A mysterious Bitcoin wallet has surged up the ranks to become the third-largest holder of Bitcoin (BTC $26,050) in the world in just over three months, with the timing sparking some wild theories about its owner.

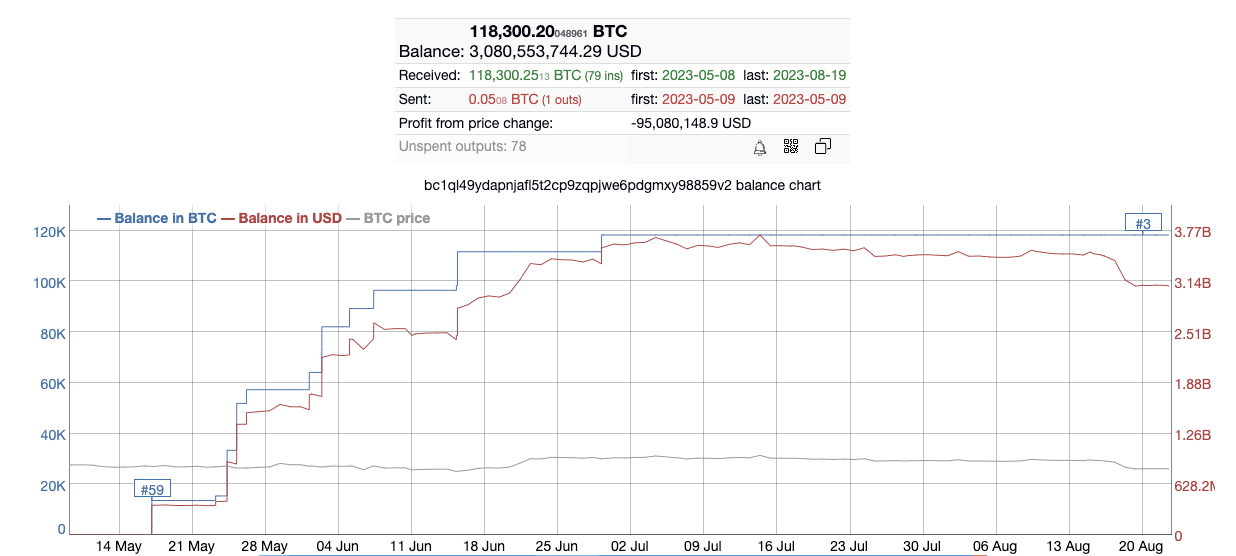

According to data from crypto statistics platform BitInfoCharts, the wallet address first received Bitcoin on March 8. Over the course of the next three months and two weeks, the wallet had accrued a staggering 118,000 BTC — worth $3.08 billion at current prices.

The mysterious wallet has accrued 118,000 BTC in less than four months. Source: BitInfoCharts

The rapid and significant accrual of Bitcoin within a single wallet address has attracted its fair share of conjecture.

Some users suggest it’s most likely a crypto exchange moving funds, while some more radical members of Crypto Twitter have posted a more wild theory — suggesting BlackRock is the “prime suspect."

The theory is not based on any solid evidence, however, others have shared their support it by posting pictures of a large black rock.

The current largest Bitcoin wallets in the world, according to BitInfoCharts, are reportedly owned by Binance and Bitfinex — as Bitcoin cold wallets.

The unknown Bitcoin whale wallet comes in third place, and is then followed by another Binance cold wallet in fourth place.

BlackRock made waves in the crypto market on June 15 when it filed an application for a spot Bitcoin ETF product which — if accepted by the Securities and Exchange Commission — will be the first of its kind in the United States.

BlackRock’s application sparked a wave of filings for similar spot products from a horde of other Wall Street heavyweights, including Fidelity, Invesco, Wisdom Tree and Valkyrie.

The prospect of a spot Bitcoin ETF whipped crypto analysts into a frenzy, sharing their bullish predictions for the price of Bitcoin — with Fundstrat’s head of research, Tom Lee suggesting that Bitcoin could reach a price of $150,000 per coin following the halving event in April 2024.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.