Near Protocol price soars 20% as NEAR joins Solana’s remarkable performance among L1s

- Near Protocol price is up almost 20%, testing the $1.573 resistance level last seen in July.

- The token joins SOL’s remarkable performance among Layer-1 tokens, with Solana price recording 15% in daily gains, revisiting pre-FTX highs.

- The $1.497 level is critical for NEAR, with a decisive close above it confirming a continuation rally.

- A close below $1.280 would invalidate the bullish thesis.

Near Protocol (NEAR) price is following on the heels of Solana (SOL) as the two Layer-1 (L1) tokens pump hard, breaking through key barriers while outperforming the broader market. Notably, L1 tokens are native coins of their own blockchains, with some validating and supporting their own networks, without requiring support from another network and reimbursing transaction fees with cryptocurrencies.

Near Protocol pumps 20% alongside Solana at the helm of L1 chains

NEAR and SOL are pumping hard, with Near Protocol price recording 20% in gains over the last 24 hours, same time its trading volume is exploding 170%. Meanwhile, Solana price is up 15%, with a 24-hour trading volume increase of 150%, largely attributed to the Solana Breakpoint meet-up in Amsterdam, Netherlands.

The remarkable performance of Near Protocol price has positioned the cryptocurrency at the helm of L1 blockchains, alongside Solana, with prospects for more gains as momentum continues to rise. Other L1 blockchain tokens include Bitcoin (BTC), Ethereum (ETH), and Avalanche (AVAX).

Remarkably, NEAR’s performance has seen it outperform the most popular L1 tokens including but not limited to BNB, Cardano (ADA), Polkadot (DOT), AVAX, and Algorand (ALGO).

L1 tokens prices

Near Protocol price prediction as NEAR tests June to July highs

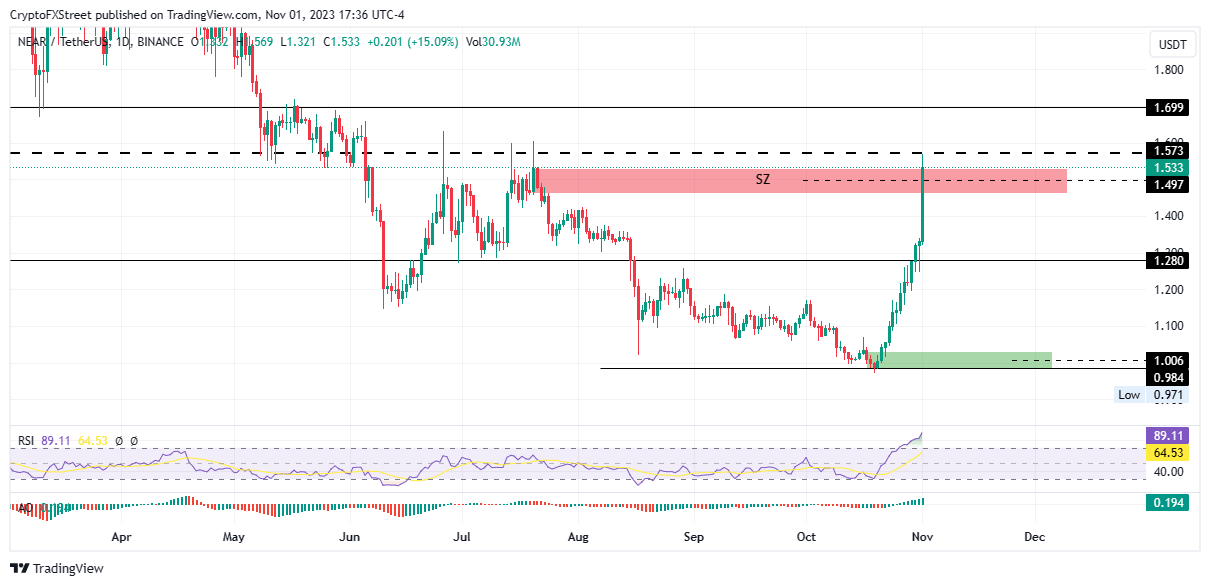

Near Protocol price is $1.533 at the time of writing, after testing the June to July highs of around $1.573. The initial breakout attempt was rejected, proving premature, but there are still multiple signals pointing towards a continuation of the trend, both from a technical and on-chain perspective.

Technically, momentum is still rising even though NEAR is overbought, indicated by the Relative Strength Index (RSI) at 89 and still northbound. The Awesome Oscillator (AO) is also in the positive territory with green-soaked histogram bars. This shows the bulls are still in control.

Increased buying pressure above current levels could see Near Protocol price shatter past the $1.573 resistance level, potentially extrapolating the gains for NEAR to collect sell-side liquidity residing above this level.

In a highly bullish case, the gains could extend for Near Protocol price, culminating in a 10% climb above current levels to test the $1.700 psychological level.

Notably, the $1.497 level is critical for the L1 token’s upside potential, marking the mean threshold of the supply zone extending from $1.459 to $1.530. Near Protocol price must record a close above this level to confirm the continuation of the trend, making the order block a bullish breaker.

NEAR/USDT 1-day chart

From an on-chain perspective, Near Protocol price still has strong bullish potential, with a significant increase in social dominance and social volume, showing that NEAR is among the most talked about asset in a sea of more than 50 projects. Often, this chatter could translate into trading activity and could lead to price increase.

Also, the Layer-1 token is also recording a growing market capitalization for the Tether (USDT) stablecoin, a move often attributed to new money flowing in or capital inflow as investors look to buy NEAR.

The percentage of stablecoin total supply held by whales with more than 5 million USD is also recording a major uptick. This signifies the high price expectation whales have for Near protocol.

NEAR Santiment metrics

Conversely, if Near Protocol price fails to close above $1.497, a correction would seem likely, potentially sending NEAR market value below the $1.400 level. In the dire case, the L1 cryptocurrency could spiral down to $1.280.

Closing below the $1.280 support level would invalidate the bullish thesis, likely sending Near Protocol price to the $1.100 depths, or worse, to the demand zone extending from $0.980 to $1.031.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B01.27.56%2C%252002%2520Nov%2C%25202023%5D-638344776450785919.png&w=1536&q=95)

%2520%5B01.53.08%2C%252002%2520Nov%2C%25202023%5D-638344776674683218.png&w=1536&q=95)