Michael Saylor begins selling $216M in MicroStrategy stocks for more Bitcoin

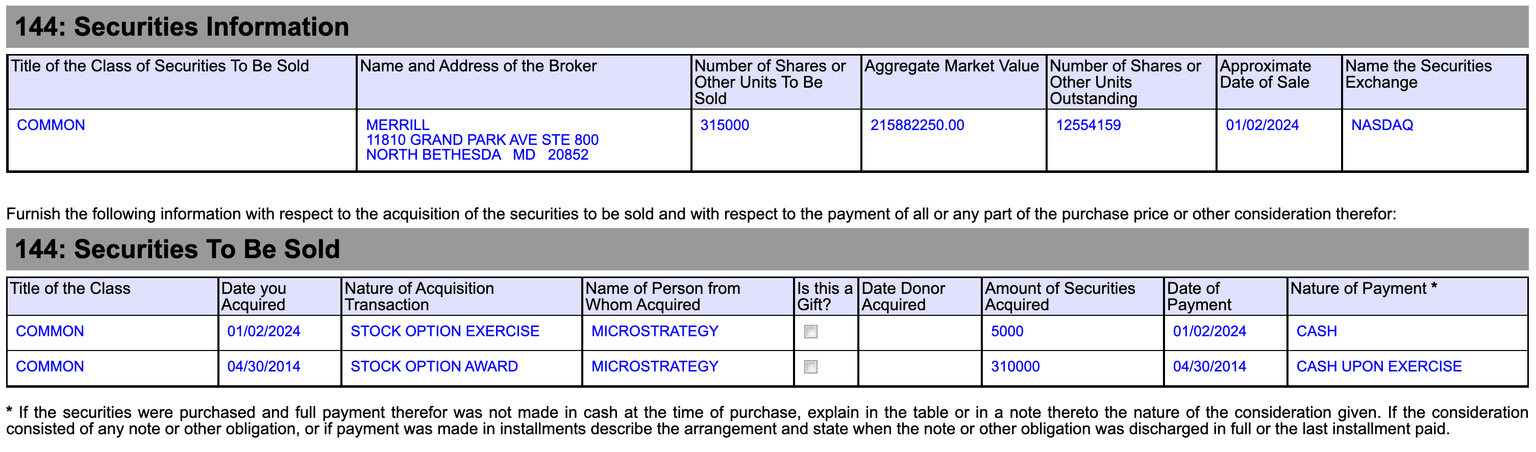

MicroStrategy executive chairman Michael Saylor has begun a four-month process of selling $216 million worth of his shares in his firm MicroStrategy, previously stating part of it would be used to buy more Bitcoin (BTC $45,281). In a Jan. 2 filing with the United States Securities and Exchange Commission, Saylor disclosed that he had already started selling his 315,000 stock options awards, first granted to him in April 2014. The awarded stock options expire on April 30, 2024.

Michael Saylor has already begun selling his MicroStrategy shares. Source: SEC

According to the filing, Saylor began the process on Jan. 2, selling his first tranche of 5,000 shares.

In MicroStrategy’s third-quarter earnings call on Nov. 2, Saylor said he planned to sell 5,000 MSTR shares daily for the next four months, which will go into addressing “personal obligations” and increasing the amount of Bitcoin he owns.

“Exercising this option will allow me to address personal obligations as well as acquire additional Bitcoin to my personal account,” Saylor said on the call. He added that his stake in the company’s equity remains “significant” despite his personal sales.

According to a Nov. 1 Q-10 filing with the SEC, Saylor can sell a maximum of 400,000 shares of his vested options between Jan. 2 and April 26 this year.

While Bitcoin enjoyed an impressive 170% rally from the start of last year, MicroStrategy has outperformed the asset by more than double, gaining 411% over the course of the last year, per TradingView data.

On Dec. 27, MicroStrategy purchased an additional 14,620 Bitcoin for $615 million. The purchase saw MicroStrategy’s total Bitcoin holdings grow to a staggering 189,150 Bitcoin — worth some $8.5 billion at current prices.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.