Near Protocol Price Prediction: NEAR fulfills targets but a 10% correction may be on the horizon

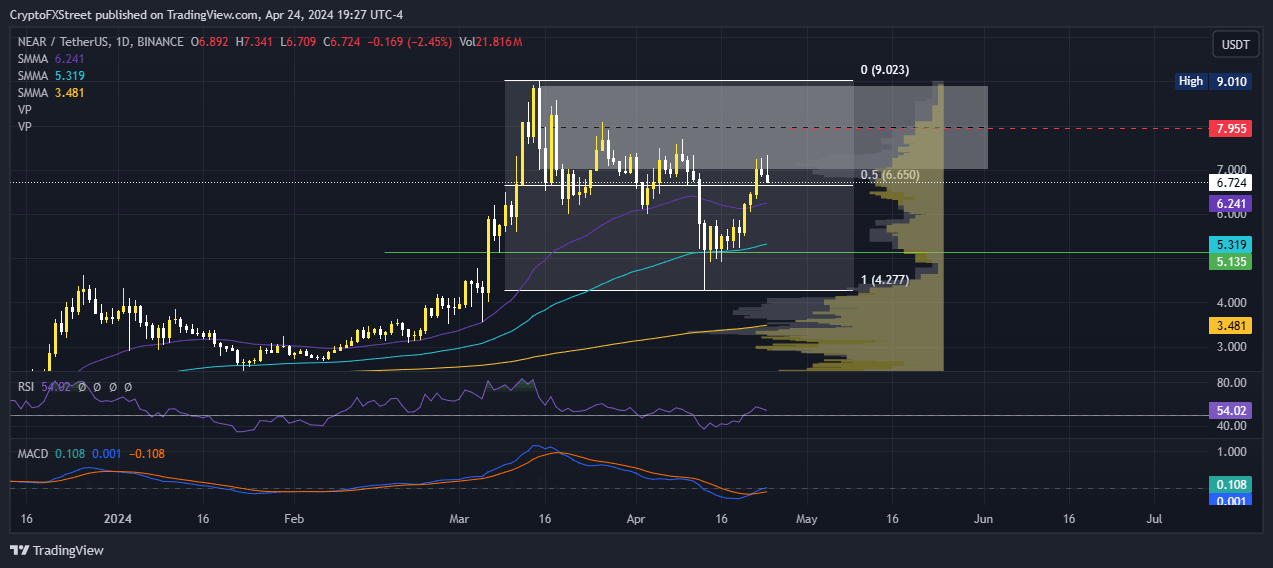

- Near Protocol price has completed a 55% mean reversal from the bottom of the market range at $4.27.

- Amid growing bearish activity, NEAR could drop 10% to the $6.00 psychological level before a potential recovery.

- A break and close above $7.95 would invalidate the downleg thesis.

Near Protocol (NEAR) price is trading with a bullish bias, and has completed a full swing recovery following a 42% drop. However, the recovery may be cut short as bears align to sell NEAR token.

Also Read: Near Protocol price poised for a strong rally if history rhymes

Near Protocol price risks 10% correction

After a 55% recovery rally from the April 13 low of $4.27, the Near Protocol price looks primed for a correction. With a huge supply zone hovering above the price between $6.98 and $8.90, the altcoin could make a 10% correction to find initial support around the $6.00 psychological level.

Based on the volume profile indicator, there is a lot of bearish activity near the $7.00 price level, just above the current NEAR token price. Large spikes of the volume profile (grey) have indicated this. These spikes point to many sellers entering the NEAR market at current price levels and could potentially lead to a decrease in price if the selling pressure continues.

A series of bearish spikes on the volume profile could signal a potential trend reversal from bullish to bearish, indicating a shift in market sentiment and direction. For confirmation, traders should watch to see whether the Relative Strength Index (RSI) produces a lower high below the ‘50’ mean level on the daily timeframe.

In a dire case where the $6.00 level fails to hold as support, the Near Protocol price could extend the fall to the 50-day Smooth Moving Average (SMMA) at $5.31, or worse, test the $5.13 support level before a recovery.

NEAR/USDT 1-day chart

On the other hand, if the bulls are able to break above the bearish cloud, confirmed by a daily candlestick close above the midline of the supply zone at $7.95, it would negate the bearish thesis. Such a directional bias could see NEAR price extend the gains to reclaim the $9.01 range high.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.