Mt.Gox transfers $2.85 billion in Bitcoin, what to expect from BRC-20, cat-themed meme coins

- Bitcoin worth $2.85 billion was transferred by Mt.Gox, crypto traders anticipate heightened selling pressure on BTC.

- Bitcoin-related assets like BRC-20 tokens and cat-themed meme coins typically rally or suffer correction in price alongside BTC.

- The market capitalization of both categories declines by nearly 8% as Bitcoin hovers around $67,000 early on Tuesday.

Bankrupt crypto exchange Mt.Gox transferred $2.85 billion worth of Bitcoin out of its wallet, according to on-chain data. This transfer has raised concerns among BTC traders since it could translate to selling pressure on the largest crypto asset by market capitalization.

Data from the on-chain tracker Lookonchain shows that Mt. Gox transferred 42,587 BTC (worth approximately $2.85 billion) early on Tuesday. About 5,110 BTC ($341.75 million) were transferred to an internal wallet and 37,477 BTC ($2.51 billion) to a new crypto wallet address.

Mt. Gox transferred 42,587 $BTC($2.85B) out 1 hour ago, of which 5,110 $BTC($341.75M) was transferred to an internal wallet and 37,477 $BTC($2.51B) was transferred to a new wallet.https://t.co/nJpumiJdAl pic.twitter.com/pVglDc5lIx

— Lookonchain (@lookonchain) July 23, 2024

Bitcoin price trend typically influences related cryptocurrencies like BRC-20, a token standard designed specifically for fungible tokens on the BTC blockchain.

Bitcoin transfer by Mt.Gox could affect these assets

BRC-20 tokens category has noted an 8% correction in its market capitalization in the last 24 hours. The market cap is $1.73 billion, per CoinGecko data.

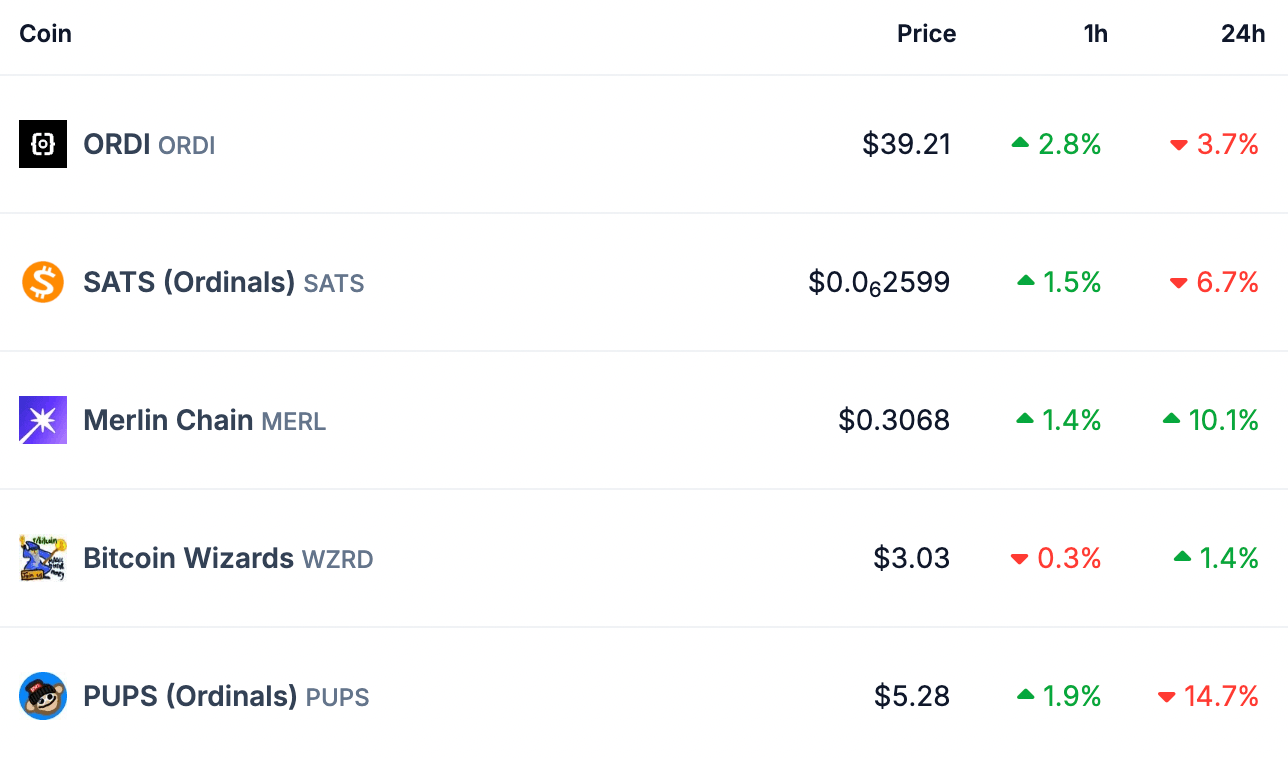

The top five assets in BRC-20 are Ordi (ORDI), SATS (Ordinals) SATS, Merlin Chain (MERL), Bitcoin Wizards (WZRD), and Pups Ordinals (PUPS). In the past hour, these assets have gained between 1% and 3%, as seen on CoinGecko.

Top five BRC-20 assets on CoinGecko

If the transferred Bitcoin is moved to exchanges, it could increase the supply of BTC across exchange platforms, making it likely to be sold, thereby contributing to the selling pressure on Bitcoin.

Another key category of assets that could be influenced by Bitcoin price trend is cat-themed meme coins. The market capitalization of cat-themed meme coins reduced by 7.4% in the last 24 hours to $3.21 billion, according to CoinGecko data.

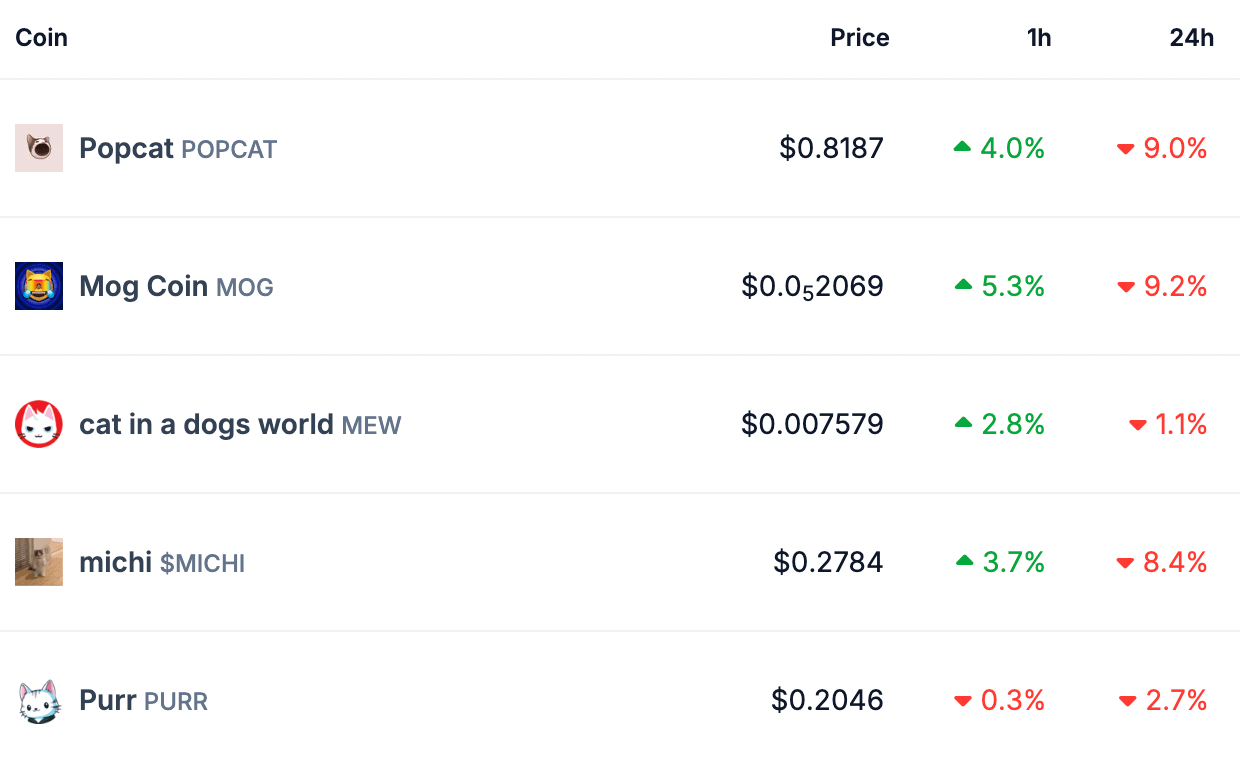

Popcat (POPCAT), Mog coin (MOG), Cat in a dogs world (MEW), Michi (MICHI), and Purr (PURR) are the top five cat-themed meme coins that have extended gains in the last hour, and noted between 1% and 9% correction in the past 24 hours, per CoinGecko data.

Cat-themed meme coins

Meme coins have led the narrative in the ongoing crypto cycle and emerged as the most profitable crypto category in Q2 2024, as seen in a recent CoinGecko report. A correction in Bitcoin could usher a correction in this category of tokens, as observed in previous instances of decline in BTC price.

Bitcoin is at risk of correction

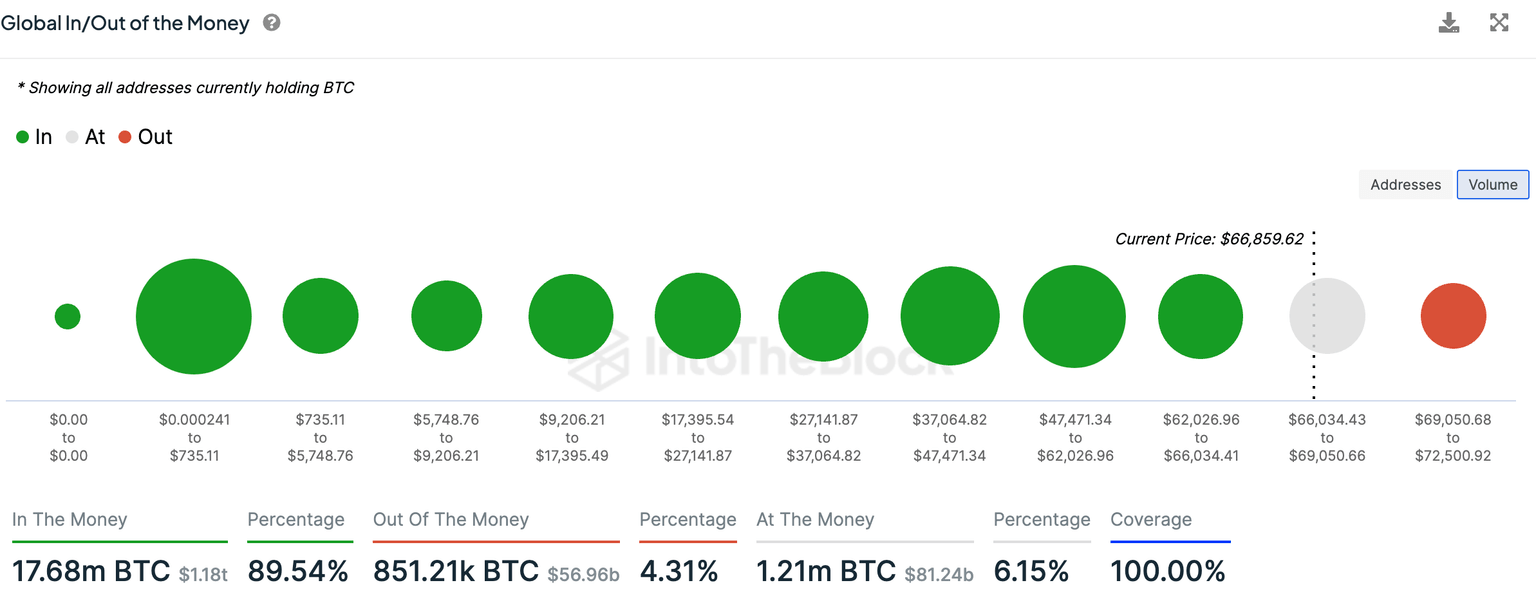

Data from Intotheblock shows that 89.54% of wallet addresses are currently profitable, which implies that profit-taking could push Bitcoin price lower. Santiment data shows consistent profit-taking by BTC holders, with $241.75 million in profits realized on Tuesday at the time of writing.

If traders continue to take profits on their Bitcoin holdings, it could result in a correction in BTC. Bitcoin could find support between $62,026 and $66,034, where 3.22 million wallet addresses acquired 1.58 million BTC.

Bitcoin wallets profitable at $66,859

At the time of writing, Bitcoin trades at $66,859, down nearly 1% on Tuesday.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.