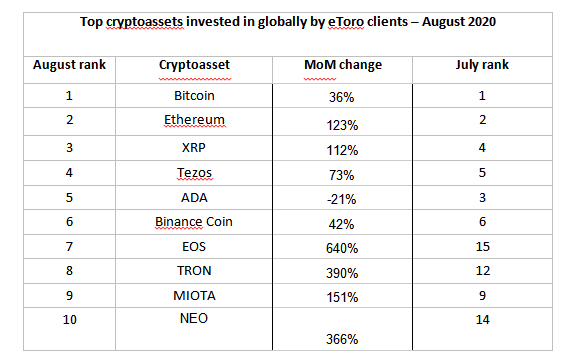

- Bitcoin, Ethereum, XRP and Tezos all saw month on month trading increases.

- Investors flocked into EOS and TRON to capture late altcoin rally.

- Trading activity up in all coins in August except Cardano’s ADA.

New data from global investment platform eToro reveals that in August retail investors returned to large cap altcoins such as Ethereum and XRP, as well as a renewed interest in Bitcoin.

All coins in the top 10, apart from Cardano’s ADA, saw a monthly increase in trades with investors taking positions in a whole range of popular cryptoassets.

Ethereum saw a particularly strong increase in popularity with global eToro users in August, constituting a 123% increase in trades compared to July. The Ethereum platform has been a major beneficiary in the exceptional rise of decentralised finance (DeFi), a theme which has been around since 2017 but exploded over the past month.

DeFi allows users to trade securities and stake cryptoassets as collateral without the use of a third party, with many DeFi applications based on the Ethereum protocol. Ethereum also launched its Medalla testnet at the beginning of August as it begins its transition to a proof of stake mechanism.

EOS and TRON both saw massive increases in month on month trades as the two coins enjoyed positive price performance towards the end of August, while other altcoins tailed off.

EOS, which saw a 640% increase in month on month trades on eToro, jumped from the 15th most traded cryptoasset in July to 7th in August. Justin Sun’s TRON made similar moves, from 12th to 8th with a 390% increase in month on month trading activity. Investors took advantage of both coins’ price rises, with EOS up 28% year-to-date and TRON up an impressive 126%.

Cardano’s ADA, which was the third most traded cryptoasset in July, dropped to fifth with a 21% decrease in investment activity on eToro compared to the previous month. Cardano successfully implemented its Shelley upgrades as it moved to a decentralised network. Despite this, the coin fell from $0.139 on the 1st of August, to $0.117 on the 31st.

Tezos, one of the first blockchains to use a proof of stake mechanism, moved up one position to fourth, as investors took advantage of the coin’s upwards price trajectory. Tezos has been one of the most popular cryptoassets over the past 12 months, with trading activity in August 2020 up a staggering 1365% compared with August last year.

Simon Peters, market analyst and crypto expert at eToro, commented:

“August saw massive increases for top altcoins in particular EOS and TRON, as investors sought to take advantage of their excellent price performance.

“Investors also flocked to Ethereum in August, as co-founder Vitalik Buterin and team continue to roll out their much anticipated 2.0 upgrade. The release of the Medalla testnet in August, an important development on the road to Eth 2.0, faced some teething problems but was clearly a step in the right direction.

“With Ethereum now sitting at $462, the price rise is clearly a statement of intent from the DeFi community. The increase in activity around Ethereum shows investors recognising the potential that exists in the DeFi space.

“Tezos saw a significant increase in trades on eToro, with the cryptoasset trading lower against bitcoin at the start of August, which may have encouraged some inflows into the token. Having already announced a partnership with China’s Blockchain Service Network, Tezos recently announced the integration of Harbinger price oracles. This allows the Tezos network to use real world pricing data for DeFi applications, which I see as being very positive for the long term success of the network.

“The question now is, will altcoins maintain retail investor interest, or will rising bitcoin prices usurp their popularity?”

The Cyprus Securities and Exchange Commission regulates eToro in Europe, authorized and regulated by the Financial Conduct Authority in the UK and by the Australian Securities and Investments Commission in Australia. Copy Trading operations are not equivalent to investment advice. The value of your investments can go down as well as up. Your capital is at risk.

This communication is for informational and educational purposes only and should not be construed as investment advice, a personal recommendation, or an offer or solicitation to buy or sell any financial instrument. This material has been prepared without regard to the investment objectives or financial situation of any particular recipient, and has not been prepared in accordance with legal and regulatory requirements to promote independent research. Any reference to the past or future performance of a financial instrument, index or packaged investment product is not, and should not be considered, a reliable indicator of future results. eToro makes no representations and assumes no responsibility as to the accuracy or completeness of the content of this publication.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.