Monero Price Prediction: XMR's uptrend could be jeopardized leading to a steep correction

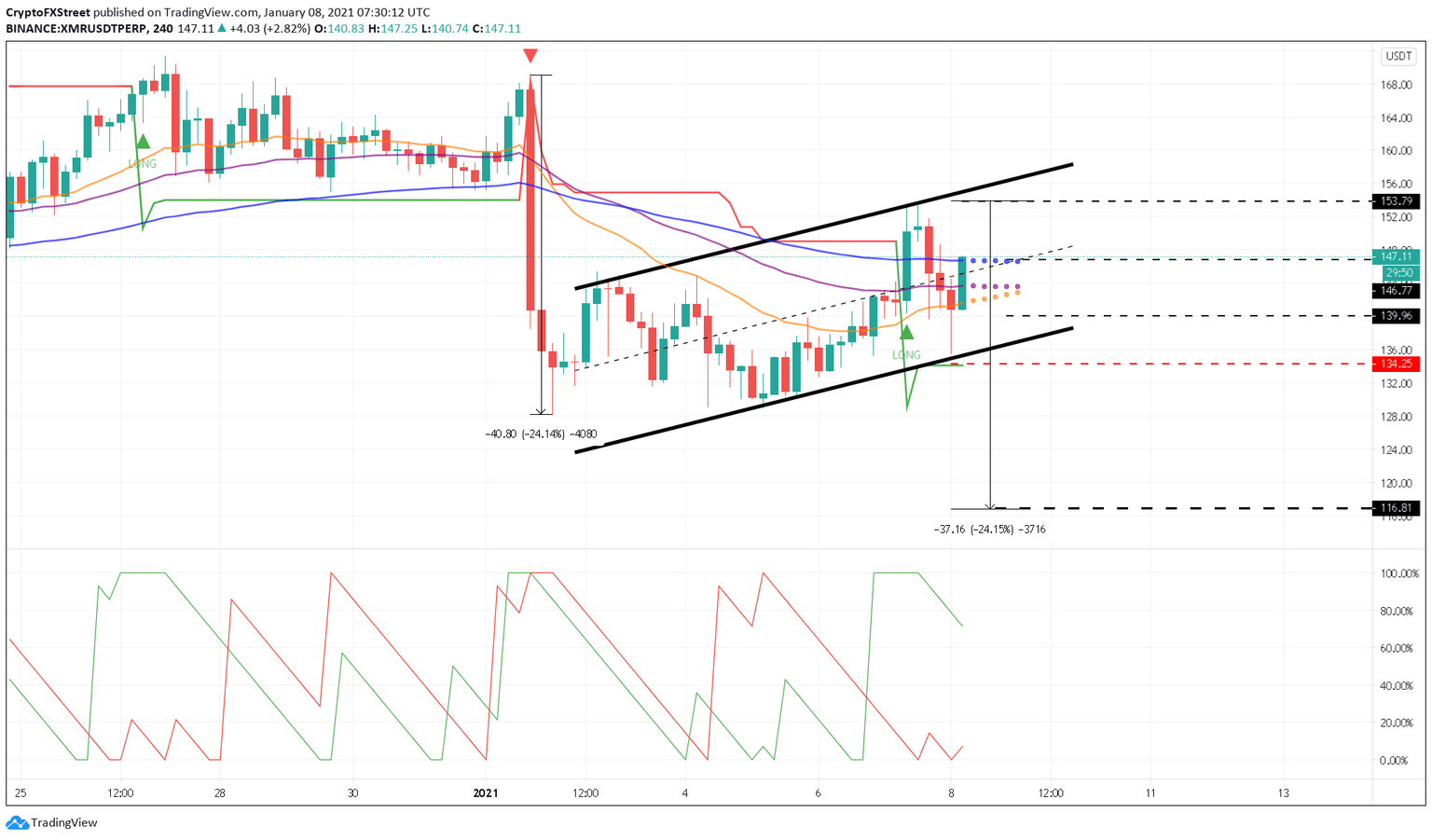

- Monero price is consolidating within an ascending parallel channel, hinting at a crash after a small bullish impulse.

- If validated, XMR could drop by more than 25% to revisit the $115 support level.

Monero seems to be forming a massive bearish pattern that could see its price lose some of the gains made recently. Everything will depend on its ability to remain trading above the $135 support level.

Monero price’s bearish outlook overshadows the recent surge

Privacy-centric token, Monero, appears to be forming a bearish flag on its 4-hour chart. This technical formation highlights a high probability of a breakdown equal to the flag pole’s length.

If sell orders begin to pile up, Monero price could drop as much as 25% after slicing through the $135 support.

XMR/USD 4-hour chart

Multiple technical indicators, such as the Exponential Moving Averages, indicate that the odds favor the bears. The short, mid, and long-length EMAs hover above Monero price, acting as substantial resistance barriers.

Moreover, the declining green Aroon line fuels the bearish thesis as it suggests that the downtrend’s strength is increasing over time.

If Monero price closes below the $135 support level on the 4-hour chart, the bears will likely gain control. Further selling pressure around this price level would push XMR towards the nearest support area at $115.

On the flip side, only a 4-hour candlestick close above the $153 resistance level could invalidate all the bearish signals previously mentioned. If this were to happen, Monero price could enter a new uptrend that sees it rise to $200.

Author

FXStreet Team

FXStreet