Michigan becomes latest state to propose crypto reserve bill

Michigan has become the latest US state to propose a strategic Bitcoin reserve bill, bringing the total number of states moving crypto reserve-related legislation to 20.

On Feb. 13, Representatives Bryan Posthumus and Ron Robinson introduced HB 4087 to amend the state’s Management and Budget Act to establish a strategic Bitcoin BTC $96,675 reserve.

The move makes Michigan the 20th US state with legislation for state crypto investments pending a vote.

“Michigan can and should join Texas in leading on crypto policy by signing into law my bill creating the Michigan Crypto Strategic Reserve,” Posthumus said on X. Texas Senator Charles Schwertner had filed a similar bill to the state’s Senate on Feb. 12.

The Michigan bill would allow the state’s treasurer to invest in crypto from both the general fund and economic stabilization fund with a cap of 10%. The bill doesn’t specify any limits or guidelines for what cryptocurrencies can be bought for the reserve.

The bill also includes a provision for lending crypto, saying that “if cryptocurrency can be loaned without increasing financial risk to this state, the state treasurer is permitted to loan the cryptocurrency to yield further return to this state.”

The state must hold crypto directly through secure custody solutions or exchange-traded products from registered investment companies.

Excerpt of Michigan House Bill 4087. Source: Michigan Legislature

Michigan’s state pension fund already has exposure to Bitcoin and Ether exchange-traded funds.

Posthumus also floated the idea of “MichCoin” in a Feb. 13 X post, which he said was “a stablecoin, which I believe the state of Michigan should create” that he said would “have real value — tied to our gold and silver reserves.”

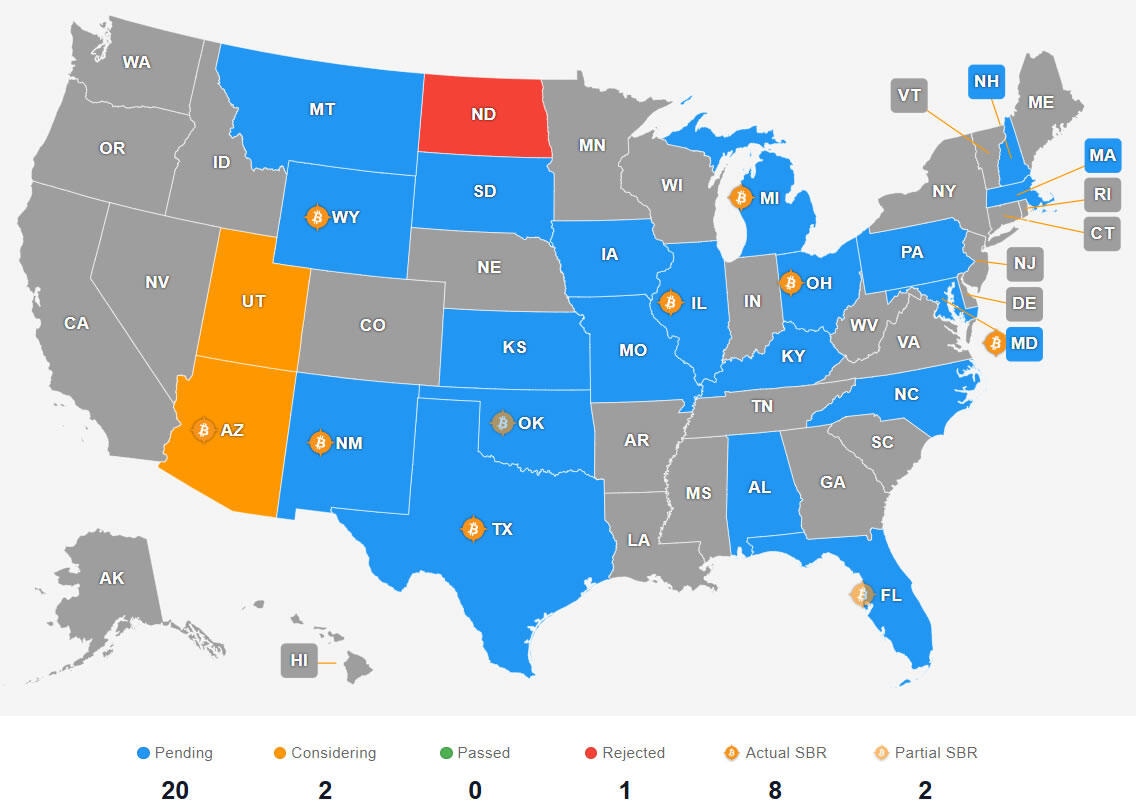

There are currently 20 US states that have crypto reserve bills that have advanced beyond the level of a House committee.

The most recent state to propose or amend a crypto bill was Texas, which filed for legislation this week to allow the state to invest and trade crypto assets. North Dakota, meanwhile, is the only state to have rejected legislation regarding crypto investments.

The status of crypto reserve-related bills. Source: Bitcoin Reserve Monitor

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.