- MINA's price surges over 100% in the last 24 hours after the listing announcement by Upbit exchange.

- Mina Procotol is a layer 1 chain with zero-knowledge smart contracts in a 22KB blockchain.

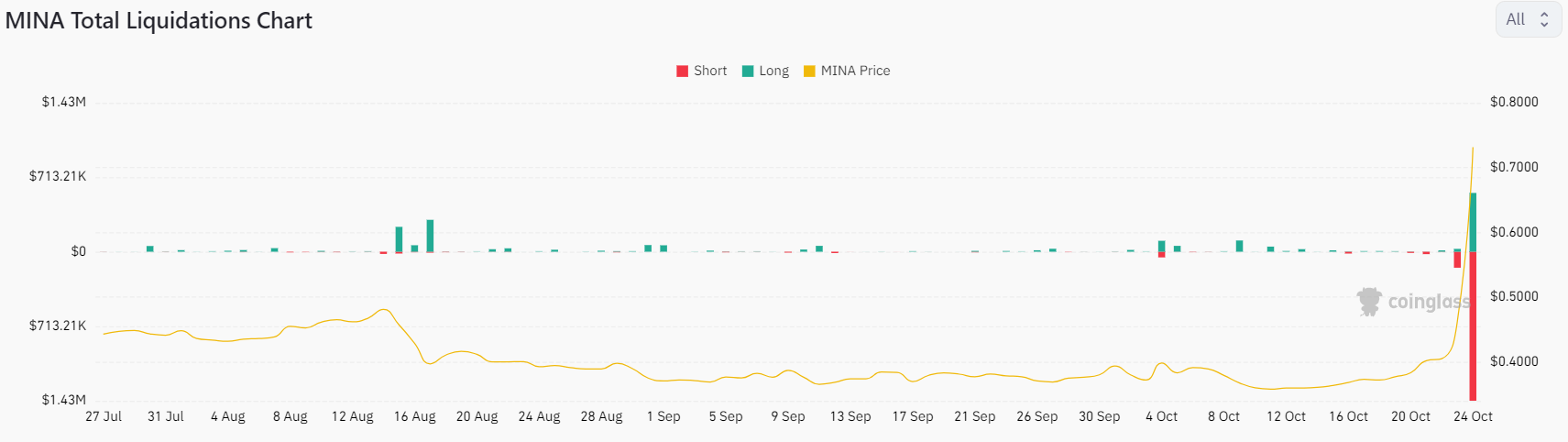

- MINA derivatives witnessed a 15,000% increase in volume as short liquidations exceeded $1 million on Tuesday.

Mina Protocol's (MINA) price has experienced over a 100% surge within a 24-hour period following its listing on South Korea's Upbit exchange. MINA, a blockchain project known for its lightweight design and zero-knowledge smart contracts, is seeing the majority of traders who are short, suffering a squeeze as the market rallies on Tuesday.

MINA price surges by 100%

Mina Protocol (MINA) has witnessed over a 100% price surge after trading up from the $0.40s to the mid $0.80s in just 24 hours, according to data from CoinMarketCap.

The influx of buying interest comes after one of the top crypto exchanges in Korea, Upbit, announced that it is listing MINA. After the announcement on Tuesday, the translated release by the exchange said that new digital assets have been added in accordance with the travel rules put in place to target money laundering.

Meanwhile, MINA also saw large derivatives trading activity with volumes increasing by 15,000% on Tuesday at the time of writing. The volume surpassed $2 billion, with the open interest or outstanding contracts surging by 800% to $116 million, as per Coinglass data.

Binance, the largest crypto exchange by volume, is showing a long/short ratio of 0.70 for the MINA/USDT trading pair yet short positions are increasingly getting squeezed as the price rallies.

Short liquidations spike

Short outweighed long liquidations by well over two to one on October 24. Traders closed shorts to the tune of $1.7 million while the total long liquidations were registered at $570,000.

MINA liquidations

MINA liquidations

The price surge and increased trading activity come on the back of Upbit listing pushed by the broader market strength that took Bitcoin beyond the $34,000 mark.

However, MINA which is currently trading at $0.88, is still a long way from its record peak of $9.00 achieved in June 2021. After hitting its all-time low of $0.35 on October 12, its journey back to $1.00 will have to be monitored to understand its long-term price trajectory.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.