Nearly three-quarters of Solana transactions have failed throughout March amidst rising DEX volume

- Solana DEX volume recovers after declining in March 2024.

- Nearly three-quarters of transactions on the SOL network failed, according to stats on Dune Analytics.

- SOL price is nearly unchanged in the past week.

Solana (SOL) has seen a surge in failed transactions since March 2024. Nearly three-quarters of transactions on the SOL chain have failed, per data from Dune Analytics. While failed transactions are mostly bots, it shows the rise in “spam” on the Solana blockchain, alongside increase in usage.

Solana price climbed slightly on Thursday, up 1% to $187.63.

Failed transactions on Solana average close to 75%

Data from Dune Analytics shows that failed transactions on Solana are close to three-quarters of all transactions. The average is close to 75%, on April 4, the number is 73.2%, as seen in the chart below. While most of the failed transactions can be attributed to bots spamming the Solana blockchain, users may be affected if they interact with the blockchain for swaps or DEX transactions.

Solana Failed Non-Vote Transaction Rate

While transaction failure may not be an issue for every other Solana user, it affects the performance of the chain and results in regular outages. The DEX volume on Solana has climbed after dropping from its peak in March. The rising DEX volume and meme coin frenzy on SOL are likely drivers of spam and failed transactions on the Solana chain.

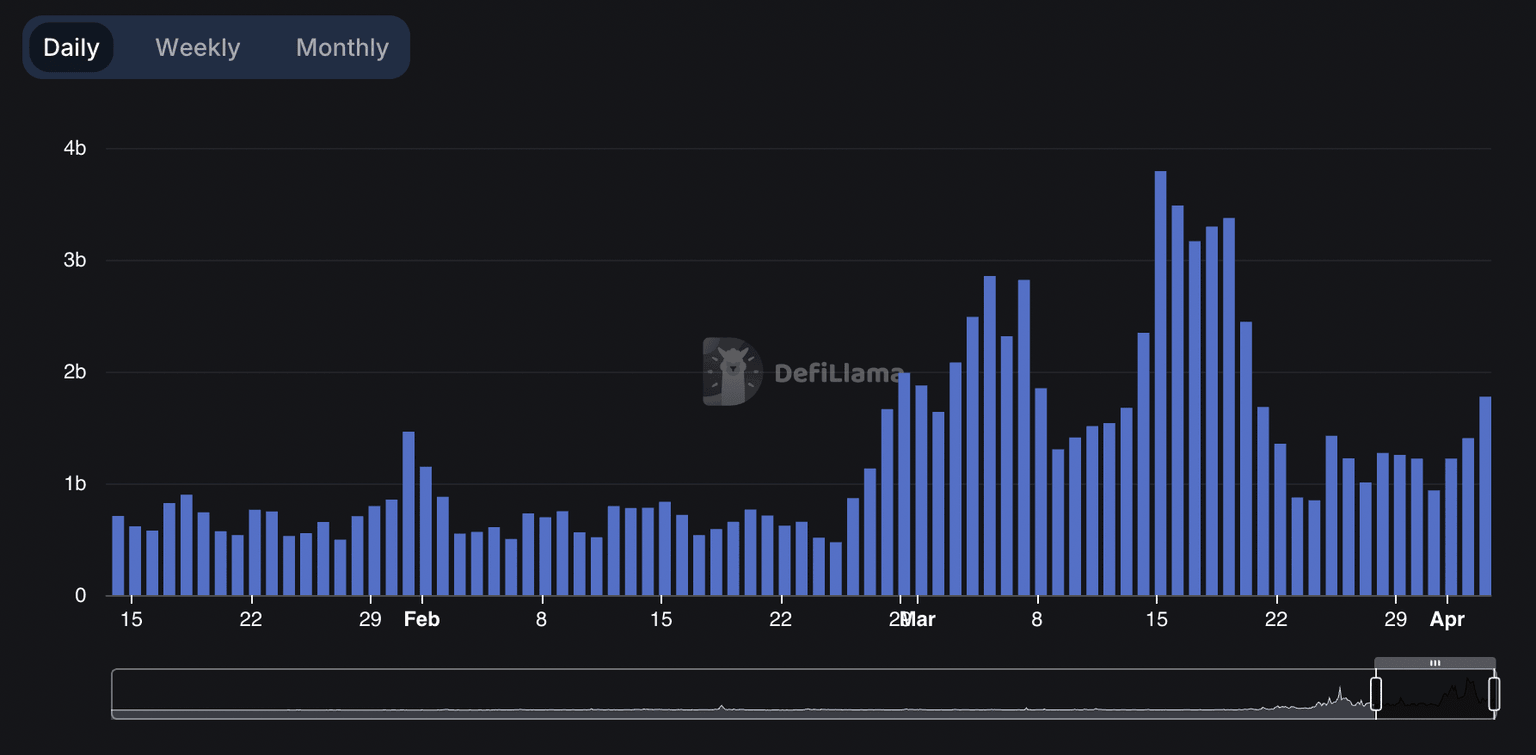

DeFiLlama data shows DEX volume is up from the March 23 low of $873.79 million to $1.775 billion on April 3.

Solana DEX volume

At the time of writing, Solana price is $189.45, up nearly 1% on the day and unchanged on the weekly timeframe.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.