Memecoin dumps, then pumps after Vitalik Buterin sells unwanted airdrop

A memecoin attempting to use Vitalik Buterin’s fame to gain attention, has just seen its value pump 200%, even though Buterin completely dumped the token.

The rather obscure token attempted to gain credibility on Aug. 4, after airdropping 4% of its supply to the Ethereum co-founder to claim he was the largest holder.

Screenshot of memecoin promotion. Source: @neiroethcto

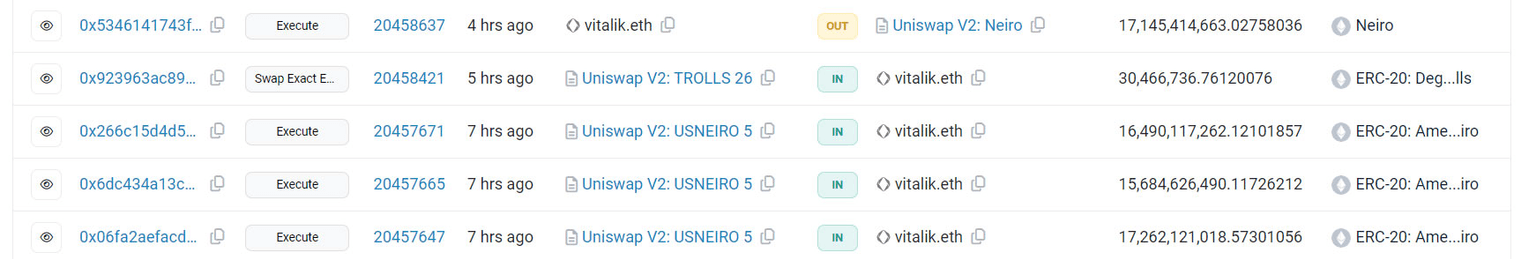

But barely an hour went by before the Ethereum co-founder dumped his entire stash of the memecoin. Buterin transferred 17.1 billion NEIRO memecoins in exchange for 44.5 (ETH $2,274) worth around $103,000 at the time.

Transfers to and from vitalik.eth. Source: Etherscan

Buterin’s quick transfer initially caused the token to dip around 60%, as people noticed the sale.

However, according to DexScreener, the Neiro on ETH (NEIRO) token has since surged more than 200% to hit an all-time high of $0.000038 on Aug. 5.

NEIRO token prices. Source: Dexscreener

At the same time, the Neiro on Ethereum (CTO) account associated with the token posted:

Hey @VitalikButerin, we see that you sold your $Neiro bag. Our humble ask is that you donate part of the proceeds to a stray dog shelter. And thank you for building our playground!

There are four different NEIRO tokens listed on CoinGecko, at least six variations of it on Uniswap, and even more potentially scammy Neiro-related accounts on X.

Additionally, on July 29, the developer of a Solana-based version of Neiro profited $2.85 million in an apparent rug pull, as reported by Cointelegraph.

In late July, independent blockchain sleuth “Wazz” posted a public warning that the “biggest Neiro token on Ethereum is a honeypot.”

Meanwhile, Memecoins are getting hammered in the market rout with the total meme market cap falling around 16% over the past 24 hours to $35.8 billion.

The biggest losers are Pepe (PEPE $0.000006), Dogwifhat (WIF), Floki (FLOKI), and Book of Meme (BOME), all having dumped between 18% and 20% over the past day.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.