Mt Gox creditors hit by delay in repayment deadlines for $3.8 billion in Bitcoin

- Mt Gox Rehabilitation Trustee has pushed the deadline for the repayment to creditors until October 31, 2024.

- The bankrupt crypto exchange holds $3.8 billion worth of Bitcoin, among other cryptocurrencies and fiat.

- The Trustee claims that rehabilitation creditors who have provided the necessary information, will receive their compensation as early as the end of 2023.

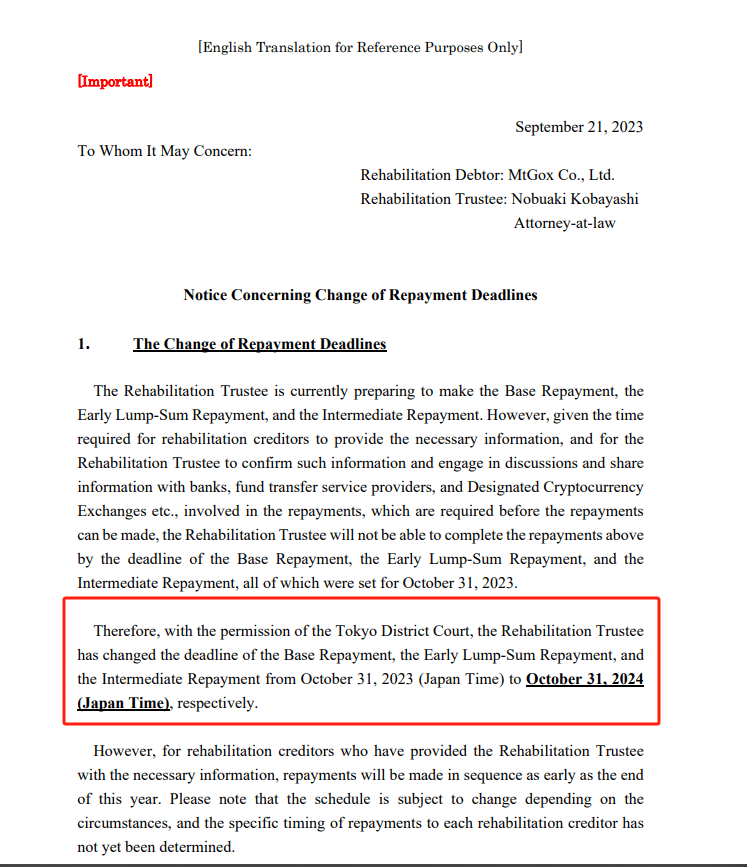

In a September 21 letter, the Mt Gox Rehabilitation Trustee, Nobuaki Kobayashi shared that he has received permission from the Tokyo District Court to extend the deadline for the three phases of repayment of creditor funds. The deadline has been pushed to October 31, 2024.

The bankrupt exchange has delayed the repayment of creditor funds for over a decade now, users have waited for a resolution since the hack that occurred in 2011.

Mt Gox creditors to suffer from delay in repayment

One of the earliest crypto exchanges, Mt Gox suffered a hack in 2011 and subsequently lost nearly 850,000 BTC. Creditors lined up for a recovery of their funds as the estate finalized a repayment plan and scheduled it with a deadline of October 31, 2023. The latest update is that this deadline has now been pushed to October 31, 2024, with court approval.

The incident was not a single exploit. Rather hackers drained the platform via a series of hacks for the years between 2011 and 2014. A total of 850,000 BTC in customer funds were lost. At the current Bitcoin price it amounts to $22.9 billion.

The exchange shared that it had successfully recovered nearly 20% of the stolen assets. About 24,000 creditors are now in line to be made whole.

The Mt Gox Rehabilitation Trustee had earlier offered hope to the exchange’s creditors, with a deadline of October 31, 2023 for the Base Repayment, the Early Lump-Sum Repayment, and the Intermediate Repayment. However, a letter from September 21 makes it clear that the deadline has been pushed to 2024 and creditors may have to wait longer than expected. This is likely to dampen the sentiment of market participants and creditors further.

Mt Gox letter from Rehabilitation Trustee

The estate currently holds 142,000 BTC, 143,000 Bitcoin Cash (BCH) and 69 billion Yen, among other assets.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.