NEO Elliott Wave technical analysis [Video]

![NEO Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/Coins/NEO/neo_XtraLarge.jpg)

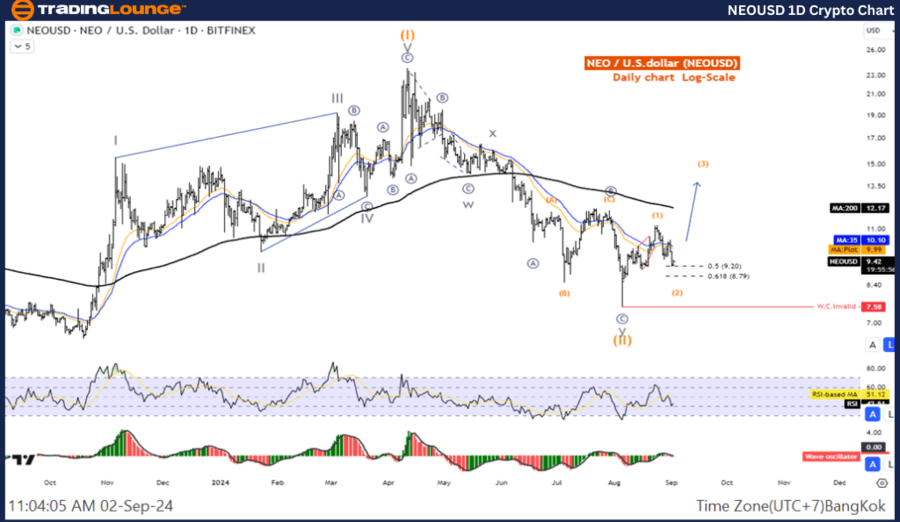

NEO/USD Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Double Corrective.

Position: Wave Y.

Direction next higher degrees: Wave (II) of Impulse.

Wave cancel invalid level: 9.85.

Details: Wave (II) is likely to have ended and prices are resuming the uptrend.

Neo / U.S. dollar (NEOUSD) Trading Strategy: It looks like the wave 2 correction is complete and the price is still likely to move up. Look for an opportunity to join the wave 3 uptrend.

Neo / U.S. dollar (NEOUSD) Technical Indicators: The price is below the MA200 indicating a downtrend, The Wave Oscillator is a Bearish Momentum.

NEO/USD daily chart

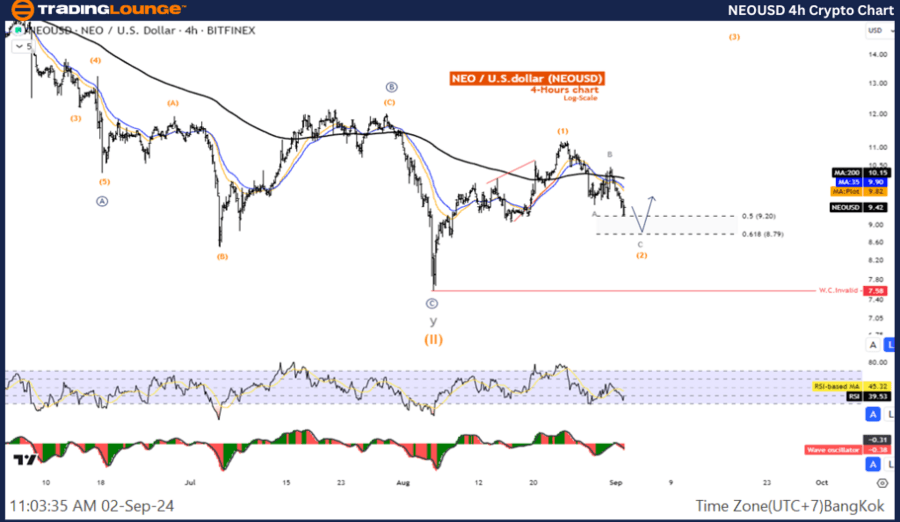

NEO/USD Elliott Wave technical analysis

Function: Counter Trend

Mode: Corrective

Structure: Double Corrective

Position: Wave Y

Direction next higher degrees: Wave (II) of Impulse

Wave cancel invalid level: 9.85

Details: Wave (II) is likely to have ended and prices are resuming the uptrend.

Neo / U.S. dollar (NEOUSD) Trading Strategy: It looks like the wave 2 correction is complete and the price is still likely to move up. Look for an opportunity to join the wave 3 uptrend.

Neo / U.S. dollar (NEOUSD) Technical Indicators: The price is below the MA200 indicating a downtrend, The Wave Oscillator is a Bearish Momentum.

NEO/USD four-hour chart

NEO Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.