- A botnet called Lemon Duck is spreading faster than ever, although it has been active since the end of December 2018.

- According to the research, it is one of the more complex mining botnets using Monero.

The botnet known as Lemon Duck has been infecting thousands of computers around the world since at least December 2018. It seems that recently the identification of the botnet has become far more difficult. It spreads through Windows 10 computers and is disguised as fake Covid-19 emails.

What’s going on with Lemon Duck?

Lemon Duck is not a simple botnet, it automatically spreads and delivers a variant of the Monero cryptocurrency mining software. The most recent report by Talos Intelligence shows the botnet has at least 12 independent infection vectors, meaning that it can spread across a network faster.

Botnet Infection Vectors

The majority of the spread originates in Asia, in countries like Iran, the Philippines, Vietnam, India, and Egypt. The main goal of the Lemon Duck botnet is to mine Monero using Windows, but also Linux in some cases. The code behind it is taken from open-source projects according to Talos Intelligence.

The Lemon Duck activity we recorded is consistent with a general uptick in cryptocurrency miners observed by Talos over the last several months, including a resurgence in PowerGhost, Prometei, and Tor2Mine.

The article also mentions a few ways users can try to detect and block this botnet and others. One of the main defenses vs any type of malware is the use of an Advanced Malware Protection software. Additionally, if users want to protect themselves further, web scanning software and email security software capable of blocking malicious emails will also help tremendously.

Monero bears look for a pullback

The Monero botnet has existed since December 2018, but can it actually have any impact on the price of the digital asset? According to a report released by Accenture Security, it can. Botnets mining Monero at scale can ‘generate massive quantities of the cryptocurrency worth millions of dollars’. The Smominru malware was able to mine around 24 XRM per day, close to $3,000 at current prices and around $10,000 at its peak.

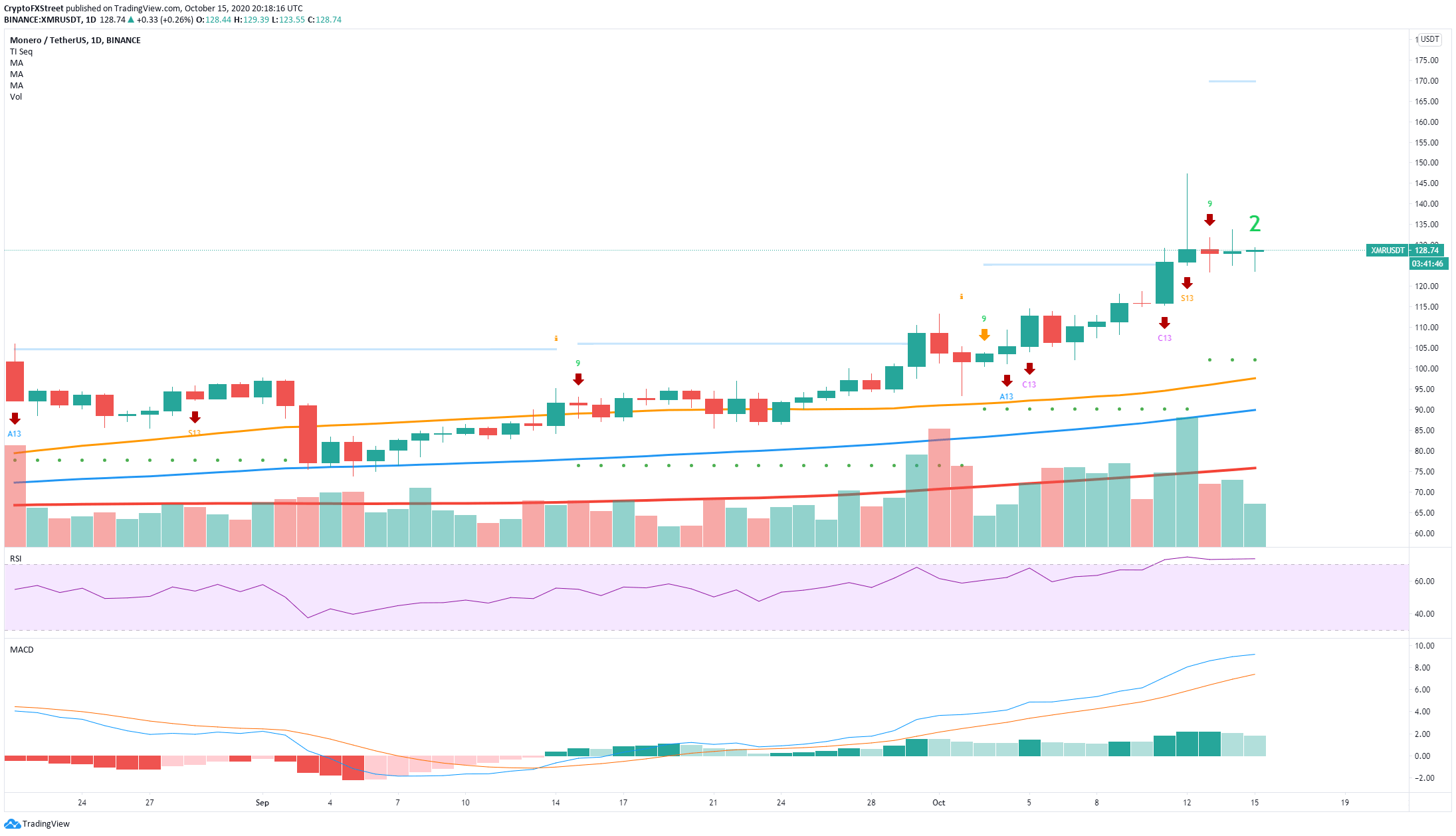

XMR/USD daily chart

Although botnets do not have an immediate effect on the price of Monero, they can certainly add up to the selling pressure in the long term. On top of that, the TD sequential indicator has presented a sell signal on the daily chart that was not validated just yet because the price remained trading sideways.

The RSI is also quite overextended after a long uptrend that started on September 5. Monero hasn’t seen much of a pullback during the past month and a half. In the worst-case scenario, we could see XMR drop towards the 100-SMA at $100. Before that, there is also another price target of $115.

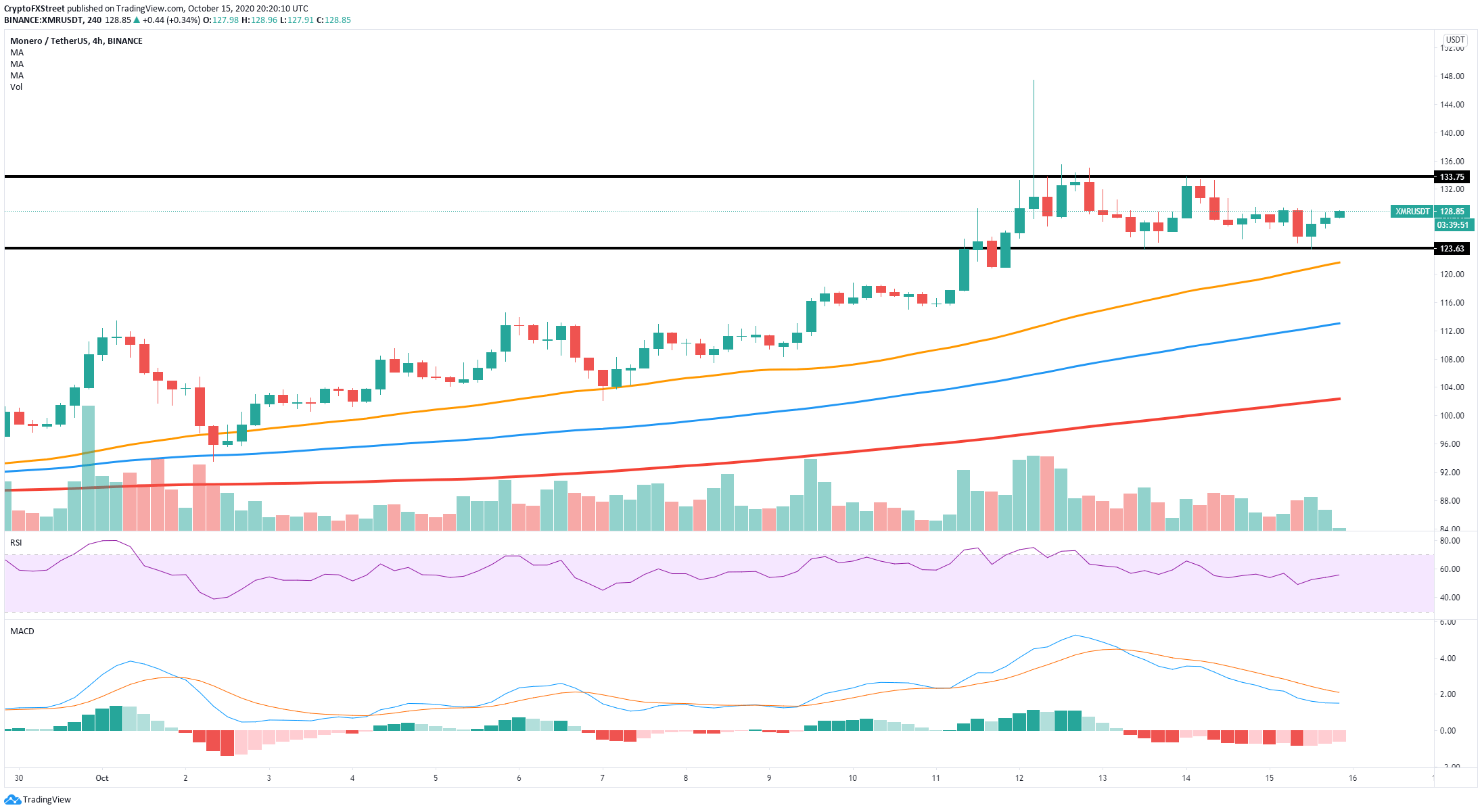

XMR/USD 4-hour chart

Nonetheless, on the 4-hour chart, the bulls managed to defend a critical support level at $123 and are eying up the resistance level at $133. The MACD is slowly shifting towards a bullish outlook and the RSI is not overextended here. A breakout above $133 could drive XMR up to $150.

Crucial price points to keep in mind

Monero could be close to topping out and bears are noticing. The nearest price target for XMR would be at $115, a support level established on October 10. Further down, there is also a critical level at $100 where the 100-SMA is located.

On the other hand, if the daily uptrend continues and bulls do not lose strength, we could see XMR climbing towards the resistance level at $133. A longer-term price target would be $150, the last high of the spike on October 12.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.