Tokens of privacy-focused cryptocurrencies Monero, Zcash and Secret were among the biggest gainers in the past 24 hours as the crypto market bounced from Tuesday’s support levels to add more than 6% to total market capitalization. The moves were among the largest for privacy tokens in recent months.

Monero’s XMR gained more than 25% in the past 24 hours, spiking as high as $277 on Binance before falling back to $196 at the time writing. Zcash’s ZEC and Secret’s SCRT increased 16% in the same period, reaching prices not seen since late January.

Price-chart analysis suggests XMR could fall to a support level at $180, while ZEC and SCRT could drop from their current $137 and $5 to $129 and $4.20, respectively.

Some analysts say masking a user’s wallet address and identity could play a role in increasing investor demand for privacy coins.

“With the quality of shielding the identity and details of transactions, many crypto users still believe privacy coins help enshrine the core tenets of blockchain transactions,” Alexander Mamasidikov, a co-founder of crypto bank MinePlex, wrote in an email to CoinDesk.

“The tokens have inherent qualities and use cases that many investors believe will also stir an increase in their demand across the board,” he said.

Monero and Zcash, unlike bitcoin or ether, use a cryptographic process to ensure that transactions cannot be linked to wallet holders and are untraceable.

Such an arrangement is helpful to some users in the current environment: Exchanges like Coinbase blocked over 25,000 crypto addresses linked to illicit activity on Sunday, as reported.

Crypto exchanges have been under pressure to monitor Russia-linked crypto activity, especially as the country faces sanctions from western countries following its invasion of Ukraine. The sanctions include blocking funding to Russian businesses and entities, as well as avoiding purchases of Russian products and commodities.

Demand for privacy cryptos

Privacy coins have seen declining interest from investors in recent years as narratives in crypto circles shifted away from privacy to decentralized finance (DeFi) – which uses smart contracts for the development of financial services – and non-fungible tokens (NFTs).

Layer 1, or base, blockchains like Terra, Cosmos and Avalanche have been another investor favorite for the scalability, speed, and affordability they provide to users. Their tokens have been among the highest gaining cryptos in the past two years.

But the war in Ukraine and resultant sanctions might have pulled some of the focus back toward privacy coins, some say.

"With some crypto exchanges announcing that they are blocking a large number of wallets many users that have normally nothing to hide or fear may still want to protect their assets,” Alexander Tkachenko, founder of VNX, said in a Telegram message. “During turbulent times safety assets like physical gold and privacy coins get large inflows of capital.”

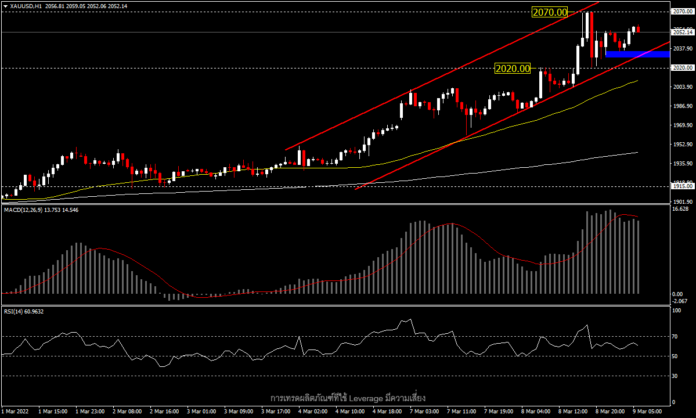

Gold neared $2,000 on Wednesday, a level last seen in September 2020. The increase came amid a broader run in metals and commodities. Nickel jumped to $101,000 on Tuesday morning, while Brent oil touched nearly $140 a barrel.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Michael Saylor predicts Bitcoin to surge to $100K by year-end

MicroStrategy's executive chairman, Michael Saylor, predicts Bitcoin will hit $100,000 by the end of 2024, calling the United States (US) election outcome the most significant event for Bitcoin in the last four years.

Ripple surges to new 2024 high on XRP Robinhood listing, Gensler departure talk

Ripple price rallies almost 6% on Friday, extending the 12% increase seen on Thursday, following Robinhood’s listing of XRP on its exchange. XRP reacts positively to recent speculation about Chair Gary Gensler leaving the US Securities and Exchange Commission.

Bitcoin Weekly Forecast: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin (BTC) surged up to 16% in the first half of the week, reaching a new all-time high of $93,265, followed by a slight decline in the latter half. Reports suggest the continuation of the ongoing rally as they highlight that the current trading level is still not overvalued and that project targets are above $100K in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.