- Arbitrum price edges closer to achieving the W-bottom pattern’s target of $1.187.

- Sustained bullish momentum could send ARB to tag a key resistance level of $1.330.

- A closer look at on-chain metrics reveals a potential reversal might be in store for ARB.

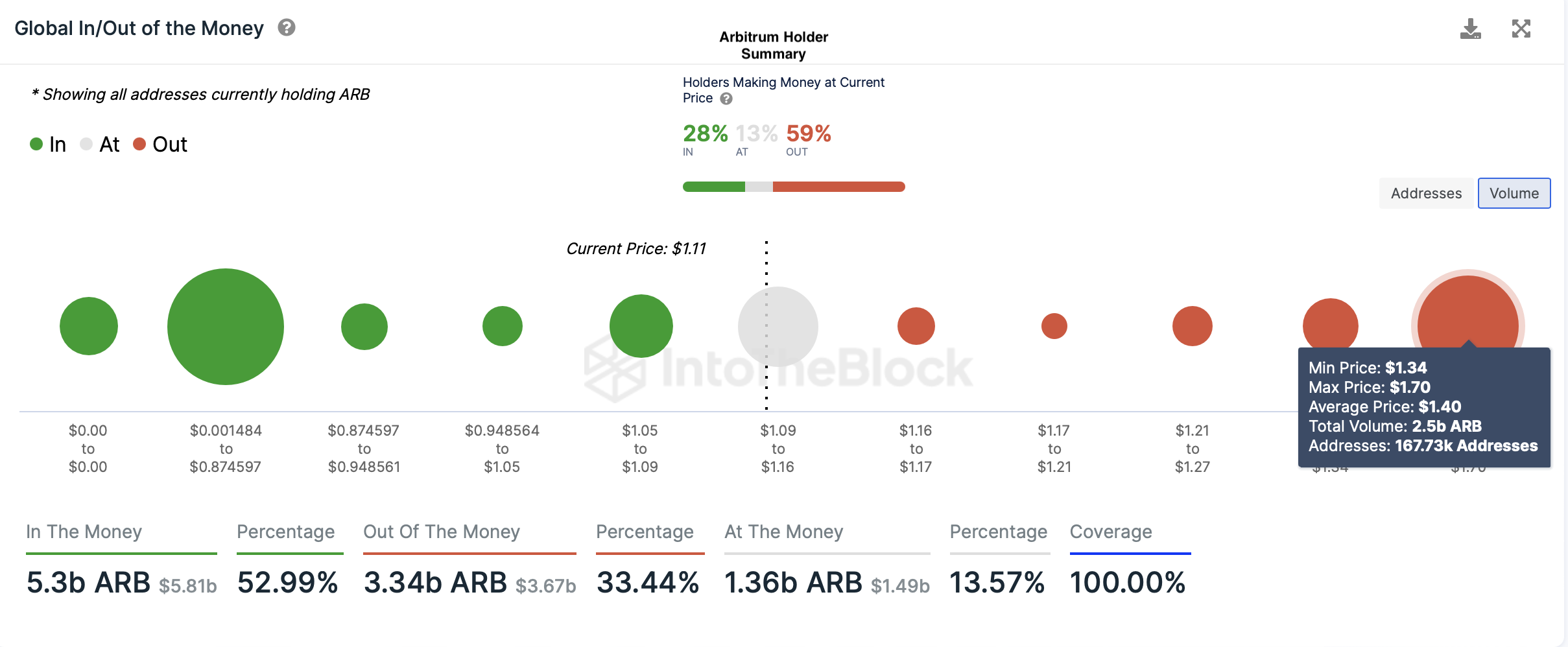

Arbitrum (ARB) price has shot up 50% since mid-October 2023 and shows signs of exhaustion. While an extension of the upswing is likely, a minor pullback could be around the corner. Despite the impressive rally witnessed over the last three weeks, most ARB holders sit underwater. To be specific, nearly 60% of all ARB investors are out of the money, according to data from IntoTheBlock.

Roughly 2.5 billion ARB tokens held by nearly 170,000 addresses are sitting underwater. These tokens were purchased at an average price of $1.400, roughly 27% away from where ARB currently trades.

ARB GIOM

Arbitrum price flashes sell signals

Arbitrum (ARB) price is close to approaching the W-pattern or double bottom setup’s target of $1.187. As the name indicates, this technical formation looks like the letter W and is formed after a downtrend. It serves as a base that kick starts a trend reversal.

Since this pattern is formed after a downtrend, a horizontal trend line connecting the peak of swing high formed between the two swing lows results in a neckline. For Arbitrum price, this neckline is formed at $0.967. When the neckline is broken the expectation is for price to reach the bullish target for the pattern. This is calculated by taking the distance from the base to the neckline and doubling it. In the case of ARB this gives a target at $1.187, which is 22% higher.

So far, Arbitrum price has rallied 20% to $1.098 and currently sits just below the target. But the Momentum Reversal Indicator (MRI) has flashed a red “two” sell signal on the daily chart, which forecasts one-to-four down candlesticks.

While the theoretical forecast from the double bottom pattern is close, it is unlikely to be tagged. Investors can expect Arbitrum price to see a minor pullback to a key support level at $1.038.

The Relative Strength Index (RSI) and the Awesome Oscillator (AO) are both showing no signs of exhaustion yet. But the RSI sits in the overbought condition, and Bitcoin price also looks to be moving sideways. Hence, a surprise spike in selling pressure could kickstart this quick pullback to $1.038 followed by a revisit of the $1.000 psychological level.

ARB/USDT 1-day chart

On-chain metrics reveal long-term holders’ intentions

While the technical outlook for Arbitrum price calls for an extension of the rally after a minor pullback, on-chain metrics show a clearer picture.

The Mean Dollar Invested Age (MDIA) indicator from Santiment can be used to detect investor sentiment. This index shows that short-term holders, aka 90-day MDIA, are accumulating while long-term holders, aka 365-day MDIA, are shedding their holdings.

If the long-term MDIA is falling as is the case with ARB, it suggests redistribution and can be viewed as a sell signal.

Although Arbitrum price has rallied 50% in the last three weeks, long-term holders are not confident about the sustainability of this upswing and could be booking profits.

ARB MDIA

The Network Growth (NG) indicator is a metric used to track the number of new addresses created on the blockchain. It is a gauge of adoption. For Arbitrum, the NG grew from 2,133 on October 21 to 10,555 on November 4.

This quadrupling of the new addresses created on the Arbitrum blockchain spike coincides with the ARB rally. But at present, the NG is hovering around 679, which is lower than when it first started out.

Hence, the technical perspective’s sell signal coincides perfectly with the NG’s local top and suggests the possibility of a trend reversal.

Additionally, the on-chain volume for ARB has also dropped from 470 million ARB on November 4 to 385 million ARB on November 7, suggesting a lack of interest among investors.

A closer look reveals that the on-chain volume has formed three lower lows while Arbitrum price has set up three higher highs, revealing a non-conformity termed “bearish divergence.” This formation also forecasts a potential correction.

ARB NG, On-chain Volume

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[13.55.26,%2007%20Nov,%202023]-638349447771485343.png)

%20[13.55.30,%2007%20Nov,%202023]-638349447971332420.png)