- Institutional money is flowing into Bitcoin.

- The trend is likely to gain traction in the nearest future.

- The technical picture implies BTC/USD needs to clear $12,000 to resume the recovery.

Bitcoin is attracting a lot of attention from large companies. According to the recent report published by the Fidelity Investments' cryptocurrency department, almost 60% of the surveyed investors believe that digital assets have a place in a portfolio. Square, Stone Ridge, MicroStrategy, and the likes turn to Bitcoin to protect their assets from inflation, diversify portfolios, or get ready for an imminent money revolution.

JPMorgan, known for its critical approach towards digital assets, admitted that Bitcoin has a lot of potential. At the same time, the recent investments announced by large companies can be interpreted as a vote of confidence.

Whatever the motives behind their BTC investments, they signal that big business spotted the advantages of the new investment tool and now pivoting to it, paving way for the cryptocurrency mass adoption.

Bitcoin is a safe haven

Bitcoin is less vulnerable to the economic woes that may plague other asset classes in the nearest months and years, Fidelity states. They pointed out that digital assets investments allow hedging the risks associated with traditional investments and get exposure to non-traditional returns.

The careful and informed use of alternative investments in a diversified portfolio can reduce risk, lower volatility, and improve returns over the longterm, enhancing investors' ability to meet their return outcomes.

The experts pointed out that Bitcoin is an easily accessible, liquid, and low-cost investment that can significantly enhance portfolio performance. According to the research, even 3% of Bitcoins in the investment portfolio would have increased the annual returns by over 4% from 2015 to 2020.

Summary portfolio metrics

Source: Fidelity Investments

Meanwhile, the former hedge fund manager Raoul Pal believes that cryptocurrency is the only answer to what the global central banks are doing.

Speaking in the interview with Daniela Cambone of Stansberry Research, he explained:

I don't dislike gold, but when you get to the macro opportunity … if bitcoin starts breaking out of these patterns that it's been forming, it is going to massively outperform gold. I'm 100% sure of that, so in which case why would I have the gold allocation.

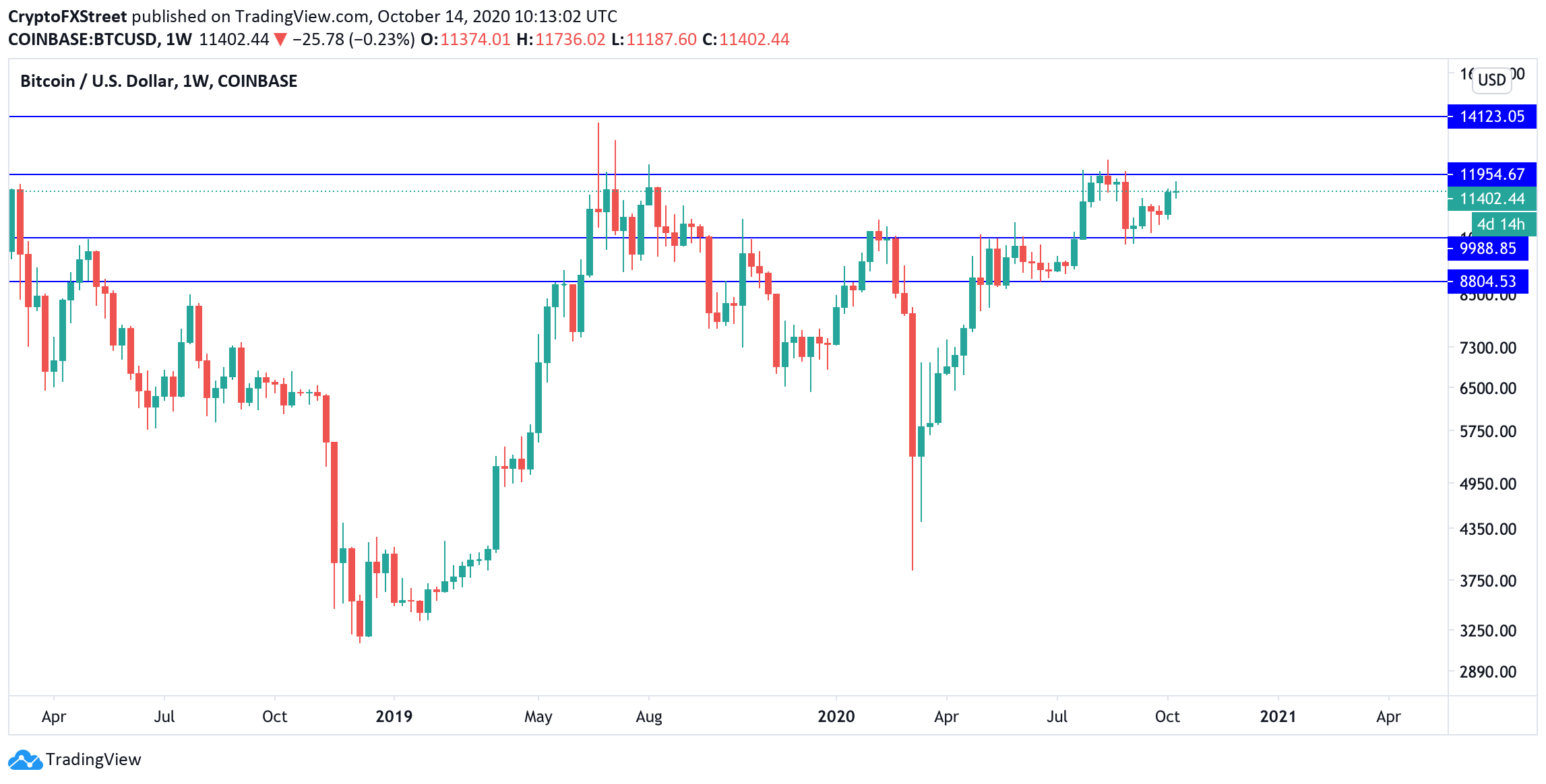

BTC/USD: The technical picture

From the long-term perspective, BTC/USD is moving inside the range limited by $12,000 on the upside and $10,000 on the downside. The coin reversed from the channel support at the end of August and has been recovering slowly ever since.

While the price is moving towards the channel resistance at $12,000, only a sustainable move above this area will signal that the bullish trend is resumed and open up the way to the psychological 13,000 and $13,800 (the highest level of 2019).

BTC/USD weekly chart

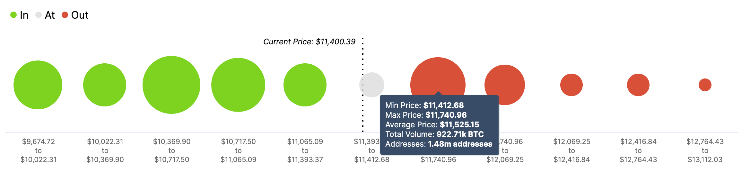

Meanwhile, Bitcoin's market positioning implies that there is a big cluster of 1.48 million BTC addresses holding nearly 1 million coins with their breakeven point on the approach to $11,700. This barrier may slow down the recovery and even push the price towards the channel support. However, once it is cleared, nothing can stop BTC from a sustainable rally.

Bitcoin's IOMP data

Source: Intotheblock

On the downside, the significant barrier comes at $10,700. The wall of 1.5 million addresses with over 1 million coins will protect their breakeven point and absorb the selling pressure. If it is passed, the sell-off may be extended towards $10,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.