- MicroStrategy plans to sell convertible bonds to purchase more Bitcoins.

- The company owns over 40,000 BTC worth over $775 million.

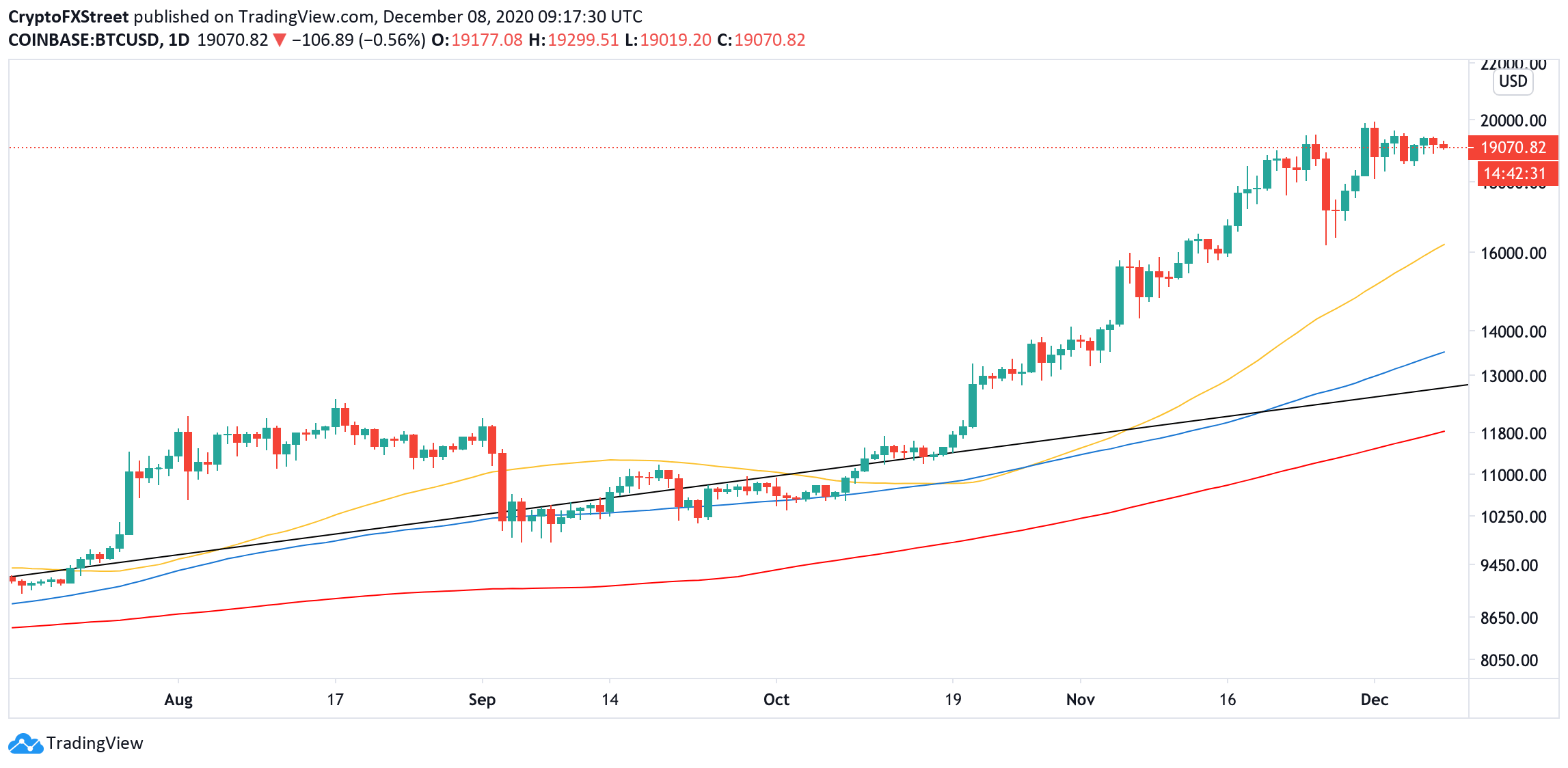

Bitcoin hit the record high and came close to a psychological barrier of $20,000. BTC is changing hands at $19,000 at the time of writing, down 1.6% on a day-to-day basis. Bitcoin touched a new all-time high at $19,915 on December 1 and retested $18,100 amid massive leveraged longs liquidation. However, the downside momentum faded, and the price returned to the area above $19,000.

BTC daily chart

As the pioneer digital asset gained over 500% from the March collapse, many experts warn that the price may be ready for a deep correction before the growth is resumed.

However, one of the largest Bitcoin holders plans to increase its exposure to the cryptocurrency market by purchasing Bitcoins worth $400 million. A business-intelligence firm Microstrategy intends to finance the investment in the digital asset via selling convertible bonds, according to the company's statement, cited by Bloomberg.

The raised capital will be invested in Bitcoin "pending the identification of working capital needs," however the exact timeframe remains unknown.

MicroStrategy goes wild

The company has been actively buying Bitcoins since August 2020. At that time, MicroStrategy acquired 21,454 BTC at an aggregate purchase price of $250 million, including fees and expenses. At the time of the purchase, BTC was trading above $11,000.

Moreover, the company announced Bitcoin as a Primary Treasury reserve asset and a part of a new capital allocation strategy.

This investment reflects our belief that Bitcoin, as the world's most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash, said Michael J. Saylor, CEO of MicroStrategy.

In September, MicroStrategy went on hoarding Bitcoins and spent another $175 million to purchase $16,796 coins. At that time, BTC was trading at around $10,500, while the first batch of purchased Bitcoins was out of the money.

On December 4, the company paid another $50 million to buy 2,574 BTC at an average purchase price of $19,427, according to a filing to the US Securities and Exchange Commission.

Thus, in the aggregate, the company spent $475 million to buy 40,824 Bitcoins. Considering that MicroStrategy's BTC investment is worth $775 million at the current exchange rate, the return on investment amounted to 63%.

Positive side effects of Bitcoin investments

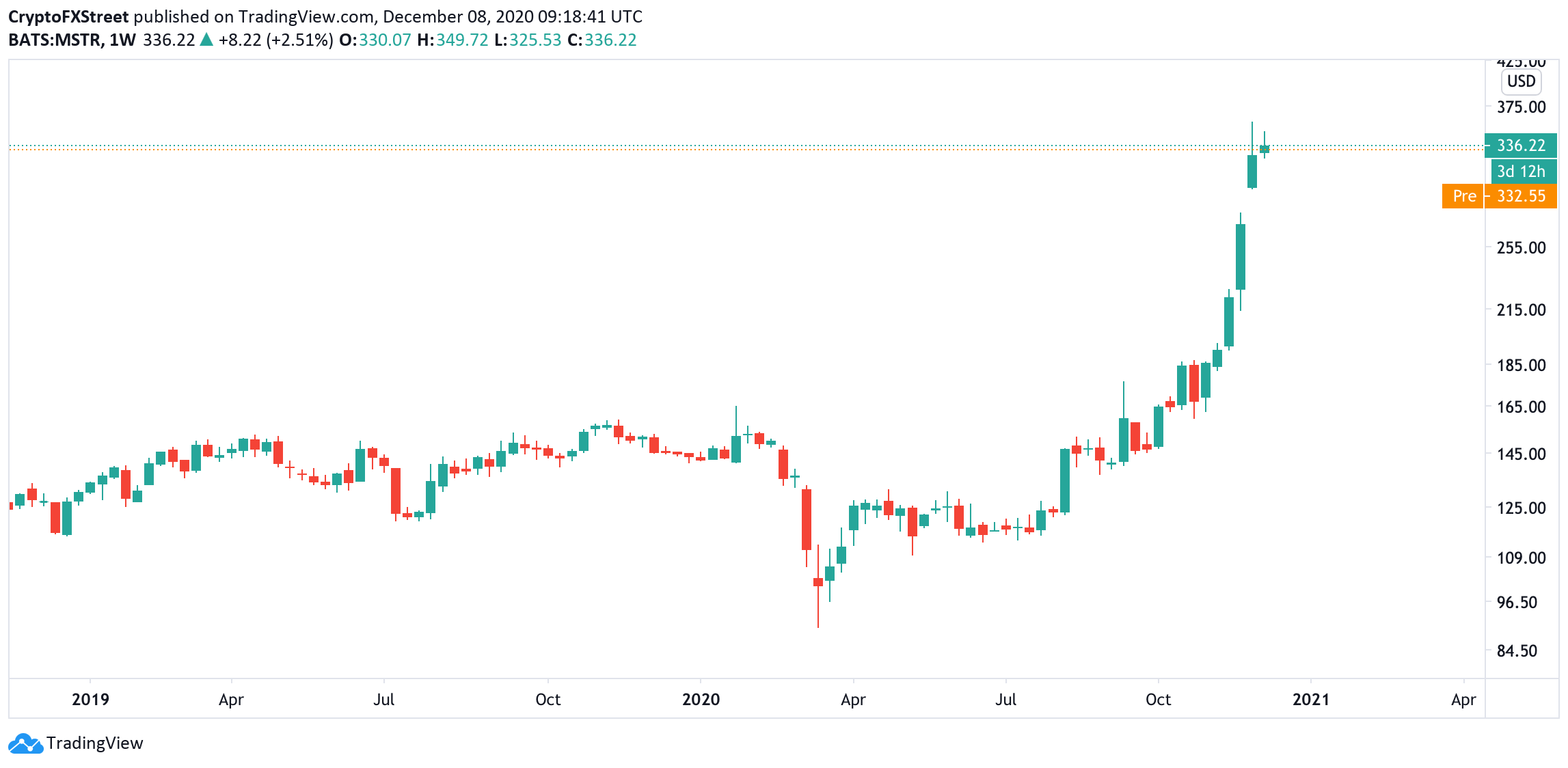

MicroStrategy's stock price has been spiraling higher after the company announced its Bitcoin-oriented investment strategy. At the time of writing, they are trading at $342 from $142 at the beginning of the year. Since the beginning of November, the price has doubled as Bitcoin entered a strong bullish trend.

MSTR, weekly chart

Other institutional investors and high-profile companies followed the lead and transferred part of their wealth to digital assets. Thus, FXStreet previously reported that billionaire flock to the cryptocurrency industry to diversify their portfolio from the traditional safe-havens and become a part of a significant trend in the financial sector.

The inflow of institutional money is a new driver for the cryptocurrency market and a distinguishing feature that sets it apart from the boom of 2017.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Tether mints another $1,000,000,000 USDT on Justin Sun’s Tron blockchain: TRX traders could profit

Tether, the world’s largest stablecoin issuer, has minted another $1 billion worth of USDT on the Tron blockchain according to Whale Alert data published Friday.

XRP Price Prediction: XRP back above $2 liquidating $18M in short positions, will the rally continue?

Ripple (XRP) seeks support above $2.0020 on Thursday after gaining 14% in the past 24 hours. The token trades at $2.0007 at the time of writing, reflecting growing bullish sentiment across global markets.

Avalanche Octane update goes live on mainnet, slashes transaction fees significantly

Avalanche (AVAX) Octane update, live on mainnet on Thursday, introduces a dynamic fee mechanism to the C-Chain. This mechanism reduces transaction costs during high network activity by adjusting real-time fees, as per ACP-176.

Dogecoin soars as 21Shares files S-1 for DOGE ETF

Dogecoin (DOGE) rallied nearly 12% on Wednesday after asset manager 21Shares filed an S-1 application with the Securities & Exchange Commission (SEC) to launch the 21Shares Dogecoin exchange-traded fund (ETF).

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.