- Monero's hash rate catapulted after the hard fork

- XMR/USD is moving inside the range without a clear direction.

Monero's hash rate increased by 186% in recent days after the team released a new update with the new mining algorithm RandomX. The new rules eliminate the benefits of ASIC-based mining and increase network decentralization.

Hash rate is ofter referred to as a network difficulty as it defines the number of hashes calculated by computers before the next block is discovered.

Prior to the upgrade, Monero hash rate was registered at 309 MHash/s, while seven days later it has settled at 952 MHash/s. Experts believe that the spike is caused by ASIC-resistant features that gives all miners an equal opportunity to participate in the mining.

Monero price resistance

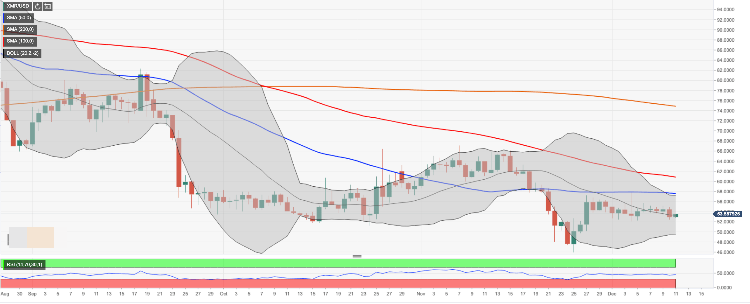

While the development is regarded as positive for the Monero network, the price has been stagnant lately. On Tuesday, XMR/USD attempted a move towards $55.00 but retreated to $52.40. At the time of writing, the coin is changing hands at $53.41, having gained about 2% of its value since the beginning of the day.

Looking technically, the strong resistance is created by a $55.00-$55.20 area. This is the upper boundary of the recent consolidation channel. Once it is out of the way, the upside is likely to gain traction with the next focus on SMA50 (Simple Moving Average) daily at $57.60, reinforced by the upper line of the daily Bollinger Band.

On the downside, a sustainable move below $52.00 will increase the selling pressure and push the price towards a psychological $50.00. The next slang-term support awaits us at $45.90, which is the lowest level since November 25.

XMR/USD, the daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Grayscale files S-3 form for Digital Large Cap ETF comprising Bitcoin, Ethereum, XRP, Solana, and Cardano

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Top crypto news: VanEck hints at BNB ETF, Circle files S-1 application for IPO

Asset manager VanEck registered a BNB Trust in Delaware on Tuesday, marking its intention to register for an ETF product with the Securities & Exchange Commission (SEC).

Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.