- The US IRS offers $500,000 for anyone who breaks Monero's privacy robustness.

- CipherTrace has developed a tool that can trace Monero transactions.

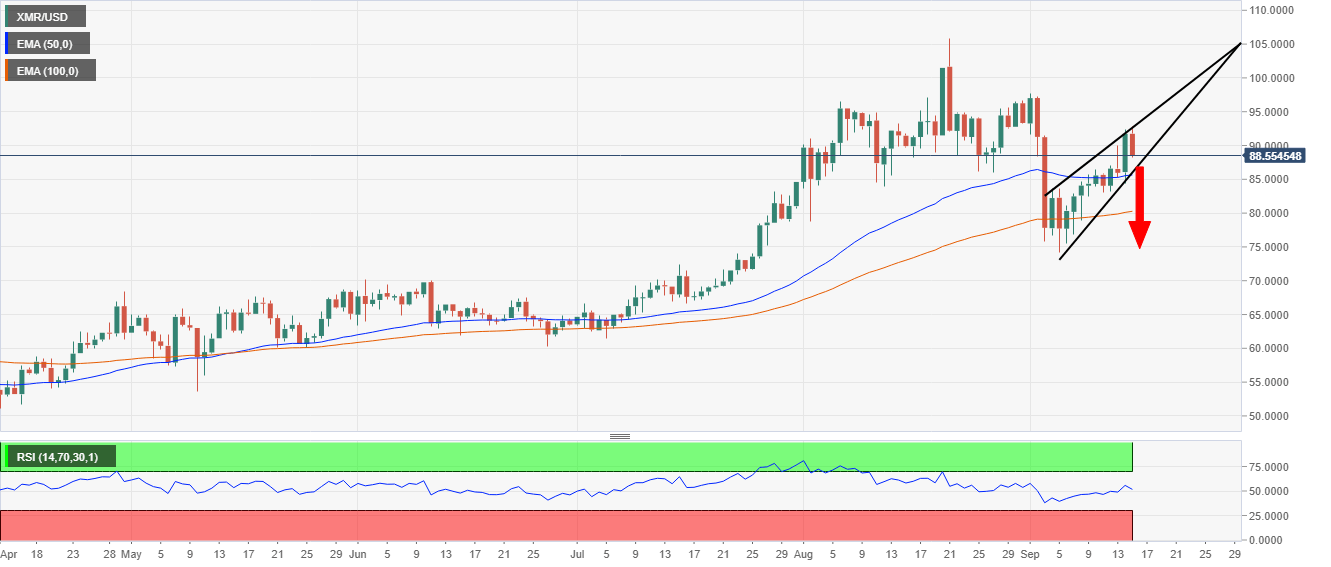

- Monero is on the verge of a breakdown to $75, especially if the wedge pattern support is broken.

It is obvious why governments around the world do not have a liking for privacy-oriented cryptocurrencies. Governments and their institutions do not like to be in the dark. However, anonymous coins such as Monero (XMR) and Zcash have been designed to protect their users' identities. Regulators and government institutions argue that privacy and anonymity oriented digital currencies can support criminal activities such as money laundering and terrorism funding.

Subsequently, the ardent user of coins like Monero could argue that “privacy guarantees are designed to benefit legitimate users who do not want their financial details made public,” as the Zerocash whitepaper reads. The paper adds that "anonymous cryptocurrencies barely affects the status quo for criminal users, who already have strong incentives to hide their activity, while it provides notable benefits to legitimate users.”

Can Monero’s privacy features be compromised?

Monero has been a topic for discussion in the past week after the United States Internal Revenue Service (IRS) asked the public to help break its privacy features. The precise instruction was to “investigative resources for tracing transactions involving privacy cryptocurrency coins such as Monero, Layer 2 network protocol transactions such as Lightning Labs, or other off-chain transactions that provide privacy to illicit actors.”

While this is not an easy task, the IRS hopes that once it has been accomplished, its agents will have the ability to trace transactions, predict inputs and outputs of funds, and reveal the identity of the senders and receivers within the network. Intriguingly, a colossal reward amounting to $500,000 has been offered to anyone who breaks Monero’s renowned privacy robustness.

At the moment, Cipher Trace made a recent announcement that its team has finalized the development of a tool that can be used to trace Monero. The tool was developed following a request from the US Department of Homeland Security (DHS). According to CipherTrace, this tool is not against Monero; in fact, it could help the digital asset gain listing on cryptocurrency exchanges.

Note that Monero’s robust signature privacy model has, for a long time, allowed users to anonymously send and receive transactions without a trace by creating a onetime address for every transaction. Unfortunately, the same features have cost it listings on various exchanges such as BitBay, and CoinCheck.

Indeed, sooner or later, there will be a success story for the IRS. However, if Monero loses even an inch of its privacy attractiveness, the storm that would blow through the network and token value would be far worse than the drama of embattled SushiSwap.

Monero flashing a destructive sell signal

Monero has been on the radar for its sort-after privacy features being compromised. The negative sentiments keep reverberating unwanted energy throughout the community and the cryptocurrency industry. From highs above $105 in August, Monero has retreated to hit a low of $75 at one point.

At the time of writing, Monero is trading at $88, following another reversal from $92. The Relative Strength Index points towards a potential breakdown, especially if the midline support at 50 is broken. Moreover, the rising wedge pattern emphasizes the bearish grip further. If the 50-day Simple Moving Average (SMA) caves in, Monero will spiral to the next tentative support at the 100-day SMA ($80). The breakdown from the rising wedge aims for the $75 support level amid the rising concerns of law enforcement interference.

XMR/USD daily chart

Looking at the other side of the picture

The hourly range shows Monero holding above the 50 SMA. If XMR/USD bulls keep the price above this level, there is a chance a bullish reversal would come into the picture, invalidating the bearish case to $75.

XMR/USD hourly chart

Note that Monero has reversed upwards every time the 50 SMA support has been protected in September. For now, support above $88 is key to ensuring that Monero does not fall into the bottomless pit.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637357607955572614.png)