Mysterious investor makes $55,400 in 20 minutes on Binance, insider trading or not?

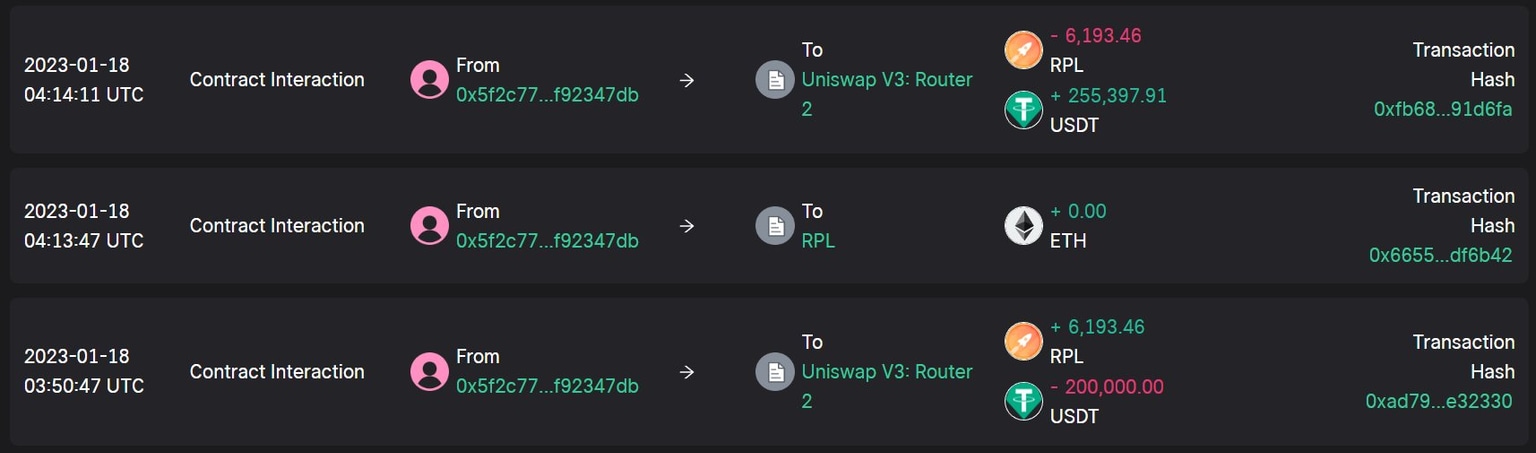

- A trader purchased 6193.46 Rocket Pool tokens 10 minutes before Binance’s listing announcement.

- Within twenty minutes of his RPL token purchase, the investor shed holdings and collected $55,397 in profit.

- Binance employees are not allowed to participate in personal short-term trading and hold positions for a minimum period of 90 days, to prevent insider trading.

A mysterious wallet scooped up Rocket Pool (RPL) tokens ahead of Binance’s listing announcement. The exchange’s policy to fight insider trading requires employees and close family to hold positions for a minimum period of 90 days. The investor made $55,400 in profits within a 20-minute timespan.

Mysterious trader makes $55,400 on a quick trade with Binance announcement listing

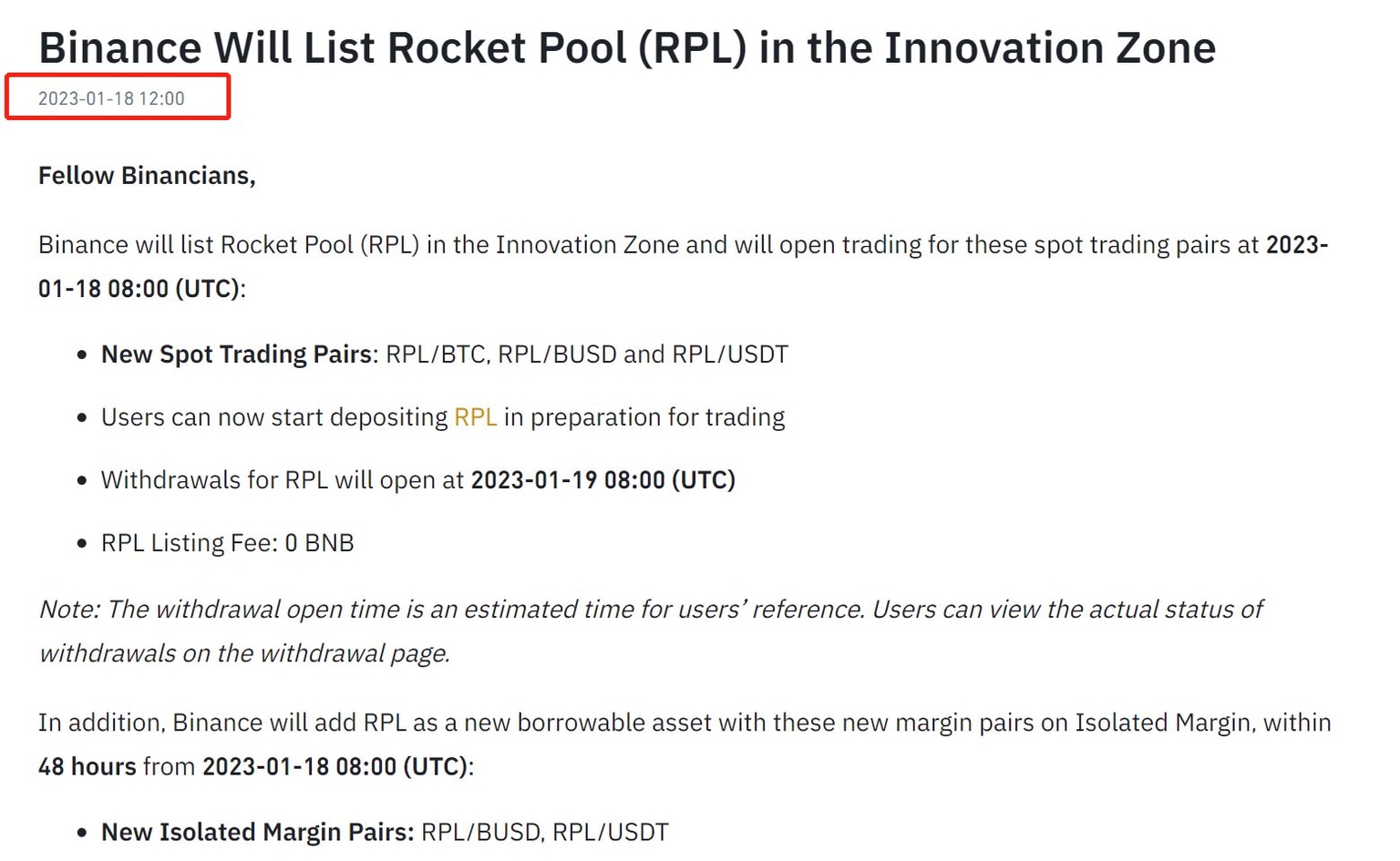

An anonymous wallet holder purchased Rocket Pool (RPL) tokens ten minutes before Binance’s listing announcement in the innovation zone.

The anonymous wallet holder scooped up RPL tokens, sold their holdings within the first ten minutes of the listing announcement and collected $55,400 in profits. The trader’s purchase of 6193.46 RPL tokens was noted by crypto experts on Twitter, examining the trade for signs of insider trading.

On January 10, He Yi, the co-founder of Binance, shared details on the exchange’s insider trading policy. Yi claimed that Binance employees of any ranking are not allowed to participate in personal short-term trading and must hold positions for a minimum of 90 days.

The investor used Uniswap and swapped 190,000 USDT for 190,024 USDC. These funds were used to purchase 5,833 RPL. The anonymous wallet holder exchanged another 10,000 USDT and bought an additional 209.49 RPL with it, ten minutes ahead of the Binance listing announcement.

RPL listing announcement on Binance

After the twenty minute wait, the trader exchanged RPL token holdings for 162.06 ETH, and pocketed 255,397 USDT, the proceeds from the trade.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.