avoid any loss due to failed transaction executions caused by insufficient Network Fees," they added.

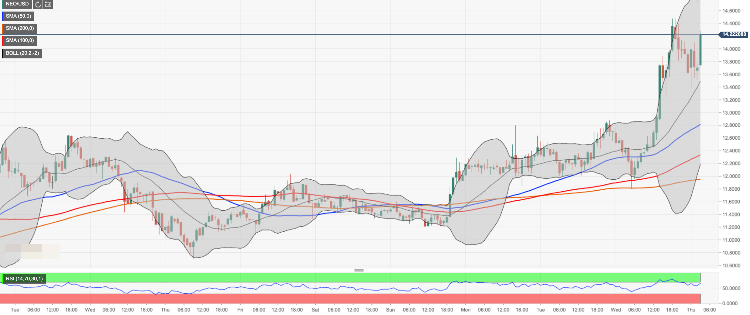

Meanwhile, the news created a favorable environment for NEO price recovery. The coin has gained over 13% in recent 24 hours and moved to the 19th place in the global cryptocurrency rating to trade at $14.20 after a strong rally to $14.47 during late Wednesday hours. On the intraday level, the price is supported by $13.50 (the middle line of 1-hour Bollinger Band). Once it is cleared, the sell-off is likely to gain traction with the next focus on $13.00 and $12.80 (Simple Moving Average (SMA) 50 1-hour). On the upside, the first resistance comes on approach $14.50 strengthened by the recent high.

NEO/USD, 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Tether expands reach with Juventus acquisition and new Bitcoin-native public company launch

Tether announced on Thursday that it had acquired additional shares in Juventus Football Club, bringing its total stake to over 10.12% and representing 6.18% of voting rights. Tether, Bitfinex, SoftBank & Jack Mallers also launch Twenty-One, the first Bitcoin-native public company.

Ethereum Price Forecast: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum (ETH) saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Stacks price eyes $1 amid growing interest in Bitcoin layer-2 protocols' DeFi ecosystems

Stacks (STX) price rises, hitting a new weekly high at $0.90 during the Asian session on Friday. The Bitcoin layer-2 protocol shows bullish resilience, trading at $0.88 at the time of writing, reflecting growing institutional interest in the decentralized finance (DeFi) ecosystem.

Bitcoin's surge to $94,000 shows a mix of macro optimism and shifting investor sentiment: Glassnode

Bitcoin (BTC) traded above $93,000 on Thursday as rumors of US-China tariff easing stirred a rebound in price, sending the percentage of supply in profit at current price levels to 87.3%, 5% above 82.7% recorded in March, according to Glassnode data.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.