- Bitcoin price revived its bullish momentum on Monday with a 4.8% rally, but breaching $42,000 could be difficult.

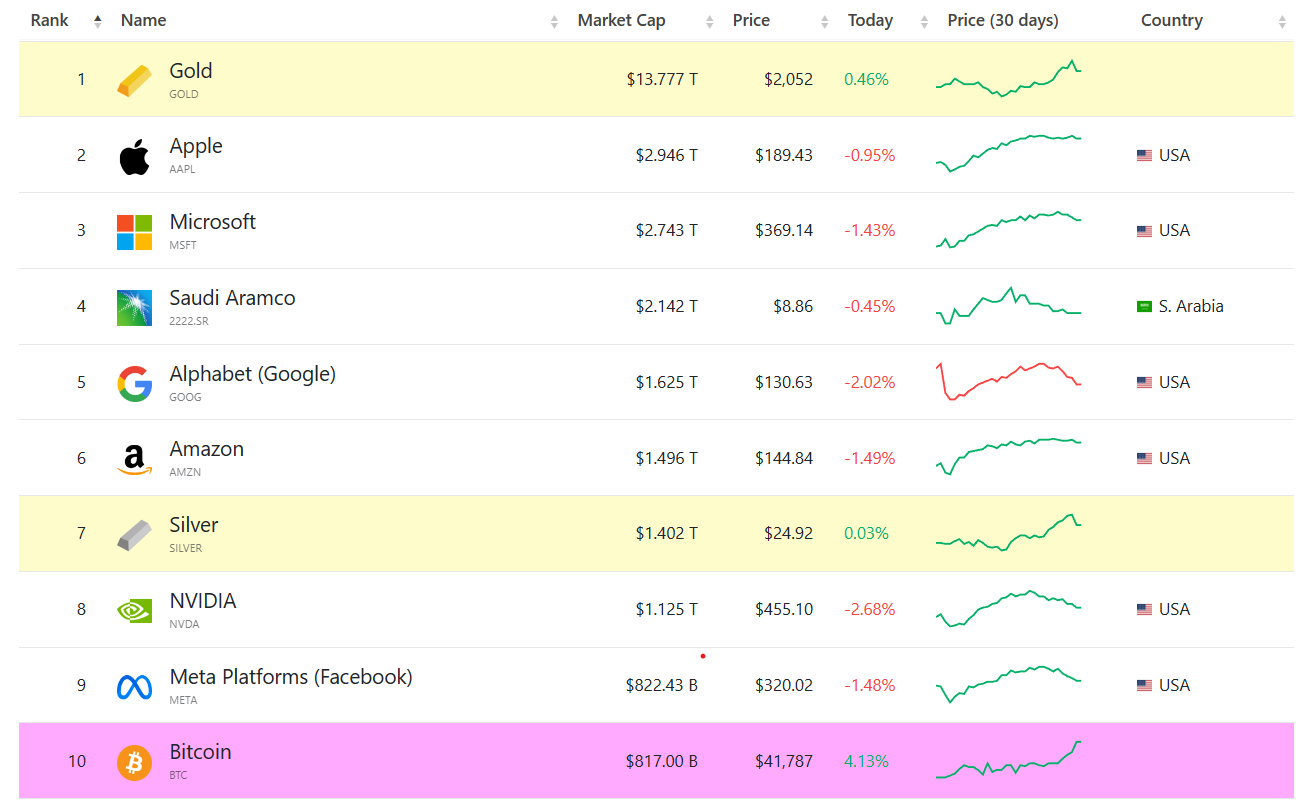

- The recent increase in price pushed Bitcoin’s market cap to $817 billion, making it a bigger entity than Visa and Bank of America.

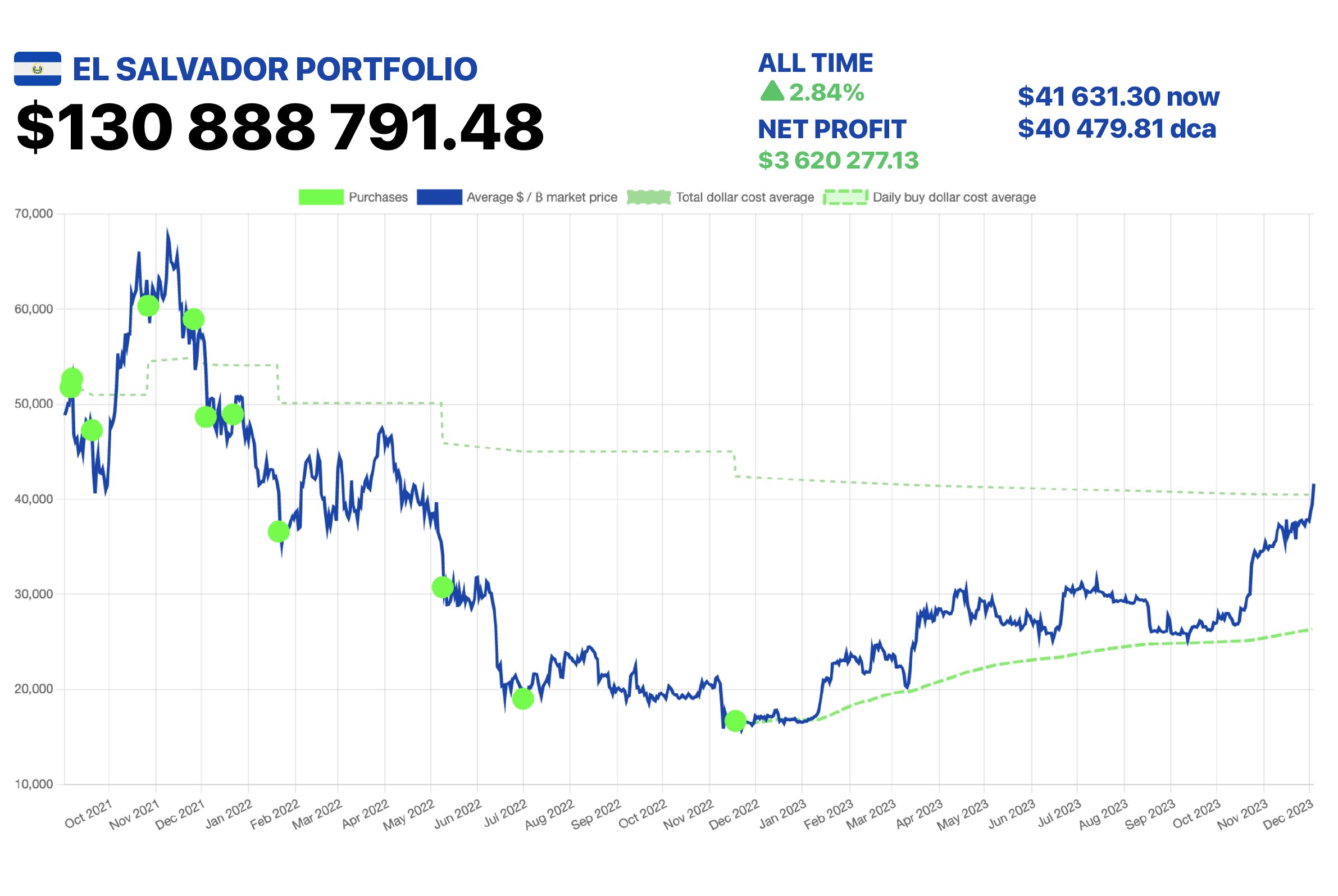

- Nayib Bukele, president of El Salvador, stated that naysayers should apologize to the country, which is now holding profits worth $3.6 million.

Bitcoin price noted stellar growth this past year, rising by more than 150% and hitting $42,000 in the past 24 hours. This growth has made Bitcoin the tenth biggest asset in the entire world, imbuing confidence in BTC enthusiasts, including the president of El Salvador, which is evidenced by his recent tweet.

Bitcoin targets Meta next

Bitcoin is presently valued at $817 billion after rising by nearly 5% in the last 24 hours. This increase in market capitalization has made BTC the tenth biggest asset in the world. The cryptocurrency managed to do so by surpassing the likes of Tesla, Visa, banks including JPMorgan Chase and Bank of America, and the company with the highest share price in the world - Berkshire Hathaway.

Bitcoin among the top 10 biggest assets

The growth noted by the cryptocurrency has now placed it less than $5 billion away from surpassing the market capitalization of Facebook’s parent company, Meta, which stands at $822 billion at the time of writing. This is expected to happen sooner rather than later, given that Bitcoin is bound to witness exceptional growth in 2024 owing to two simple reasons: the approval of spot BTC ETF applications and the halving event.

This rally also reignited the confidence of Bitcoin investors, who have been holding out hope for nearly two years now. Bitcoin price reached its all-time high of $68,789 back in November 2021, which instilled confidence in BTC holders of the cryptocurrency, eventually reaching $100,000. Bitcoin has not even remotely close to achieving that yet, but the recent rally once again imbued the same confidence in the market.

This is visible in the sentiment of the market, best noted in the recent tweet of Nayib Bukele, the president of El Salvador. Bukele took to X, formerly Twitter, to celebrate the fact that the country’s BTC holdings are now profitable. El Salvador is currently witnessing unrealized gains worth $3.62 million on the supply they hold.

El Salvador Bitcoin profits

Highlighting the rally, Bukele lashed out at the critics of the country’s Bitcoin strategy, demanding apologies from them. He stated that the responsible thing for naysayers to do would be to “issue retractions, offer apologies, or, at the very least, acknowledge that El Salvador is now yielding a profit.” However, he maintained his position on the future of Bitcoin and the plan of building its country on the back of the cryptocurrency, stating,

“Of course, we have no intention of selling; that has never been our objective. We are fully aware that the price will continue to fluctuate in the future, this doesn’t affect our long-term strategy.

Bitcoin price makes history again

Bitcoin being valued at $817 billion is not a record-breaking feat, as back in November 2021, the cryptocurrency was valued at $1.2 trillion. But the reentry into the top 10 asset list has made $42,000 a critical price level for BTC.

Flipping this level into a support floor is crucial in igniting a rally that the investors expect would be the trigger that pushed BTC to $45,000. Trading at $41,826, the cryptocurrency is on the verge of breaching $42,000 again, and the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both exhibiting bullish cues presently.

BTC/USD 1-day chart

But Bitcoin price reaching a 22-month high might also act as a trigger for profit booking for many BTC investors. This could likely result in a price crash that would occur even if the cryptocurrency fails to breach $42,000.

In such an event, a drawdown to $40,000 is possible, and losing this support would invalidate the bullish theory, sending Bitcoin price to $38,000 and lower.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

BNB Price Forecast: Poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index and Moving Average Convergence Divergence show bearish signals.

Ripple's XRP eyes recovery following executives' dinner with Donald Trump

Ripple's XRP is up 2% on Wednesday following positive sentiments surrounding its CEO Brad Garlinghouse's recent dinner with incoming US President Donald Trump. If the recent recovery sentiment prevails, XRP could stage a breakout above the upper boundary line of a bullish pennant pattern.

Has Bitcoin topped for the cycle? Here's what key metrics suggest

Bitcoin experienced a 2% decline on Wednesday as the cryptocurrency market grapples with recent losses. On-chain data has indicated a shift in the accumulation of the leading cryptocurrency, suggesting that holders are increasingly selling their assets.

Ethereum Price Forecast: ETH could decline to $3,110 despite increased accumulation from whales

Ethereum briefly declined below the $3,300 key level, recording a 4% loss on Wednesday as short-term holders led the selling pressure. If the buy-side pressure of large whales fails to outweigh the bears, the top altcoin could decline to $3,110.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.