-

MicroStrategy has broken into the top 100 U.S. publicly traded companies by market cap, with a $96 billion market cap.

-

MicroStrategy is now past $400 a share and is up 528% year-to-date.

Self-described bitcoin (BTC) development company MicroStrategy (MSTR) has just breached into the top 100 U.S. publicly traded companies, currently sitting in 97th place.

The company jumped 29 places on Tuesday's performance, which saw a 12% price surge through $400 a share, now trading at $430, just as the market closed. The impressive performance coincided with bitcoin hitting new all-time highs of over $94,000.

MicroStrategy has been one of the main stories of 2024, as it has soared over 500% year-to-date, with bitcoin up over 100% in the same time frame.

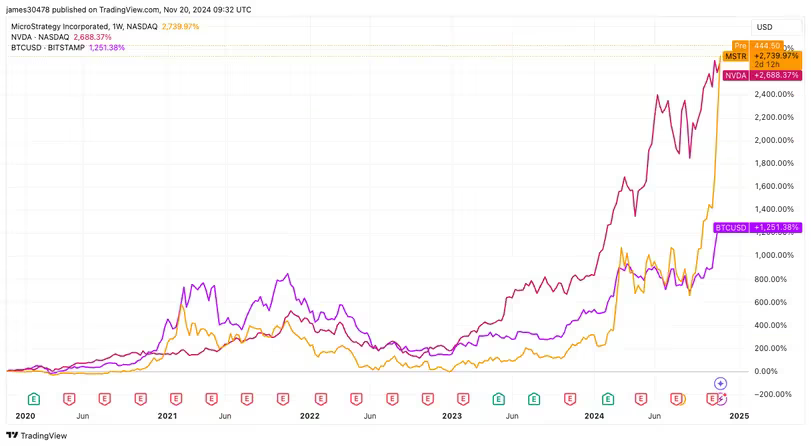

The most impressive stat is that in five years, MicroStrategy has outperformed NVIDIA (NVDA) even though MSTR only adopted bitcoin as a treasury asset in August 2020. MicroStrategy is up 2,739%, while NVIDIA is up 2,688%.

As of Nov. 18, MicroStrategy held 331,200 bitcoin, which would make their current stash worth over $30 billion.

The developments keep coming for the largest publicly traded bitcoin company. On Nov. 18, MicroStrategy announced a $1.75 billion convertible senior note at a 0% coupon. The note will mature on December 1, 2029, it can be repurchased or redeemed earlier in accordance with the terms. It is unsecured and will not bear regular interest.

We are waiting on further developments if this convertible note has been oversubscribed, which would increase its issuance by $250 million, for a total of $2 billion.

MicroStrategy is up over 3% in pre-market trading on Wednesday.

MSTR vs NVIDIA vs BTC (TradingView)

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Why is Bitcoin performing better than Ethereum? ETH lags as BTC smashes new all-time high records

Bitcoin has outperformed Ethereum in the past two years, setting new highs while the top altcoin struggles to catch up with speed. Several experts exclusively revealed to FXStreet that Ethereum needs global recognition, a stronger narrative and increased on-chain activity for the tide to shift in its favor.

Ethereum Price Forecast: ETH could see a decline as on-chain and derivatives data paint bearish picture

Ethereum (ETH) declined below $3,100 on Tuesday as market sentiment surrounding the top altcoin is turning bearish. On-chain data reveals that investors are potentially withdrawing and putting sell pressure on exchanges.

Coinbase set to delist WBTC amid cbBTC expansion

Coinbase announced via an X post on Tuesday that it will suspend WBTC trading across all its platforms on December 19. Meanwhile, the exchange also revealed that its wrapped Bitcoin token, cbBTC, launched on Arbitrum earlier today.

Dogecoin Price Forecast: Selling pressure drops 95% as DOGE traders target $0.50 breakout

The Dogecoin price breached the $0.40 resistance on Monday, rebounding from a 15% pullback. On-chain transaction flows observed this week suggest DOGE could be on the verge of another leg-up toward $0.50.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.